EasyPaisa has emerged as a beacon of convenience for millions in Pakistan, offering a range of services from money transfers to bill payments, and importantly, the provision of short-term loans. These loans are a lifeline for many, providing financial support when it’s needed the most. However, the process of how to return an Easypaisa loan can sometimes be confusing for users. This article simplifies the repayment process, guiding you through each to ensure that returning your EasyPaisa loan is as straightforward as borrowing it.

Understanding EasyPaisa Loans

Before diving into the process of how to return an Easypaisa loan, it’s essential to understand what EasyPaisa loans are. These are microloans intended to offer quick financial relief and are expected to be repaid within a short period. The ease of access to these loans through the EasyPaisa mobile app makes them an attractive option for immediate financial needs.

1: Access Your EasyPaisa Account

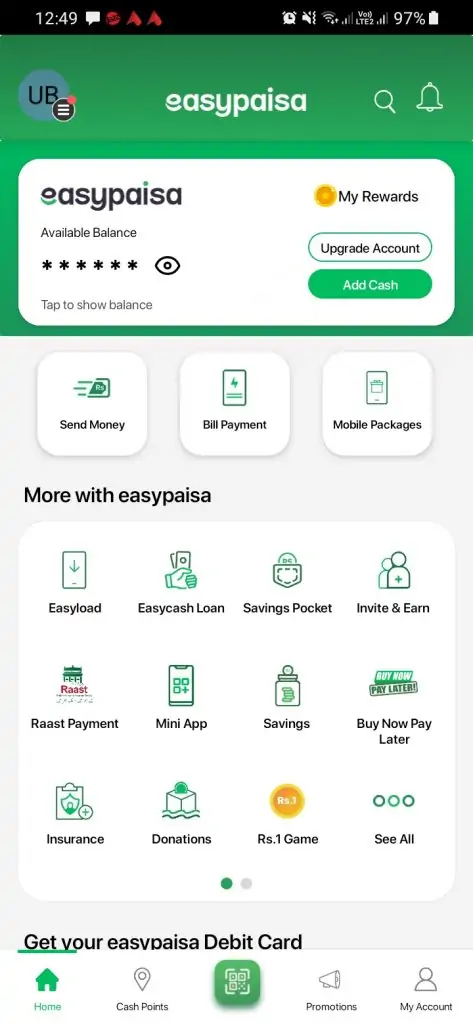

The first in repaying your EasyPaisa loan is to access your account. You can do this by opening the EasyPaisa app on your smartphone. If you haven’t already, download the app from the Google Play Store or Apple App Store and register or log in using your mobile number.

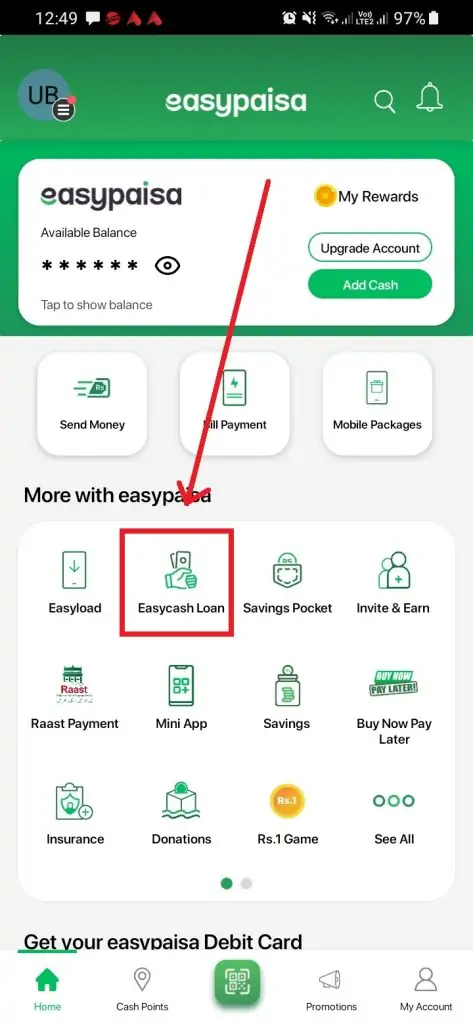

Once logged in, navigate to the loan section of the app. This is typically found in the app’s main menu, often labeled as Easycash Loan. Tap on this option to proceed.

