Making your own EasyPaisa QR code is very easy and it helps both people and businesses to get money without any trouble. This guide will show you step by step how to make your EasyPaisa QR code, making sure you can get payments smoothly from your customers. When you finish reading this, you will know all about how to use this simple and modern way to get payments.

Understanding EasyPaisa QR Code

EasyPaisa is a big name in mobile financial services in many places, and it gives you an easy way to do transactions with QR (Quick Response) codes. A QR code is a special kind of barcode that a smartphone camera can read. For EasyPaisa, this QR code has your account details, so customers can pay you easily without needing to type in your mobile number or other information by hand.

Steps to Create an EasyPaisa QR Code

Through these steps, you can learn how to create an Easypaisa QR code.

1: Download the EasyPaisa App

The first is to download the EasyPaisa app from the Google Play Store or Apple App Store. Install the app on your smartphone and proceed to the next .

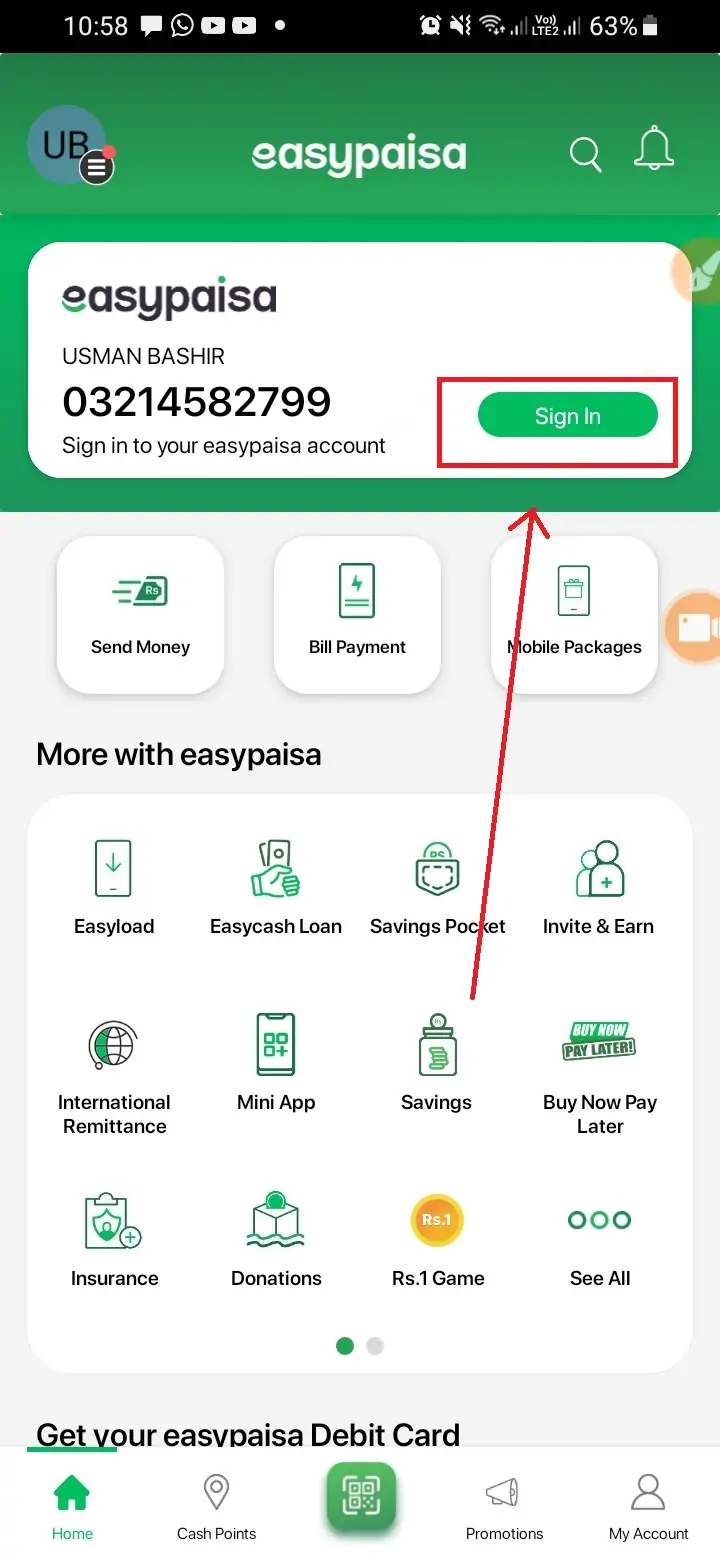

2: Register or Log In

If you are a new user, you will need to register by providing your mobile number and verifying it through an SMS code. Existing users can simply log in using their credentials.

