Easypaisa, a leading mobile money service in Pakistan, offers more than just mobile wallet services. Among its array of services is the coveted Easypaisa debit card, a tool that makes cashless transactions a seamless experience. If you’re considering obtaining this card, this guide will walk you through every step of the way.

Why Opt for an Easypaisa Debit Card?

Before diving into the process, it’s crucial to understand the card’s benefits:

- Convenience: No more carrying bulky wallets; with the Easypaisa Debit Card, you can shop anywhere MasterCard is accepted.

- ATM Access: Withdraw cash anytime from Telenor Microfinance Bank ATMs or any 1LINK ATM across Pakistan.

- Safety: The card offers secure transactions, minimizing the risks associated with carrying large sums of money.

- Online Shopping: Elevate your online shopping experience. The card is accepted by various online merchants, both locally and internationally.

Steps to Get Your Easypaisa Debit Card

1. Obtaining an Easypaisa Debit Card through Telenor SIM

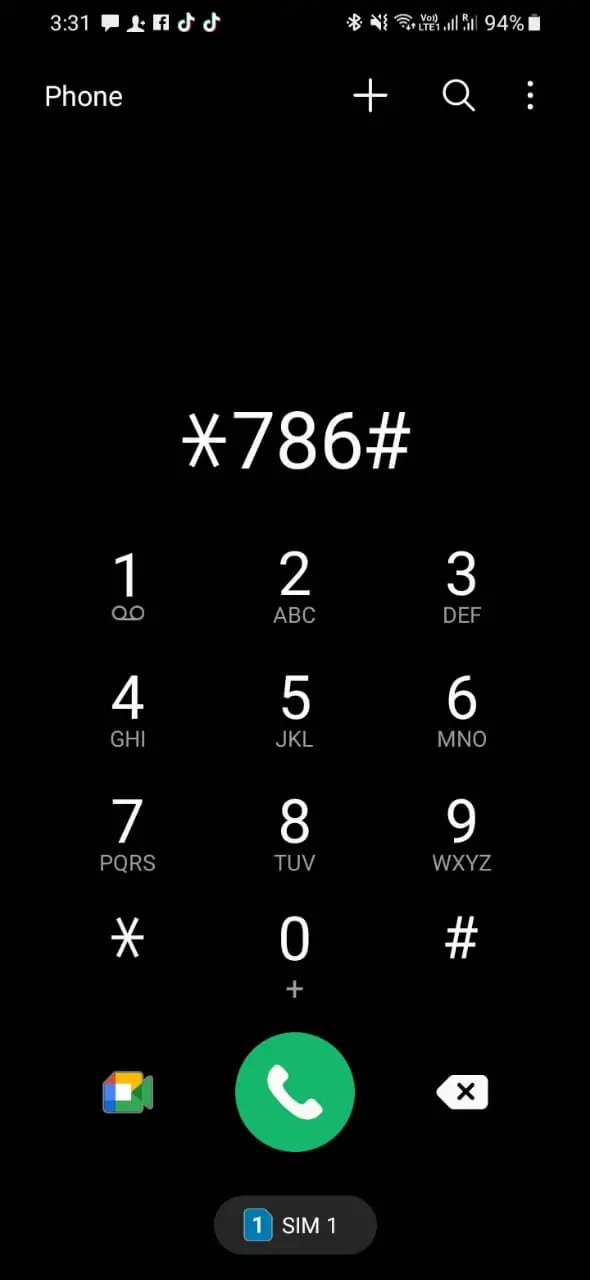

- Easypaisa Mobile Account Registration:

- If you haven’t registered for an Easypaisa account, dial *786# from your Telenor SIM.

- Follow the on-screen instructions to register by entering your CNIC issuance date and creating a 5-digit PIN.

- Requesting the Debit Card:

- Once your Easypaisa Mobile Account is active, dial *786# again.

- Navigate through the menu to find the option related to the Easypaisa Debit Card (the exact option might vary, but it could be under “My Account” or a similar heading).

- Select the option to request the debit card.

- Provide Details:

- You might be prompted to confirm or provide your current address. This is where the card will be delivered, so ensure it’s accurate.

- Confirmation:

- After successfully requesting the card, you should receive an SMS confirming your request and providing an estimated delivery time.

- Delivery and Activation:

- Wait for the card to be delivered to your provided address.

- Once you receive the card, there will be instructions on how to activate it. This might involve sending an SMS, calling a helpline, or using the Easypaisa app.