3: View Your Loan Details

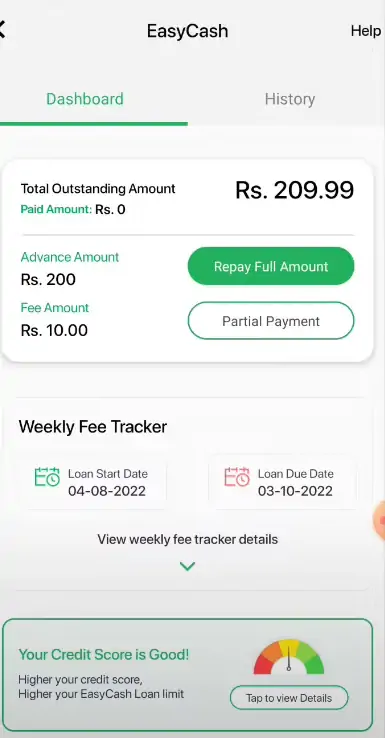

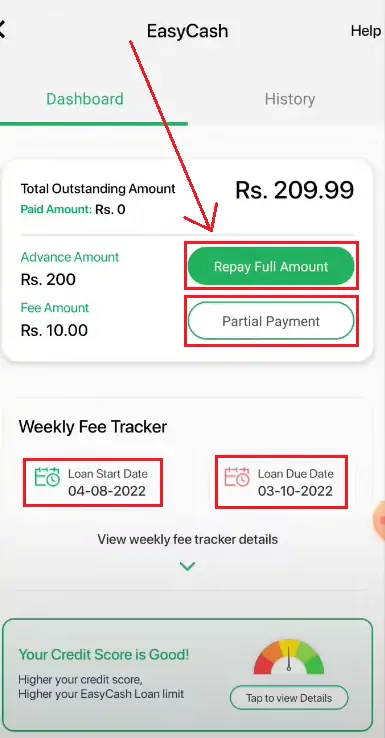

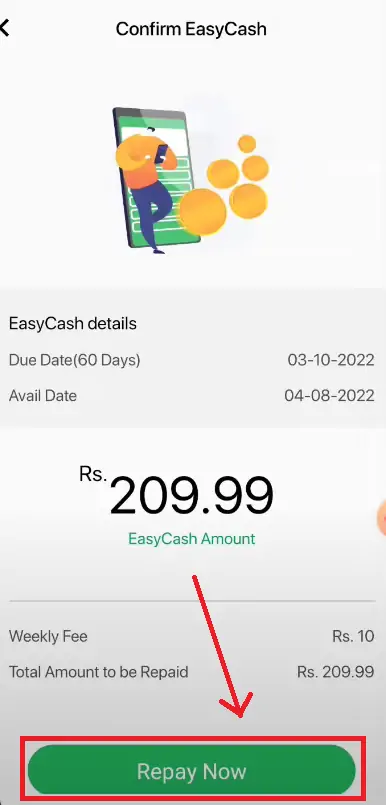

In the easy cash loan section, you will find details of your current loan, including the principal amount, the due date for repayment, and any applicable interest or fees. Review these details carefully to ensure you understand the total amount you need to repay.

4: Initiate the Repayment Process

To begin the repayment process, look for an option labeled Repay Full Amount Loan or Partial Payment. Selecting this option will lead you to the next s specific to repayment.

5: Choose Your Repayment Method

EasyPaisa offers multiple repayment methods for your convenience. You can choose to repay your loan using your EasyPaisa wallet balance, through a linked bank account, or by using a debit/credit card. Select the method that suits you best.

6: Enter Repayment Amount

After selecting your repayment method, enter the amount you wish to repay. You can choose to pay the full amount due or make a partial payment, if allowed by the loan terms. Be sure to double-check the amount before proceeding.

7: Confirm the Payment

Before finalizing the repayment, you will be asked to confirm the payment details. This typically includes the repayment amount and the method of payment. Review all details carefully to ensure accuracy, then confirm the payment.

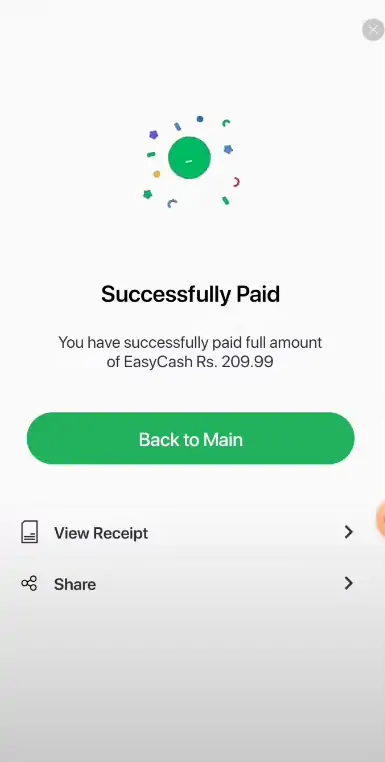

8: Completion and Confirmation

Upon confirming the payment, the repayment process is initiated. This may take a few moments. Once completed, you will receive a confirmation message or notification in the app, confirming that your payment has been received and your loan has been repaid.

Tips for Smooth Repayment

- Stay Informed: Keep track of your loan due dates and ensure you understand the repayment terms to avoid any surprises.

- Use Reminders: Set reminders a few days before your loan is due to ensure timely repayment.

- Check for Penalties: Be aware of any late payment fees or penalties to avoid additional charges.

- Contact Support: If you encounter any issues or have questions about your loan, don’t hesitate to contact EasyPaisa customer support for assistance.

Related articles:

- How To Make Easypaisa Account on Telenor

- How To Make Easypaisa Account On Ufone

- How To Make Easypaisa Account On Jazz and Warid

- How To Send Money From HBL App To EasyPaisa

- How To Upgrade Easypaisa Account

Conclusion

Repaying an EasyPaisa loan is designed to be a simple and hassle-free process, mirroring the ease of obtaining the loan itself. By following the steps outlined above and making use of the tips provided, you can ensure a smooth repayment experience. Remember, timely repayment not only frees you from debt but also helps in maintaining a good financial standing with EasyPaisa, enabling you to access financial support easily in the future.

Assalamualaikum sir main ne loan Liya tha easy Paisa account se abi us ko 3 years ho ge hain aour mery account per repayment ka option ni aa rha abi MN repayment Kesy kr Sakta hn

Loan