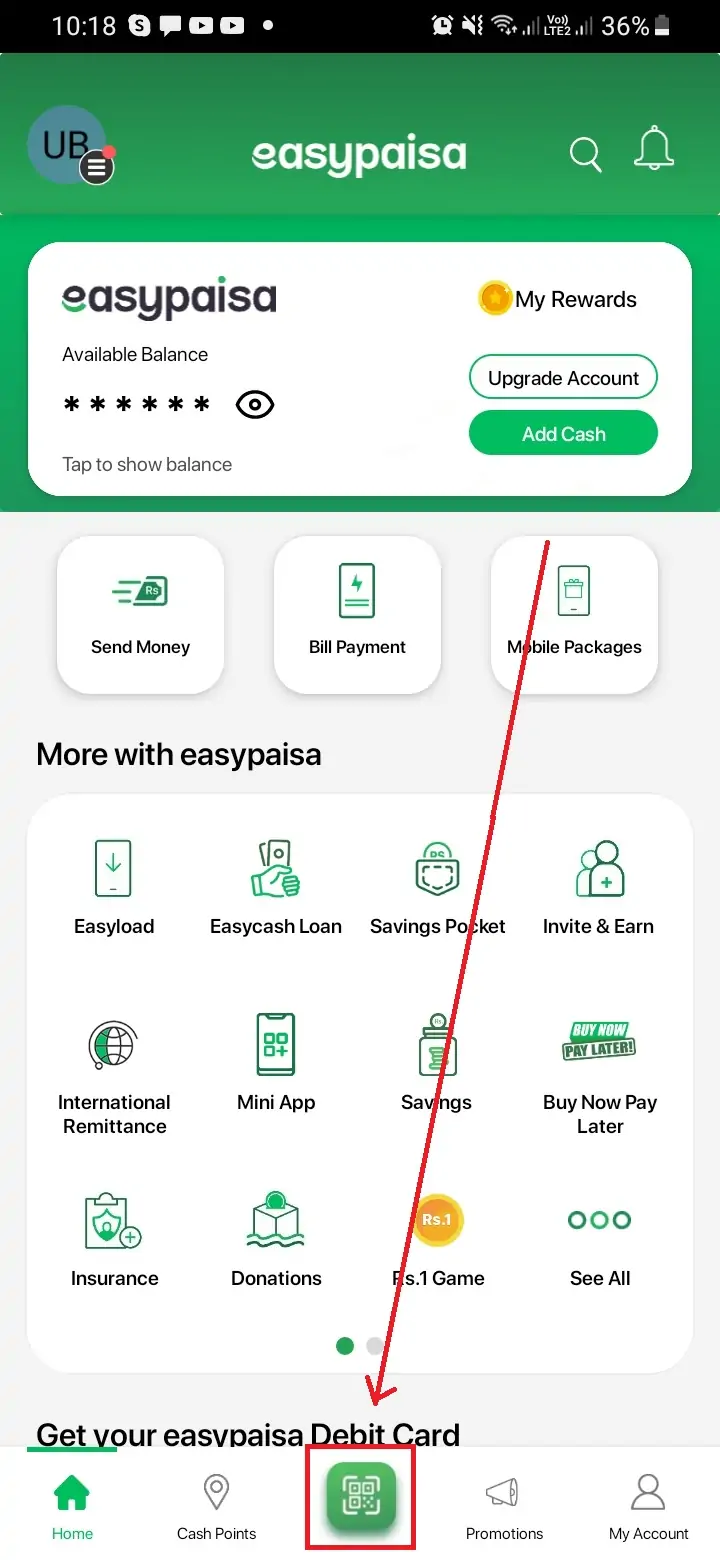

3: Access the QR Code Feature

Once logged in, navigate to the app’s main menu. Look for the “QR Code” option, which is showing at the bottom of the front page and lies in the center. Select this option to proceed.

