With the rise of digital banking in Pakistan, opening a bank account has become more convenient than ever. Meezan Bank—Pakistan’s first and largest Islamic bank—offers a smooth online account opening process that allows customers to start banking from the comfort of their homes. Whether you’re looking for a Shariah-compliant savings account or a current account, Meezan Bank’s digital onboarding process makes it easy.

In this guide, we’ll walk you through how to open a Meezan Bank account online, the requirements, verification steps, and tips for a smooth experience.

Why Choose Meezan Bank?

Before diving into the process, it’s important to understand why Meezan Bank is a preferred choice:

- Shariah-Compliant Products: Meezan operates under Islamic banking principles approved by a dedicated Shariah Board.

- Extensive Branch Network: Over 900 branches in 300+ cities across Pakistan.

- Digital Services: Internet banking, mobile banking, and 24/7 customer service.

- Multiple Account Types: Meezan offers Asaan Account, Meezan Asaan Remittance Account, Rupee Current Account, Meezan Bachat Account, and more.

Who Can Open a Meezan Bank Account Online?

Meezan Bank allows Pakistani residents with valid identity documentation to apply for an account online. Both salaried individuals and self-employed professionals are eligible.

You can open:

- Individual accounts

- Joint accounts

- Freelancer-friendly accounts

- Accounts for remittances

Documents You’ll Need

To get started, make sure you have the following documents ready:

- Valid CNIC (Computerized National Identity Card)

- Scanned signature or e-signature on white paper

- A clear selfie (holding your CNIC may be required)

- Proof of income (salary slip, freelancer certificate, or business income proof)

- Utility bill (if address verification is needed)

- Email address and an active mobile number

Step-by-Step: How to Make Meezan Bank Account Online

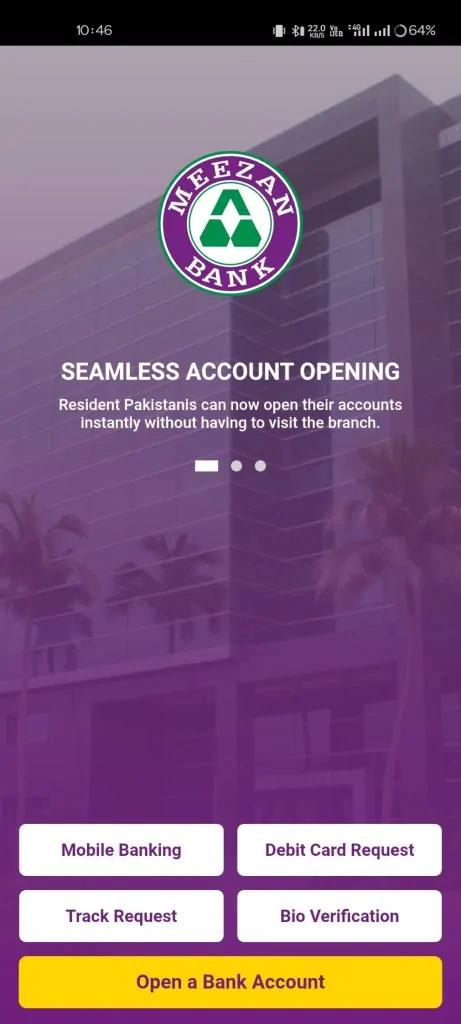

Meezan Bank has introduced a convenient mobile solution for account opening—the Meezan Digital Account Opening App. This app-based process allows individuals to open a fully functional Meezan Bank account from their smartphones without visiting a branch.

Here’s how to use the Meezan Digital Account Opening App to open your account:

1. Download the Meezan Digital Account Opening App

First, head over to:

- Google Play Store (for Android users), or

- Apple App Store (for iPhone users)

Search for “Meezan Digital Account Opening” and download the official app developed by Meezan Bank.

2. Launch the App

Once installed, open the app and tap on the “Open a Bank Account” button on the home screen to begin your registration.

