EasyPaisa is one of Pakistan’s most widely used mobile wallets, offering convenient services like money transfers, bill payments, and mobile loads. But if you no longer need the account—whether you’re switching to another service, lost your number, or just want to clear your data—it’s important to know how to deactivate it properly.

Deleting or deactivating your EasyPaisa account ensures your information isn’t misused and helps keep your financial records clean. Here’s everything you need to know about safely closing your EasyPaisa account.

Why You May Want to Deactivate Your EasyPaisa Account

There are several valid reasons to close your account:

- You’re no longer using the phone number linked to your account

- You’ve switched to another mobile wallet or bank

- You’re concerned about data privacy or account misuse

- You want to manage fewer digital accounts

- Your SIM has been lost or stolen

Regardless of the reason, EasyPaisa provides official methods to deactivate your account securely.

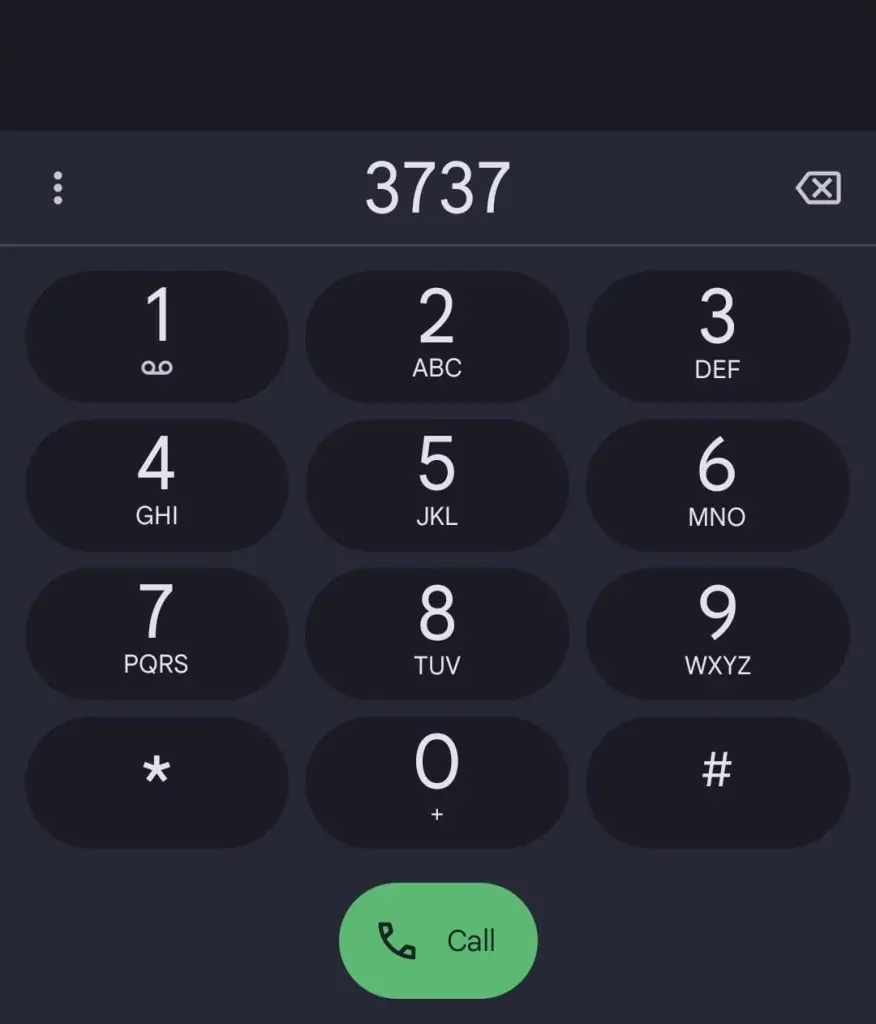

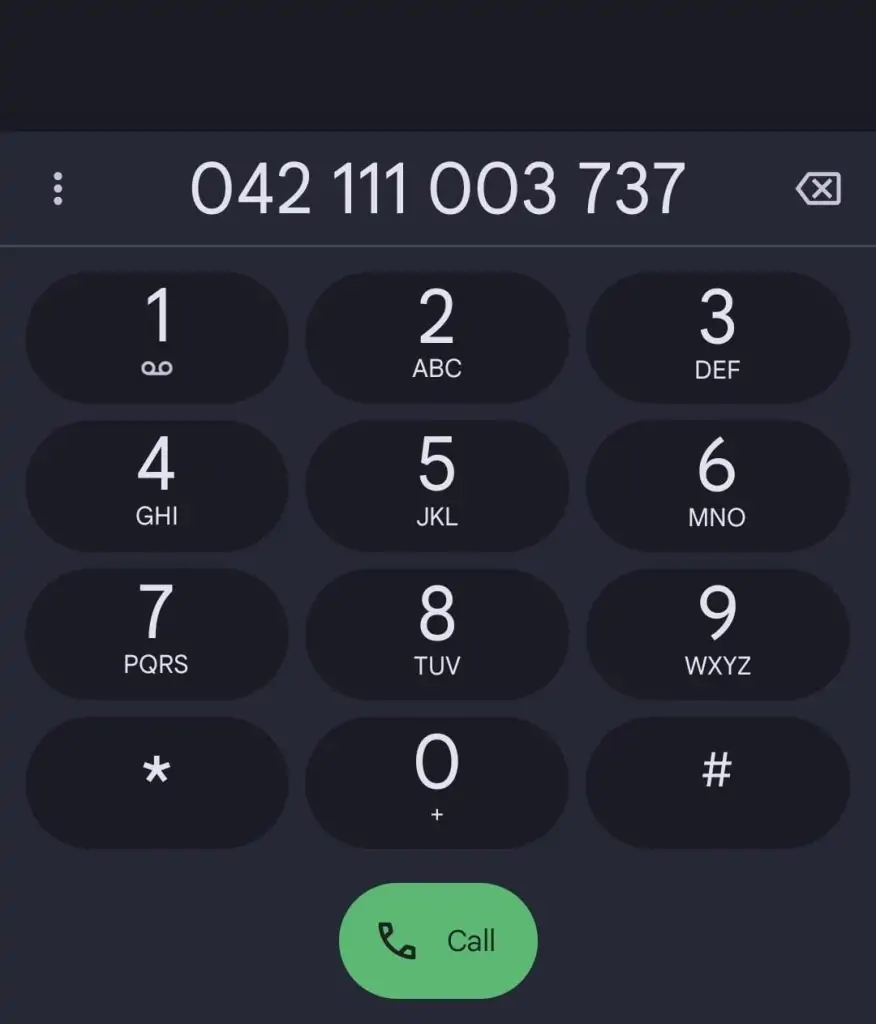

Method 1: Deactivate via Easypaisa Helpline

The most reliable way to close your EasyPaisa account is by speaking directly with a representative.

What to do:

- Dial 3737 from your Telenor number

- Or call 042-111-003-737 from any other network

- Ask the representative to deactivate your account

- You will be asked to verify your CNIC number and other account details

🕒 Once verified, your account will be closed, and any remaining balance will be addressed during the call.

Method 2: Visit a Telenor Franchise or EasyPaisa Retailer

If you prefer in-person assistance:

Steps:

- Visit your nearest Telenor service centre or authorised EasyPaisa shop

- Bring your original CNIC