- Charges:

- Be aware that there might be a fee for obtaining the card. This fee will be deducted from your Easypaisa Mobile Account.

- Additionally, familiarize yourself with any transaction or maintenance fees associated with using the card.

2. Get the Easypaisa Debit Card through the Easypaisa App

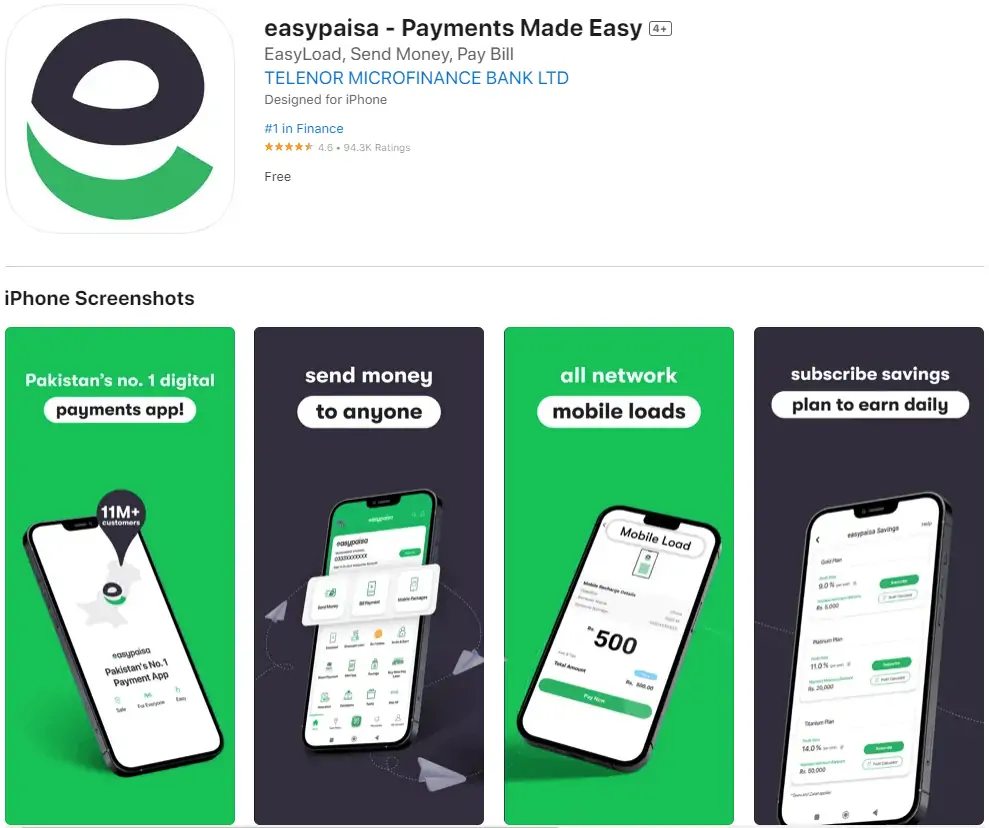

- Download and Install:

- If you haven’t already, download the Easypaisa app from the Google Play Store (for Android devices) or the Apple App Store (for iOS devices).

- Install and open the app.

- Login or Register:

- If you’re already an Easypaisa user, log in using your credentials.

- If you’re new to Easypaisa, you’ll need to register. Tap on the “Register” option and follow the prompts. You’ll typically need to provide your mobile number and CNIC details.