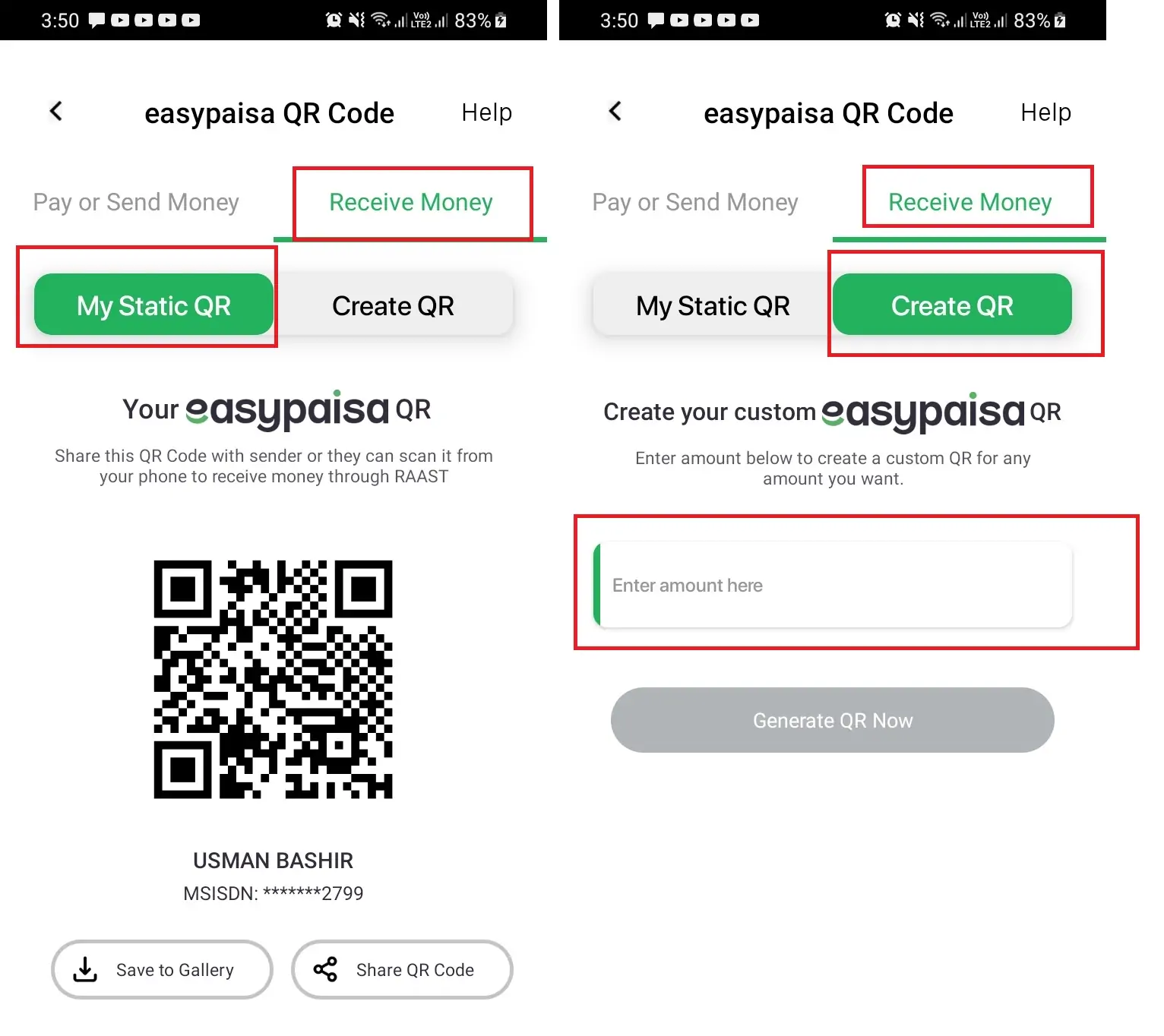

4: Generate Your QR Code

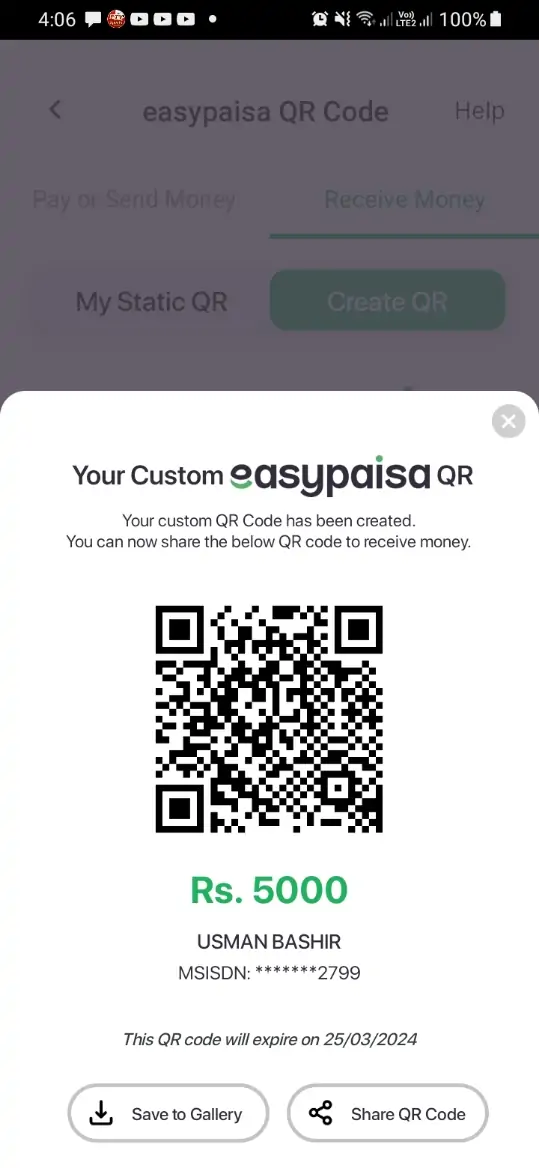

After selecting the QR code option, the app will present you with the choice to generate a new QR code. Follow the on-screen instructions, which may include entering the amount you wish to receive (for specific transactions) or leaving it open for the payer to decide.

Once your QR code is generated, you can save it to your device. The app typically offers options to download the QR code as an image or share it directly through social media, email, or messaging apps. Print the QR code if you need a physical copy for your store or business location.

Benefits of Using Easypaisa QR Code

- Efficiency: Transactions are completed within seconds.

- Convenience: Customers can pay by simply scanning the QR code with their smartphone.

- Security: Reduces the risk of entering incorrect payment details.

- Accessibility: Enables digital payments without the need for a traditional bank account.

Tips for Using Your EasyPaisa QR Code

- Display Clearly: Ensure your QR code is displayed prominently if you are using it in a physical location.

- Test the QR Code: Before using it for transactions, scan the QR code yourself to ensure it directs to the correct account.

- Educate Your Customers: Not all customers may be familiar with QR code payments. Be prepared to guide them through the process.

- Security: Regularly monitor your EasyPaisa account for transactions to ensure all payments are accounted for correctly.

Troubleshooting Common Issues

- QR Code Not Scanning: Ensure the QR code is not damaged or blurred. Check the camera’s focus and lighting conditions.

- Incorrect Payment Amounts: Verify that the amount entered by the customer matches the intended transaction value.

- App Errors: If the EasyPaisa app encounters errors, try restarting the app or your device. If issues persist, contact EasyPaisa support.

Related articles:

- How To Transfer Money From Payoneer To Easypaisa

- How To Pay PTS Fee Through Easypaisa

- Which Is Better JazzCash Or EasyPaisa

- How to Load Mobile Balance from Easypaisa

Conclusion

Creating an EasyPaisa QR code is a user-friendly process that enhances the payment experience for both businesses and customers. By following the s outlined above, you can set up your QR code and start enjoying the benefits of quick, convenient, and secure transactions. Remember to keep your app updated and periodically check your account for any new features or security updates. Embracing digital payment solutions like EasyPaisa not only streamlines your transactions but also positions your business or personal transactions for the digital age, ensuring you are accessible to a broader customer base.