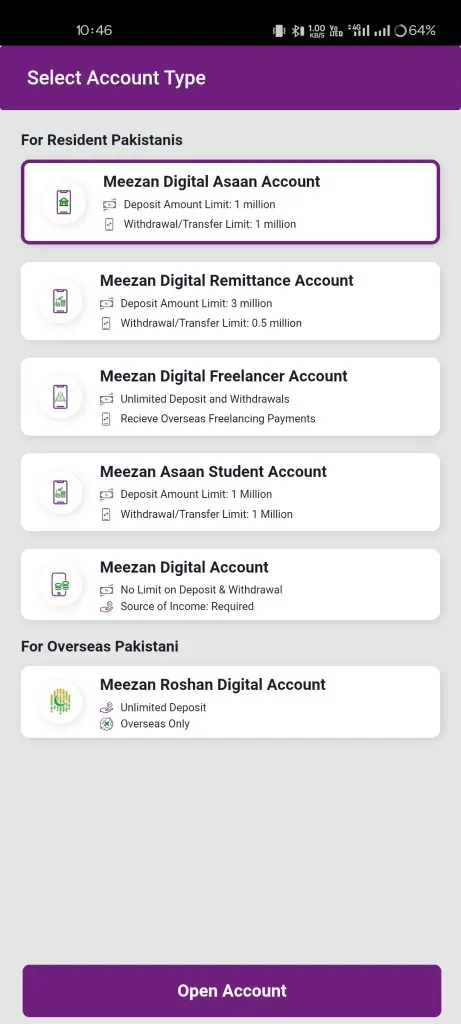

3. Choose Your Account Type

The app will prompt you to choose from several account options, such as:

- Meezan Asaan Account

- Meezan Bachat Account (Savings)

- Rupee Current Account

- Meezan Freelancer Digital Account

Select the one that best suits your financial needs.

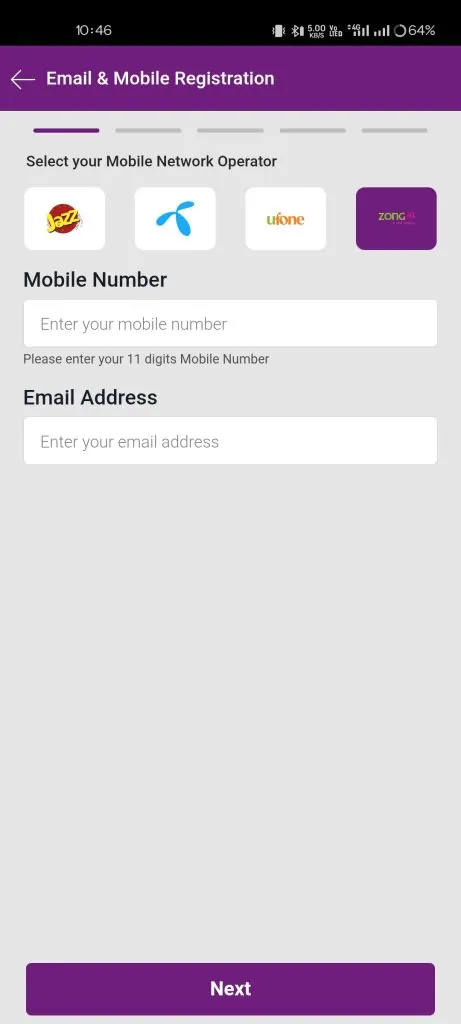

4. Enter Your Mobile Network and Personal Details

You’ll now be asked to:

- Choose your Mobile Network Operator

- Enter your Mobile Number

- Provide a valid Email Address

Make sure the mobile number is registered under your CNIC.