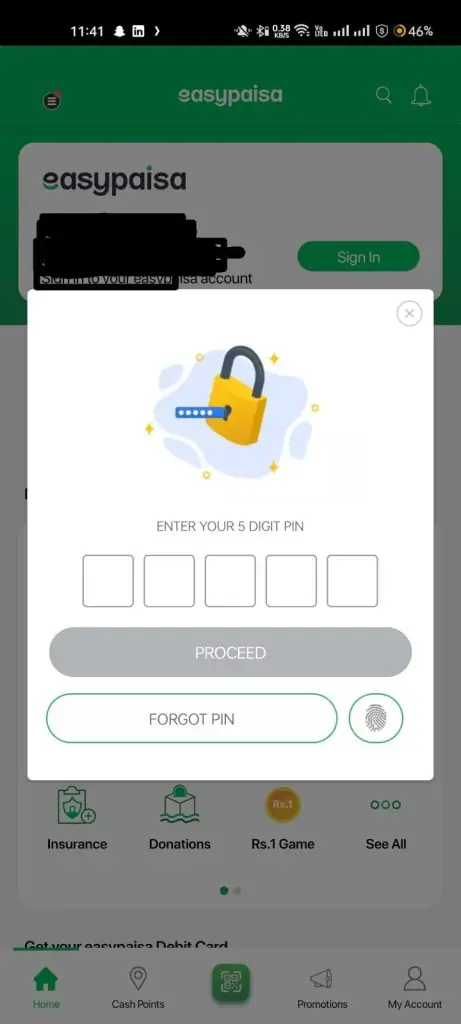

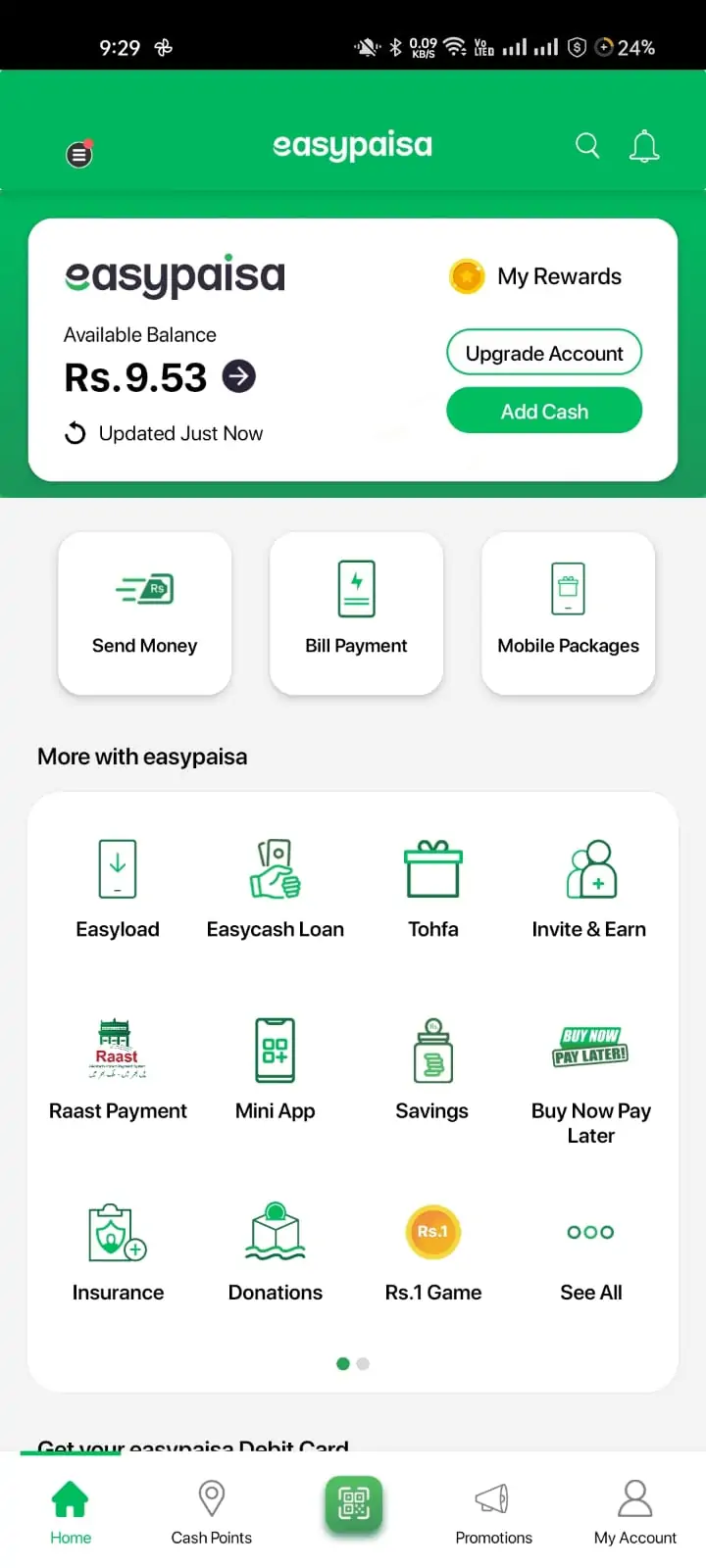

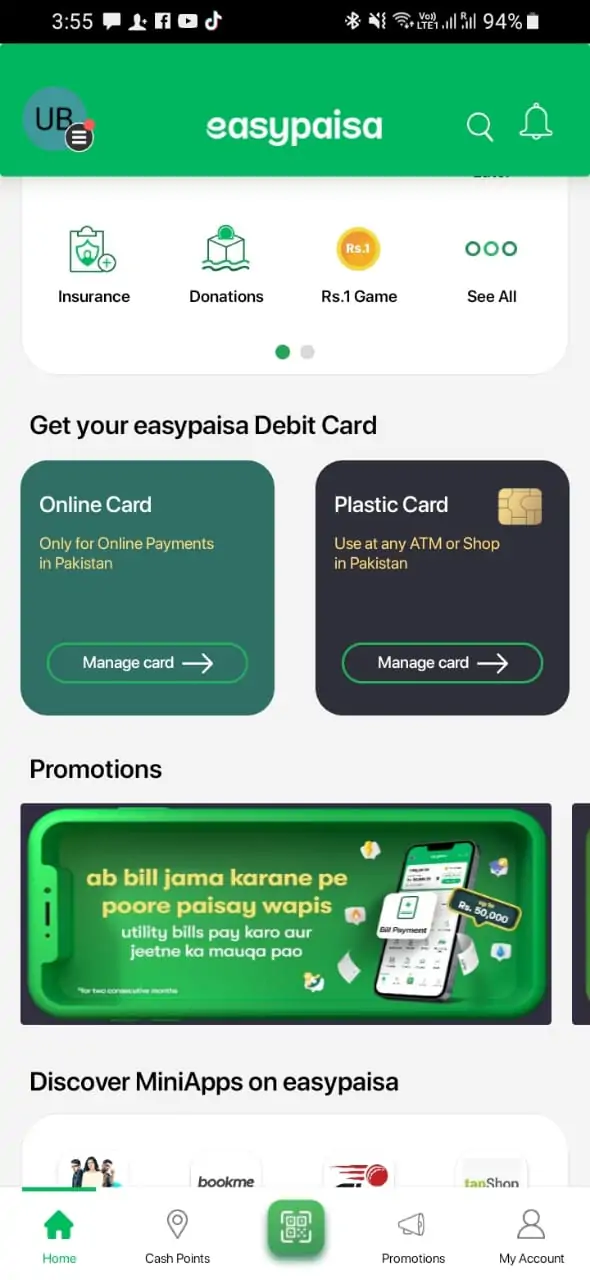

- Dashboard Navigation:

- Once logged in, you’ll be presented with the main dashboard. Here, you’ll see various options and services offered by Easypaisa.

- Accessing the Debit Card Section:

