With the evolution of technology, financial transactions have become more streamlined. Notably, one can now obtain loans directly from mobile apps. For instance, the EasyPaisa app, a leading financial platform in Pakistan, offers this service. In this article, we’ll walk you through the loan process with EasyPaisa. Thus, you’ll have all the insights to make an informed choice. So, dive in to learn step-by-step how to secure funds swiftly with EasyPaisa, your reliable financial ally.

What is EasyPaisa?

EasyPaisa, launched by Telenor Microfinance Bank, is one of Pakistan’s leading mobile banking platforms. It offers a range of services, from money transfers to bill payments, and now, loans. The app’s user-friendly interface and secure transactions make it a preferred choice for many.

Methods To Get a Loan From Easy Paisa

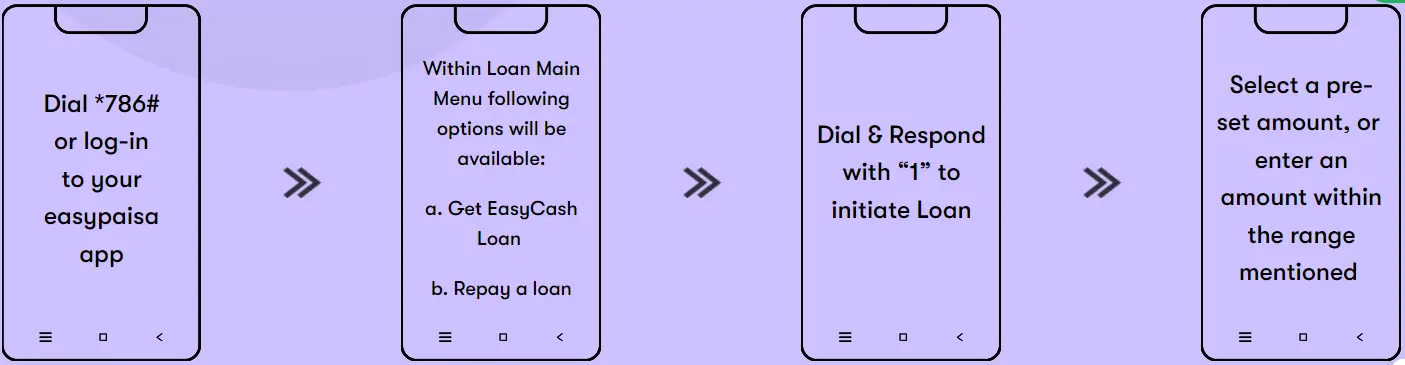

1. Steps to Obtain a Loan Through EasyPaisa SIM

- Access the EasyPaisa Menu: On your Telenor SIM, dial *786# to access the EasyPaisa Mobile Account Menu.

- Navigate to Loans: Using your keypad, select the ‘Loan’ option from the menu.

- Specify Loan Details: Enter your desired loan amount and preferred repayment duration.

- Provide Necessary Information: You may be prompted to provide some personal and financial details, depending on your loan request and history with EasyPaisa.

- Submission: After entering the details, submit your loan request.

- Await Confirmation: You’ll receive an SMS notification regarding your loan application’s status. If approved, the loan amount will be credited to your EasyPaisa Mobile Account.

- Repayment: An SMS reminder will be sent as your repayment date approaches. Ensure you have sufficient balance in your EasyPaisa Mobile Account for automatic deduction.

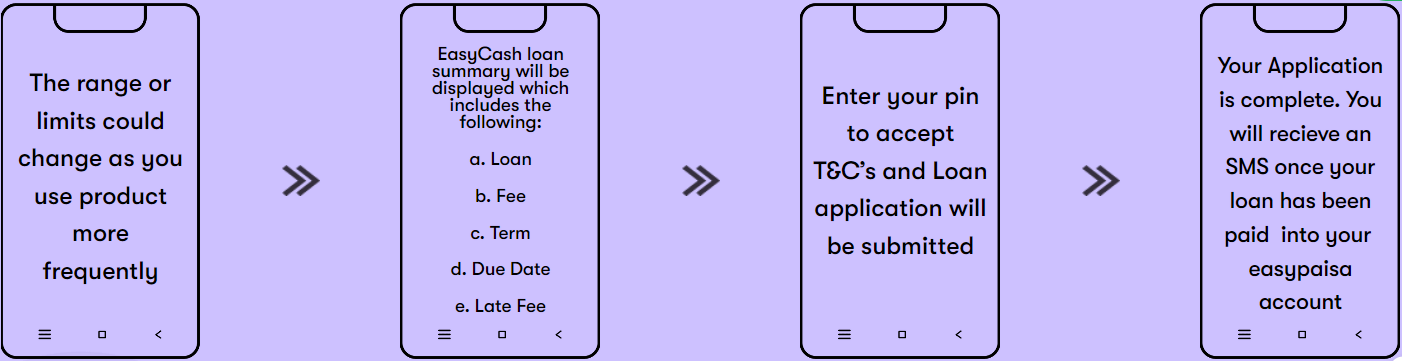

2. Step-by-Step Guide to Getting a Loan from EasyPaisa Through Mobile App

- Download and Install: To start off, ensure you have the EasyPaisa app downloaded and installed on your smartphone. Conveniently, it’s available on both the Google Play Store and Apple App Store.

- Registration: Moving on, if you’re venturing into EasyPaisa for the first time, register by entering your mobile number and diligently following the on-screen instructions.