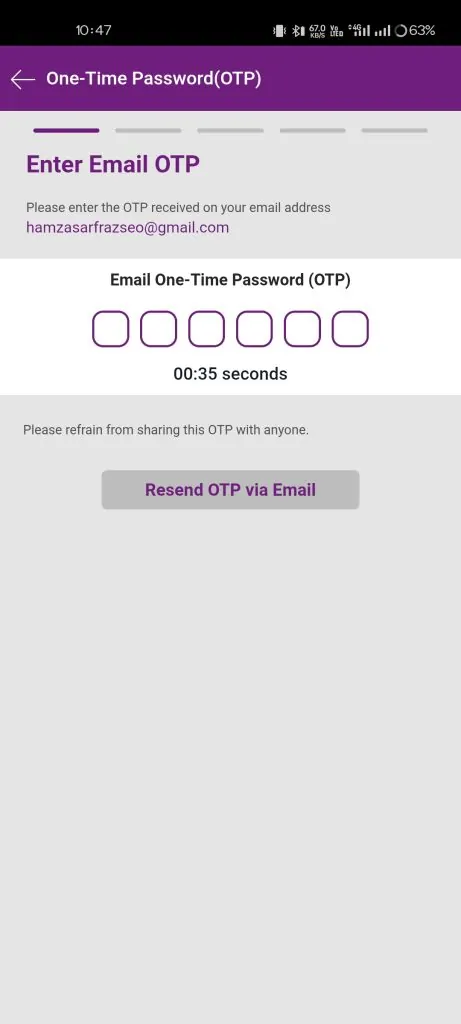

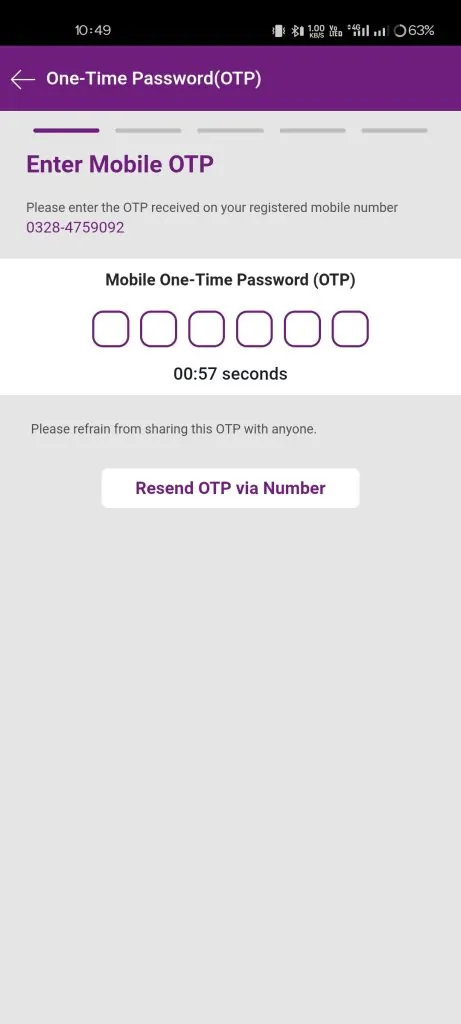

5. Verify Your Identity with OTP

A One-Time Password (OTP) will be sent to both your email and mobile number. Enter both OTPs into the app to proceed with identity verification.

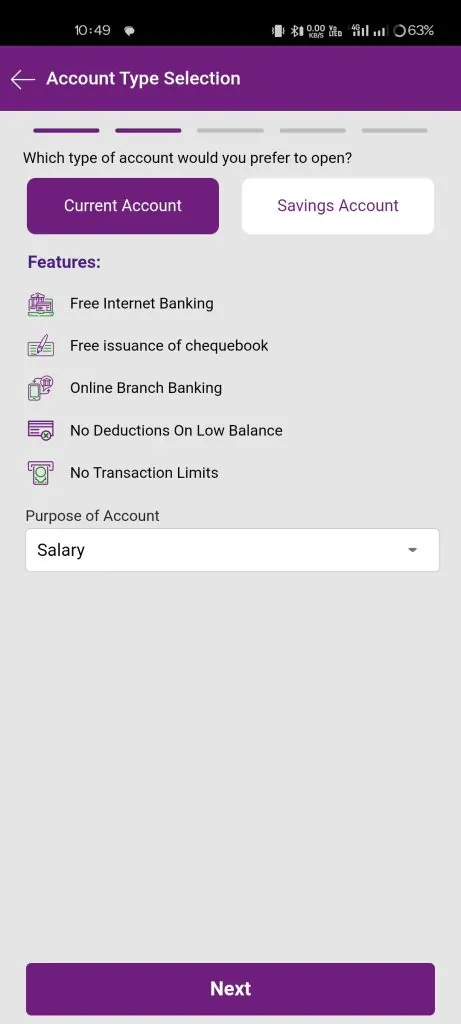

6. Select Your Account Type Again

In this stage, you’ll confirm your preference between:

- Current Account

- Savings Account

This ensures the system prepares the appropriate documents for submission.