- Look for an option related to the debit card. This might be labeled as “Easypaisa Debit Card”, “Order Card”, “ATM Card”, or something similar.

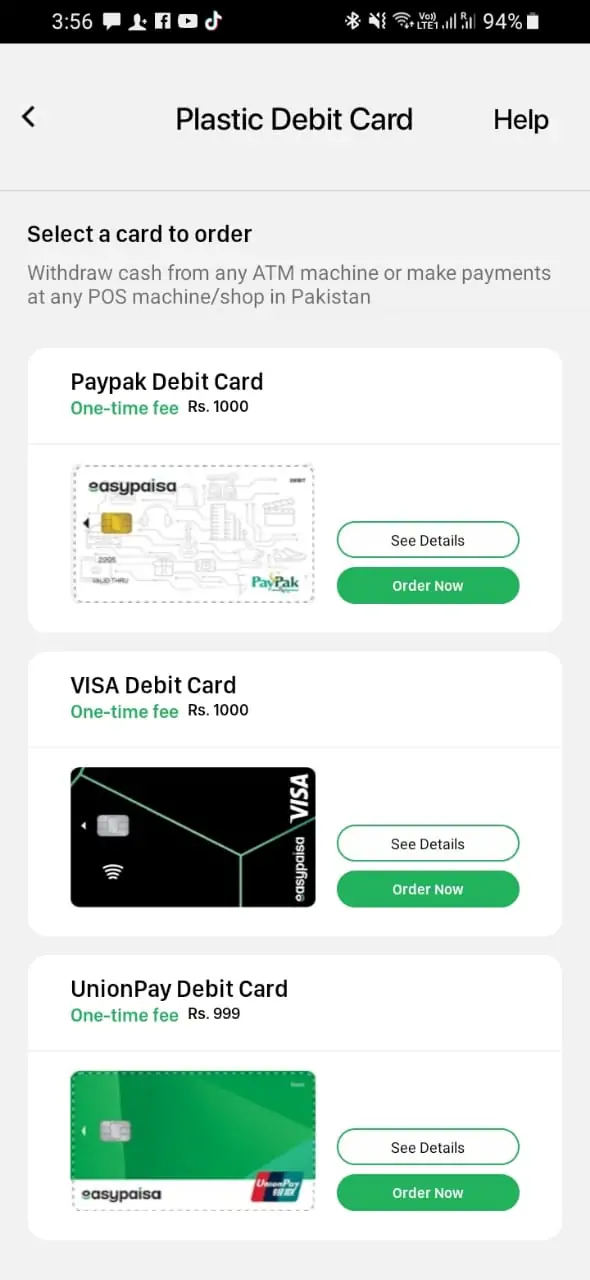

- Requesting the Card:

- Tap on the debit card option. You’ll be taken to a new screen with details about the card.

