Easypaisa stands out as a popular and convenient choice for millions. If you’re a Jazz or Warid subscriber, setting up an Easypaisa account can unlock a myriad of financial services right from your mobile phone, including funds transfer, bill payments, mobile recharges, and much more. This guide aims to walk you through the process of creating an Easypaisa account on your Jazz or Warid connection in simple, super English.

Understanding Easypaisa

Easypaisa, launched by Telenor Pakistan in collaboration with Tameer Microfinance Bank, is a mobile banking platform that allows users to carry out financial transactions easily. It’s designed to cater to the banking needs of all Pakistanis, regardless of whether they have a bank account.

Benefits of Using Easypaisa

- Convenience: Perform financial transactions anytime, anywhere.

- Accessibility: Available to both Telenor and non-Telenor subscribers, including Jazz and Warid users.

- Security: Equipped with advanced security features to protect your money and personal information.

- Versatility: Offers a wide range of services, from sending and receiving money to paying bills and buying mobile load.

How to Create an Easypaisa Account on Jazz/Warid

Steps to create an Easypaisa account on Jazz and Warid.

1: Preparation

Before you begin, ensure you have a Jazz or Warid SIM card active in your phone. Your SIM should be biometrically verified as Easypaisa requires this for account creation. Also, make sure you have your original CNIC (Computerized National Identity Card) and your phone number linked to it, as these details will be necessary for the account setup.

2: Download the Easypaisa App

The easiest way to create an Easypaisa account is through the mobile app. Go to the Google Play Store or Apple App Store on your smartphone and search for the “Easypaisa” app. Download and install the app on your device.

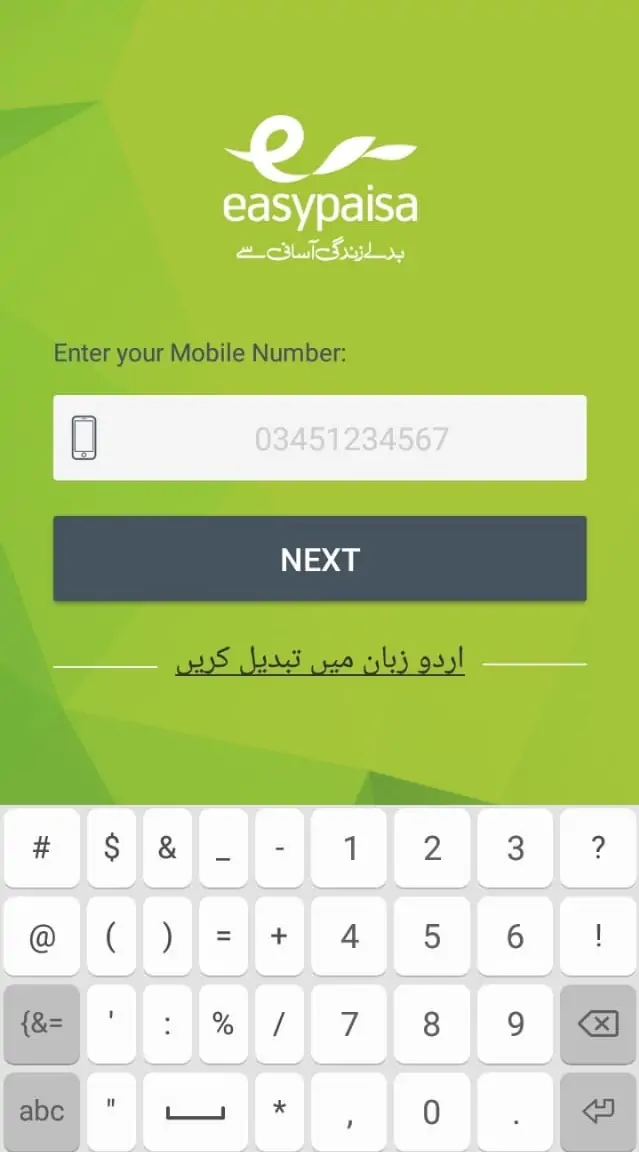

3: Open the App and Register

Once the Easypaisa app is installed, open it. You will see an option to create a new account. Tap on it. Enter your Jazz or Warid mobile number in the designated field. The app will then send a verification code via SMS to your phone. Enter this code in the app to proceed.