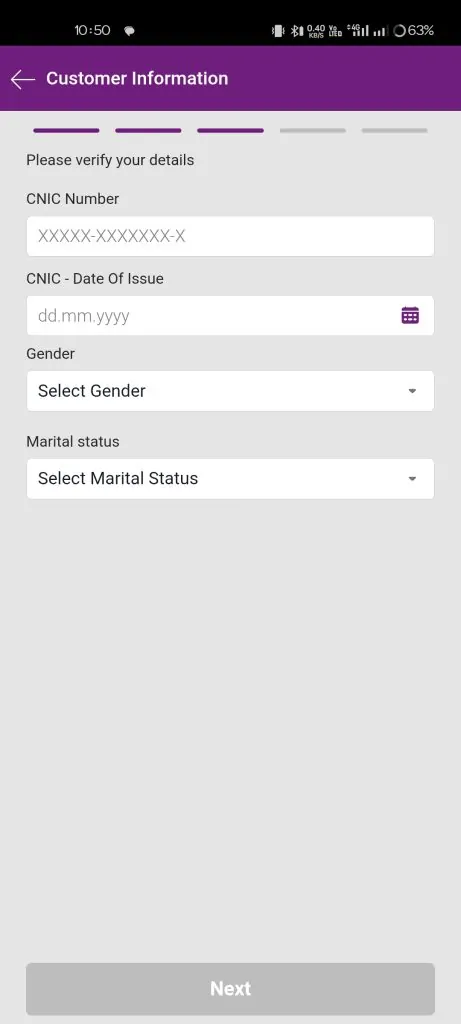

7. Fill in Customer Information

Next, fill out the required information, including:

- Full Name

- CNIC Number

- Date of Birth

- Residential Address

- Source of Income

- Employment/Occupation Details

Be accurate, as this will be verified later during the process.

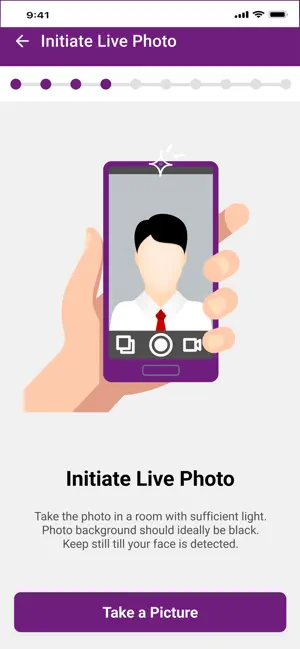

8. Take a Live Photo

The app will now initiate live photo verification. Hold your phone steadily and allow the camera to take a clear picture of your face for biometric matching.

This adds an extra layer of security and confirms your identity with NADRA’s verification system.

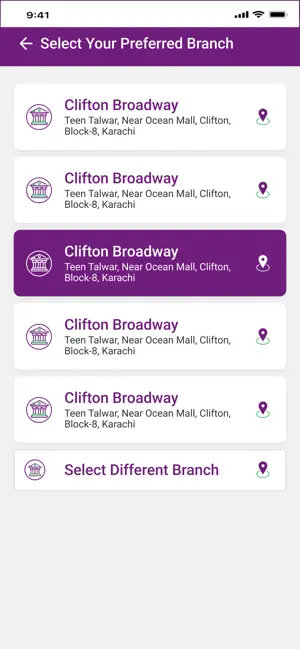

9. Select Your Preferred Branch

Choose a Meezan Bank branch where your account will be officially registered. This branch will serve as your home branch for cheques, ATM card processing, and other services.

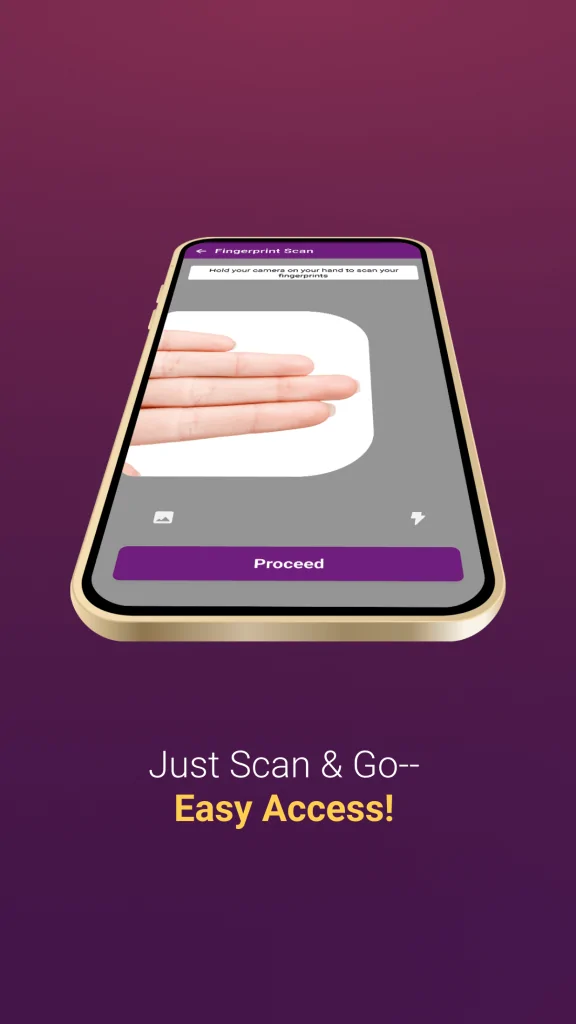

10. Biometric Verification and Final Submission

Once all details are entered:

- Proceed to the Biometric Verification stage. This uses NADRA’s e-verification system to verify your fingerprint digitally.