- There should be an option to “Order” or “Request” the card. Tap on it.

- Providing Details:

- You might be prompted to enter or confirm personal details, such as your name, CNIC, and delivery address. Ensure all details are accurate, as this is where your card will be sent.

- Confirmation:

- After successfully submitting your request, you should receive a confirmation message within the app. Additionally, you might receive an SMS on your registered mobile number confirming the order and providing an estimated delivery date.

- Delivery and Activation:

- Wait for the card to be delivered to the address you provided.

- Once you receive the card, there will be instructions included on how to activate it. This might involve entering details in the app, sending an SMS, or calling a helpline.

- Charges:

- There might be a nominal fee associated with ordering the card. This fee will be deducted from your Easypaisa account balance. Ensure you have sufficient funds.

3. Via Easypaisa Helpline

- Dial the Helpline:

- Call the official Easypaisa helpline. The number is usually

3737from a Telenor mobile or111-003-737from any other network.

- Call the official Easypaisa helpline. The number is usually

- Navigate the Menu:

- Listen to the automated voice prompts. There will likely be different options for various services. Choose the option related to “Easypaisa Debit Card” or “Card Services.”

- Speak to a Representative:

- Once connected to the appropriate department, you might be connected to a customer service representative. Inform them that you wish to obtain an Easypaisa Debit Card.

- Verification:

- The representative will ask for certain details to verify your identity. This usually includes your CNIC number, Easypaisa mobile account number, and possibly some recent transaction details for added security.

- Provide Delivery Details:

- Once verified, provide the address where you want the card to be delivered. Ensure the address is accurate to avoid delivery issues.

- Confirmation:

- The representative will confirm the details and process your request. You should receive an SMS or a reference number confirming your request.

- Wait for Delivery:

- After your request, the card will be dispatched to the provided address. Delivery times can vary based on your location.

- Activation:

- Once you receive the card, there will be activation instructions provided. Follow these steps to activate your card. If in doubt, you can always call the helpline again for assistance with activation.

- Charges:

- The representative might inform you about any charges associated with the card’s issuance or delivery. Ensure you’re aware of these and any other potential fees related to card usage.

4. From Easypaisa Shop

- Locate a Shop: Find the nearest Easypaisa shop or Telenor franchise using the Easypaisa app or website.

- Request: Visit the shop and inform the retailer that you want the Easypaisa Debit Card.

- Provide Details: The retailer will ask for your CNIC and Easypaisa mobile account number for verification.

- Processing: The retailer will process your request, and you might receive an SMS confirming the same.

Additional Tips for Easypaisa Debit Card Users

- Regularly Update Your Contact Details: Ensure Easypaisa has your latest contact details. This is especially important for receiving OTPs (One-Time Passwords) and other notifications.

- Be Wary of Phishing Attacks: Never share OTPs, PINs, or other sensitive details over phone calls, messages, or emails, even if they appear official.

- Set Up Two-Factor Authentication: If available, enable two-factor authentication for an added layer of protection.

- Stay Vigilant: Regularly check your account statements for any unauthorized transactions.

- PIN Safety: Never share your card PIN with anyone and avoid writing it down.

- Lost Card: In case of card loss or theft, report immediately via the Easypaisa app or helpline to block the card.

FAQs

Is there a monthly fee for the Easypaisa Debit Card?

While there’s a one-time issuance fee, be sure to check the Easypaisa website for any monthly or yearly maintenance fees.

Can I use the Easypaisa Debit Card internationally?

The card is primarily for local use. However, since it's affiliated with MasterCard, some international merchants might accept it.

What should I do if I forget my PIN?

Reach out to the Easypaisa helpline or use the mobile app to reset your PIN.

Conclusion

The Easypaisa Debit Card is a game-changer for many, offering the convenience of cashless transactions while ensuring security. With this guide, obtaining your card becomes a straightforward process, paving the way for smoother financial transactions.