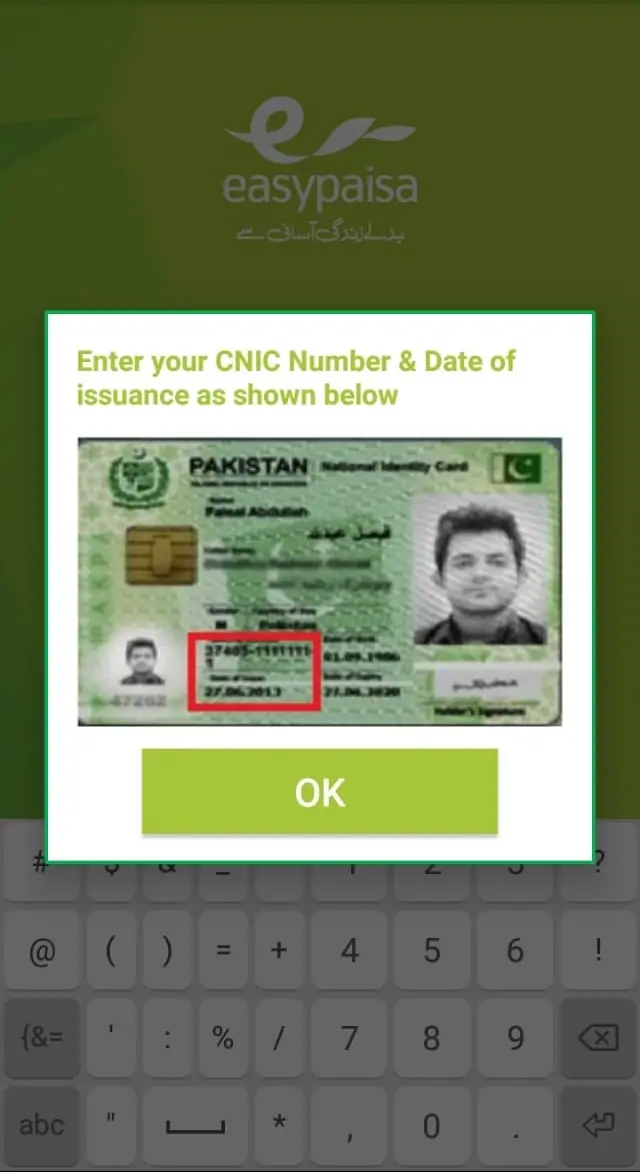

4: Provide Your Personal Information

After verification, the app will ask you to provide personal information, including your full name, CNIC number, and the issuance date of your CNIC. Ensure that the details match exactly with what’s on your CNIC, as any discrepancies can lead to verification issues.

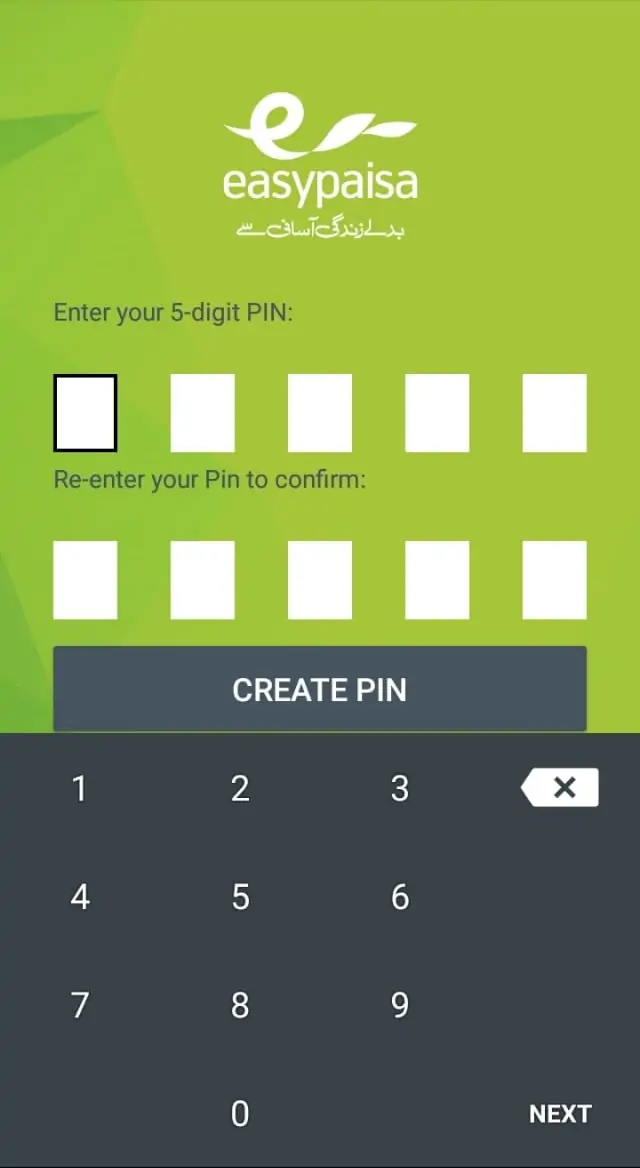

5: Create a 5-digit PIN

You will be prompted to create a 5-digit PIN for your Easypaisa account. This PIN will be used to authorize transactions and access your account, so make sure it’s something you can remember but hard for others to guess. Avoid using obvious sequences like “12345” or your birth year.

6: Biometric Verification

For Jazz or Warid subscribers, biometric verification is a mandatory. You may need to visit a nearby Telenor franchise, Easypaisa shop, or Tameer Microfinance Bank branch for this. Present your CNIC and have your fingerprints scanned. This ensures the security and authenticity of your account.

7: Account Activation

Once the biometric verification is completed, your Easypaisa account will be activated. You’ll receive a confirmation message on your Jazz or Warid number. Now, you can start using your account to perform various financial transactions.

Using Your Easypaisa Account

With your Easypaisa account now set up, explore the variety of services it offers. You can send and receive money to and from any bank account or other Easypaisa users, pay utility bills, recharge your mobile balance, participate in savings plans, and much more. The app’s user-friendly interface makes it easy to navigate through these options.

Related articles:

- How to Return an EasyPaisa Loan

- How To Make Easypaisa Account on Telenor

- How To Make Easypaisa Account On Ufone

- How To Send Money From HBL App To EasyPaisa

- How To Upgrade Easypaisa Account

Conclusion

Creating an Easypaisa account on your Jazz or Warid connection is a straightforward process that opens up a world of financial services at your fingertips. By following the s outlined in this guide, you can enjoy the convenience, security, and versatility that Easypaisa offers. Remember, the world of mobile banking is at your service, making your financial transactions easier, faster, and safer than ever before.