- Submit the application after the biometric match is confirmed.

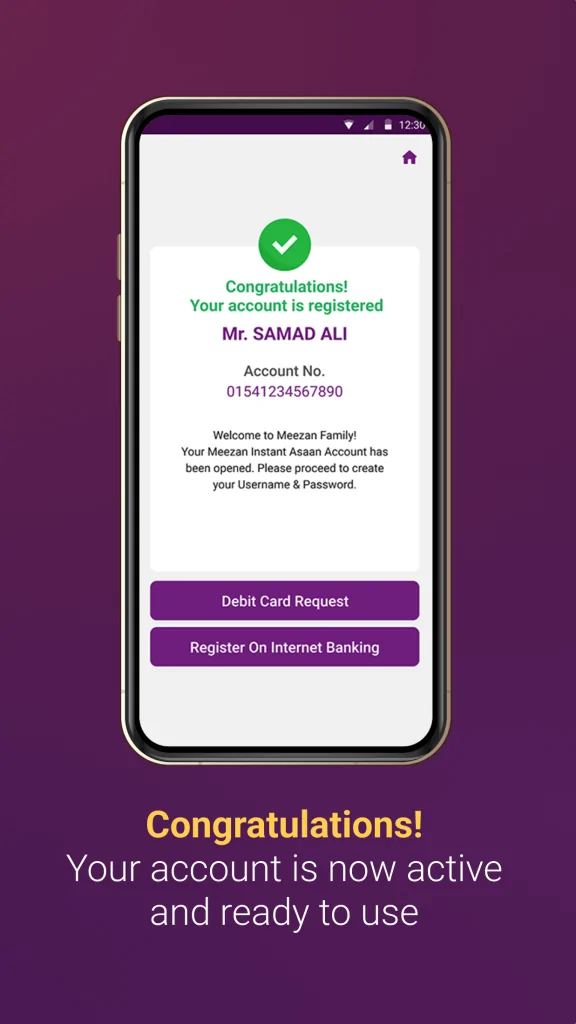

11. Await Account Confirmation

After submission:

- You’ll receive an email and SMS confirmation that your application has been received.

- Meezan Bank typically completes the verification and account activation within 24 hours.

Once your account is successfully opened, you’ll receive:

- A Confirmation SMS and Email

- Your Meezan Bank Account Number (IBAN)

From there, you can request an ATM card, chequebook, and gain access to Meezan’s mobile and internet banking features.

What Happens After Submission?

- You will receive an email and SMS confirmation that your application has been received.

- Meezan Bank’s team may contact you for any missing or unclear information.

- Once approved, your IBAN (International Bank Account Number) and account details will be shared with you.

- You can request a physical ATM card and chequebook via courier.

Online Banking Access

After your account is active, you can:

Log in to Meezan Internet Banking.

Or download the Meezan Mobile App from the Play Store or App Store to:

- Check balance

- Transfer funds

- Pay bills

- Manage cards

✅ Benefits of Using the Meezan Digital Account App

- Completely branchless account opening

- Biometric authentication through NADRA e-verification

- Supports current and savings accounts

- Ideal for salaried individuals, freelancers, and entrepreneurs

- Fast turnaround—account activation within 24 hours

This is the most direct and efficient way to start with Meezan Bank’s Shariah-compliant banking services.

FAQs

Can I open a Meezan Bank account without visiting a branch?

Yes, the entire process can be completed online for eligible individuals.

How long does it take to activate the account?

Usually between 24 to 48 hours, depending on document verification.

Is it safe to open my account online?

Absolutely. Meezan Bank uses secure HTTPS encryption and OTP verification to protect your information.

Can I receive international remittances on this account?

Yes, if you choose a Remittance or Regular Savings Account, you can receive payments from abroad.

Opening a Meezan Bank account online is quick, secure, and hassle-free. It’s a great solution for anyone who values convenience and Islamic banking principles. Whether you’re a salaried professional, freelancer, or small business owner, the bank offers tailored account types to suit your needs.

So, if you’re wondering how to make Meezan Bank account online, now you know—it’s only a few clicks away.

Note: Always ensure you are on the official Meezan Bank website while applying. For any issues, you can call their 24/7 helpline: +92 21 111 331 331.