The convenience of digital transactions has become a necessity. The HBL mobile app and Easypaisa stand out in Pakistan for their reliability and ease of use. This guide aims to simplify the process of how to send money from the HBL app to Easypaisa, ensuring that even first-time users can navigate through with ease.

HBL and Easypaisa

HBL (Habib Bank Limited), one of Pakistan’s largest banks, offers a comprehensive mobile banking app that allows its users to perform a wide range of financial transactions seamlessly. Easypaisa, on the other hand, is a leading mobile financial service platform in Pakistan, offering services ranging from money transfer to bill payment and savings, all within the comfort of your mobile phone.

Setting Up for the First Time

Before you start, ensure you have the HBL mobile app installed on your smartphone. If you haven’t registered for HBL mobile banking yet, follow these simple s:

- Download the HBL mobile app from the Google Play Store or Apple App Store.

- Open the app and select the ‘Register’ option.

- Follow the on-screen instructions, which will require your CNIC (Computerized National Identity Card) number, HBL account number, and other personal details for verification.

- Create your login credentials and set a PIN for transactions.

For Easypaisa, you need to have an active account which can be set up by downloading the Easypaisa app and following a similar registration process.

Transferring Money from HBL App to Easypaisa

Here you you will learn the steps of how to send money from hbl app to Easypaisa.

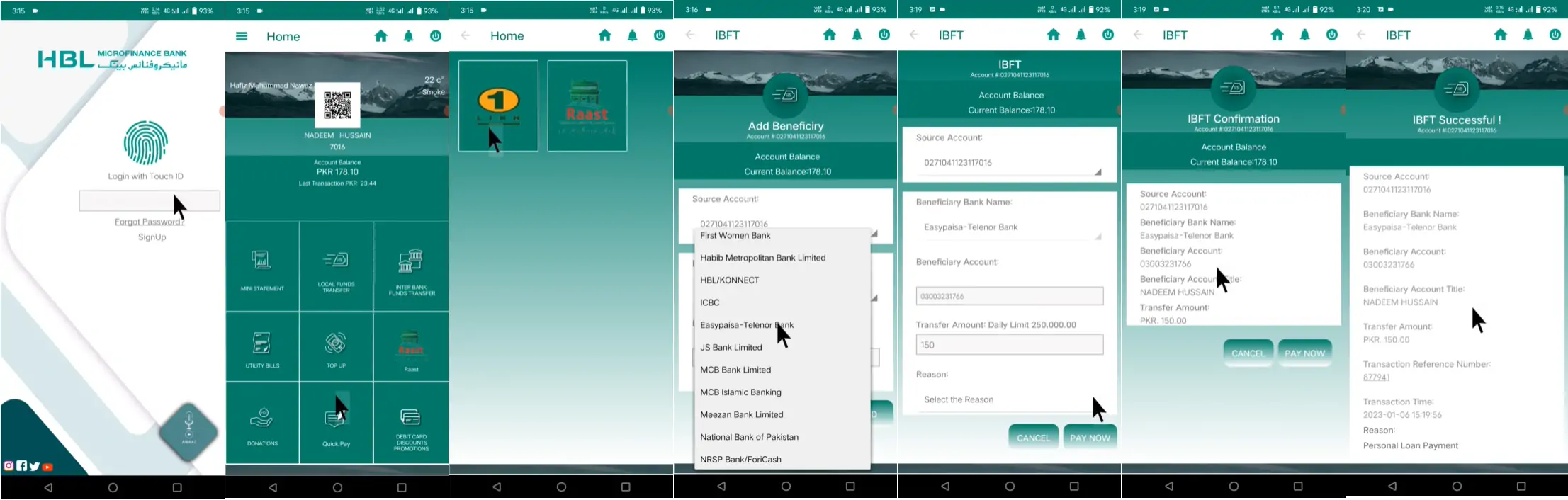

- Log in to the HBL App: Open the HBL app on your smartphone and log in using your credentials. Ensure your account has sufficient balance for the transfer.

- Navigate to the Funds Transfer Option: Once logged in, look for the ‘Funds Transfer’ option on the home screen or within the menu. This section allows you to make transactions with other banks or mobile wallets.

- Select Transfer to Mobile Wallet: In the funds transfer section, choose the option to transfer to a mobile wallet/account. You will then need to select ‘Easypaisa’ from the list of available services.

- Enter Recipient Details: You will be prompted to enter the recipient’s mobile number. Make sure to double-check the number, as this will be the Easypaisa account where the funds will be sent. Some interfaces might also ask for the recipient’s name for additional verification.

- Enter Amount: Enter the amount of money you wish to transfer. Be aware of any transaction limits or charges that might apply. HBL usually provides this information on the same page.

- Review and Confirm: After entering all necessary details, you will be taken to a summary page where you can review your transaction. Check the recipient’s details and the amount carefully. You may also be asked to enter your transaction PIN or password for security purposes.

- Transaction Completion: Upon confirming the details, click on the ‘Send’ button. You will receive a confirmation message or notification indicating the successful completion of your transaction. Both you and the recipient will receive SMS notifications confirming the transfer.

Post-Transaction Tips

- Keep Records: It’s a good practice to screenshot or note down transaction IDs for future reference.

- Check Limits: Be aware of daily or monthly transfer limits to plan your transactions accordingly.

- Security: Never share your app PIN or password with anyone. HBL and Easypaisa will never ask for this information through calls or messages

Conclusion

Transferring money from the HBL app to Easypaisa is a straightforward process that combines convenience with security. By following the s outlined above, users can ensure smooth and hassle-free transactions. As digital banking continues to evolve, understanding these processes can significantly enhance your banking experience, saving you time and making your financial dealings more efficient. Always stay updated with any new features or changes to the services for a seamless banking journey.