- Login: For those already acquainted with the platform, simply log in using your established credentials.

- Navigate to the Loan Section: Once inside, on the app’s welcoming home screen, scout for and select the ‘Loan’ option.

- Choose Loan Amount and Duration: Here’s where you decide. Reflect on the loan amount you need and the repayment duration that aligns with your financial plans.

- Fill in Details: Subsequently, you’ll be prompted to provide essential personal and financial details. This could encompass aspects like your monthly income, employment specifics, and other pertinent data.

- Submit Application: Having ensured all details are accurate, go ahead and submit your application.

- Wait for Approval: With your part done, the app takes over. It will meticulously process your application, and in a short span, you’ll receive a notification shedding light on your loan approval status.

- Loan Disbursement: On the fortunate chance of approval, the loan amount will be seamlessly transferred to your EasyPaisa account without delay.

- Repayment: Lastly, it’s paramount to remember to repay the loan amount by the stipulated date. Doing so not only safeguards your credit score but also fortifies your standing for prospective loans.

3. Steps to Obtain a Loan Through Easypaisa Customer care

Obtaining a loan through Easypaisa, a leading mobile wallet in Pakistan, involves a series of steps. While the exact process may vary depending on the type of loan and specific promotions or offers, the general steps to obtain a loan through Easypaisa’s customer care are as follows:

1. Eligibility Check:

Before diving into the application, ensure you meet the eligibility criteria set by Easypaisa. This typically includes having an active Easypaisa account, a certain transaction history, and a good credit score.

2. Contact Easypaisa Customer Care:

Next, dial the Easypaisa helpline number. Telenor users can call 3737, whereas non-Telenor users should dial 042-111-003-737 from their mobile phones. After dialing, follow the automated instructions to connect with a customer care representative.

3. Loan Inquiry:

Once connected, inform the representative of your interest in obtaining a loan. They will then provide details about the types of loans available, interest rates, loan amounts, and repayment terms.

4. Provide Necessary Information:

Subsequently, you’ll be asked to provide personal and financial details to assess your loan application. This may encompass your CNIC number, monthly income, employment details, and other pertinent information.

5. Loan Approval:

After assessing your details, the representative will inform you about your loan eligibility and the approved loan amount. Additionally, they will provide specifics about the interest rate, loan tenure, and monthly installment amounts.

6. Loan Agreement:

If the terms sound agreeable, the representative will guide you through the loan agreement process. This might involve receiving an SMS or email with a link to the agreement. It’s crucial to review this agreement carefully, and if all looks good, accept the terms.

7. Loan Disbursement:

Following your agreement acceptance, the loan amount will be disbursed to your Easypaisa account. The disbursement speed can vary, but it’s generally swift.

8. Repayment:

It’s essential to remember to repay the loan amount, along with the interest, by the due date. Typically, repayments can be made through your Easypaisa account. However, failing to repay on time might lead to additional charges and can negatively impact your credit score.

9. Stay Informed:

Additionally, it’s wise to regularly check your Easypaisa account and SMS notifications. This ensures you stay updated on your loan status, repayment dates, and any other vital information.

10. Loan Closure:

After repaying the entire loan amount and interest, your loan will be officially closed. You’ll then receive a confirmation from Easypaisa, signaling the successful closure of your loan.

Note: Always ensure you read and understand all terms and conditions before securing a loan. If any aspect seems unclear, don’t hesitate to ask the customer care representative for further clarification.

Benefits of Using EasyPaisa for Loans

- Accessibility: Ideal for those without smartphones or internet access.

- Simplicity: No app downloads or updates are required.

- Security: Transactions are PIN-protected, ensuring safety.

- Speed: Quick loan processing and disbursement.

- Convenience: No need to visit a bank or stand in long queues.

- Quick Processing: Get loan approval within minutes.

- Transparent Charges: No hidden fees or complicated terms.

- Flexible Repayment: Choose a repayment plan that suits your needs.

FAQs

Is this service available for non-Telenor users?

The SIM-based EasyPaisa service is exclusive to Telenor users. However, other network users can still use the EasyPaisa app.

Accessing the EasyPaisa Mobile Account Menu (786#) is free, but it's always good to check for any updates on charges.

How do I repay my loan if I don't have enough balance in my EasyPaisa account?

You can deposit money into your EasyPaisa Mobile Account through any EasyPaisa agent or transfer funds from a bank account.

What is the maximum loan amount I can get from EasyPaisa?

The loan amount varies based on your transaction history and credit score. It's best to check the app for the most accurate information.

Are there any charges for late repayment?

Yes, late repayment might incur additional charges. It's essential to read the terms and conditions before taking the loan.

Can non-Telenor users apply for a loan?

Yes, EasyPaisa is open to all mobile network users in Pakistan.

Conclusion

The EasyPaisa app has revolutionized the way we view financial transactions, making it easier than ever to secure a loan. With its user-friendly interface and transparent terms, it’s a reliable choice for those in need of quick financial assistance. Always remember to borrow responsibly and ensure timely repayments to enjoy the full benefits of this service.

AOA sir .sir ma ny 10 mertba complain Ki lkin koi response nhi Mila ..ma ny get now pay later pakg Ki peyment May ma return kar di thi lkin Abi tk JB ma again pkg K lia apply krta to masg a jta K peyment pending or loan b lia Tha Jo ma ny 2 Nov ko time sy 6325 pay kr dia Tha ab na loan milta na pkg sir .