- Request account deactivation

- A representative will initiate the process after verification

📌 This method is useful if your mobile number is inactive or inaccessible.

Method 3: Contact via EasyPaisa Social Media or Email

You can also request account closure through EasyPaisa’s official online channels.

Options:

- Email: Send a request to [email protected] with your CNIC, mobile number, and reason for closure

- Facebook: facebook.com/Easypaisa

- Twitter/X: x.com/Easypaisa

📩 A representative will respond and may guide you through the verification process digitally.

What Happens After Deactivation?

Once your EasyPaisa account is deactivated:

- Your wallet will no longer be accessible

- Any remaining balance should be transferred before closure

- Linked services (e.g., bill payments, top-ups, auto-pay) will be discontinued

- You can open a new account in the future with the same CNIC if needed

⚠️ Important: Be sure to withdraw or transfer your balance before initiating the closure request.

Things to Remember Before Closing Your Account

- Make sure there are no pending transactions or unresolved issues

- Clear any EasyLoad, loan, or credit-related features tied to your account

- Update payment settings in apps linked to EasyPaisa

- Take screenshots or record your balance/transaction history if needed

Conclusion

Closing your EasyPaisa account is simple, but it’s important to follow the official process for security reasons. Whether you call the helpline, visit a service centre, or reach out online, EasyPaisa ensures a smooth deactivation process once your identity is verified.

If you’re done with digital wallets or switching services, make sure your account is properly closed—don’t leave it active and vulnerable.

Plz deactivate my easy paisa account