In our digital age, financial transactions have never been more convenient. One such innovation is the JazzCash App, a mobile banking application that’s transforming how we manage our finances. Let’s delve into what makes JazzCash App a must-have on your smartphone.

What is JazzCash App?

JazzCash App is a mobile wallet developed by Jazz, Pakistan’s leading telecom operator. It aims to bring financial convenience right to your fingertips. With a wide array of features, the JazzCash App allows users to make transactions, pay bills, and even purchase mobile load and bundles. It offers a secure, swift, and readily accessible means of handling your financial tasks.

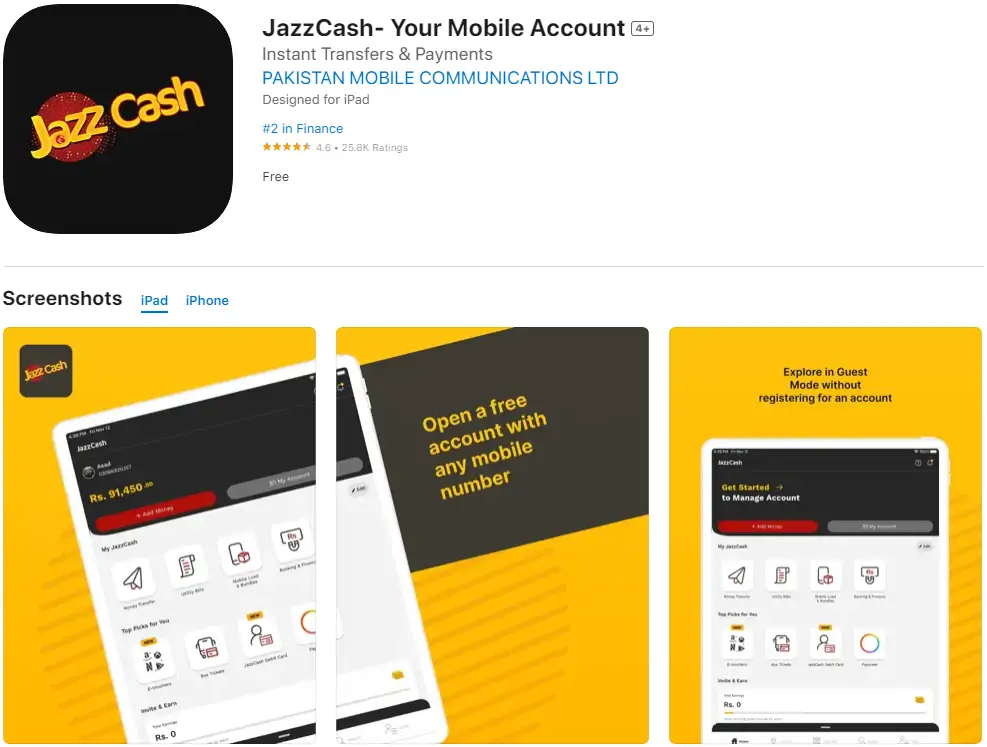

Download the JazzCash App

The JazzCash App serves as a one-stop solution for all your financial needs. Its 24/7 accessibility means you can conduct transactions at any time, from anywhere. The app’s user-friendly interface and its ability to perform multiple transactions set it apart from its counterparts. Whether you’re paying your electricity bill, transferring funds, or simply checking your balance, JazzCash App has you covered.

Must Read: How to Open Jazzcash Account?

How to Download and Install the JazzCash App?

For both Android and iOS users, follow these easy steps:

- Open your App Store: Android users should navigate to Google Play Store while iOS users need to visit the Apple App Store.

- Search for the App: Type “JazzCash” in the search bar at the top of the screen.

- Select the App: Find the app from the search results and click on it.

- Download and Install: Click on the “Install” or “Get” button, and the app will automatically download and install on your device.

- Launch the App: Once installed, click “Open” or find the JazzCash App icon on your home screen and tap it to open.

JazzCash App’s user interface is designed for ease of use. The home screen displays various options, such as “Send Money,” “Pay Bills,” and “Mobile Load.” To perform any transaction, select the relevant option, enter the required details, and confirm your MPIN. It’s as simple as that!

Must Read: How to Delete a JazzCash Account?

Troubleshooting Common Problems in JazzCash App

Facing issues while using the app? Here are some common problems and their solutions:

- Login Problems: If you’re unable to log in, double-check your credentials. If you’ve forgotten your MPIN, use the “Forgot MPIN” option to reset it.

- Transaction Failures: Failed transactions could be due to unstable internet connections or server issues. Check your internet connection, and if the issue persists, try again after a while.

- Account Setup Issues: If you’re having trouble setting up your account, ensure you’re accurately entering the correct mobile number and following the OTP verification process.

- Reach out to Support: If you still face issues, don’t hesitate to contact JazzCash’s customer support for further assistance.

The Future of Jazz Cash App

While the JazzCash App already offers a multitude of services, the developers continue to innovate for an even better user experience. With the ever-evolving tech trends, we can anticipate more features, more integrations, and an even more user-friendly interface in the future.

Benefits of JazzCash App:

- Convenient Money Transfers: Send and receive money with just a few taps. You can transfer money to other JazzCash wallets, bank accounts, and even CNICs.

- Mobile Loads & Bill Payments: No need to visit shops or wait in long queues. Pay utility bills or top up your mobile balance right from the comfort of your home.

- QR Payments: JazzCash introduces a more streamlined payment process where you can make payments by simply scanning QR codes at various outlets.

- Savings Account: With JazzCash, you can open a mobile-based savings account and earn daily interest.

- Online Shopping: Integrated with a multitude of online retailers, you can shop online and pay using your JazzCash balance.

- Ticket Bookings: Planning to travel or watch a movie? Book your bus or movie tickets using the app.

- Digital Loans: Need cash urgently? JazzCash offers short-term loans for its eligible customers.

- Secure Transactions: The app uses advanced encryption methods, ensuring your data and money remain safe from any potential threats.

- Notifications & Alerts: Stay updated with real-time notifications for all your account activities.

FAQs

1. How to Setup JazzCash?

To set up JazzCash on your mobile device, you can follow the steps mentioned below:

- Download the App: Go to the Google Play Store or Apple App Store, search for “JazzCash,” and download the app.

- Register: Once downloaded, open the app and click on the “Register” button.

- Enter your Mobile Number: You’ll be asked to enter your mobile number. Make sure to provide a valid number that you use frequently.

- Verify with OTP: A one-time password (OTP) will be sent to the mobile number you provided. Enter the OTP in the designated space in the app.

- Set up MPIN: After successfully verifying your OTP, you’ll be asked to set up an MPIN. This MPIN will be used for future logins. Remember, it’s important to keep this MPIN secure and confidential.

- Start Using the App: Once you have successfully set up your MPIN, you can start using JazzCash for your transactions.

2. How can I get 50 rupees in JazzCash?

There is no specific way to get a direct credit of 50 rupees in JazzCash. You could receive such an amount through a promotion, a referral bonus, or a cashback offer. However, such offers would depend on the current policies of Jazz Cash. It’s best to check the app or the official JazzCash website for the latest promotions and updates.

3. How can I log in to JazzCash?

To log in to JazzCash:

- Open the App: Launch the JazzCash app on your smartphone.

- Enter your Mobile Number and MPIN: On the login screen, you will be asked to enter your registered mobile number and MPIN.

- Log In: After entering the correct details, tap on the “Log In” button.

Please remember, if you have forgotten your MPIN, you can choose the “Forgot MPIN” option on the login screen to reset it.

4. How can I remove JazzCash from CNIC?

The process of unlinking or removing a JazzCash account from a CNIC (Computerized National Identity Card) generally involves contacting Jazz Cash customer service directly. They will guide you through the necessary steps, which may involve identity verification and possibly completing a form. Remember, this process should be undertaken carefully to ensure the security of your personal information.

Conclusion

The JazzCash App offers not only convenience but also a comprehensive solution for managing your finances. Its user-friendly features and secure transactions make it a standout choice among mobile banking apps. So, why wait? Download the JazzCash App today and experience the convenience yourself.

References

For further details, visit the official JazzCash website. Remember, JazzCash is here to simplify your financial life.