Creating an Easypaisa account is a great solution for those who want to manage their finances easily without the need to visit a bank. Many individuals encounter difficulties due to the lack of convenient access to banking services, which complicates the process of sending and receiving money, paying bills, or recharging mobile balances. Fortunately, Easypaisa provides a straightforward method to accomplish all of these tasks directly from your mobile phone. This service is particularly beneficial for individuals residing in regions where banking facilities are scarce. By following a few straightforward steps on how to create an Easypaisa account, anyone with a mobile phone can set up their own account and begin managing their finances more efficiently.

How To Create Easypaisa Account For Telenor Users:

For Telenor users interested in how to make an Easypaisa account, there are two main approaches, each suited to various preferences and levels of access:

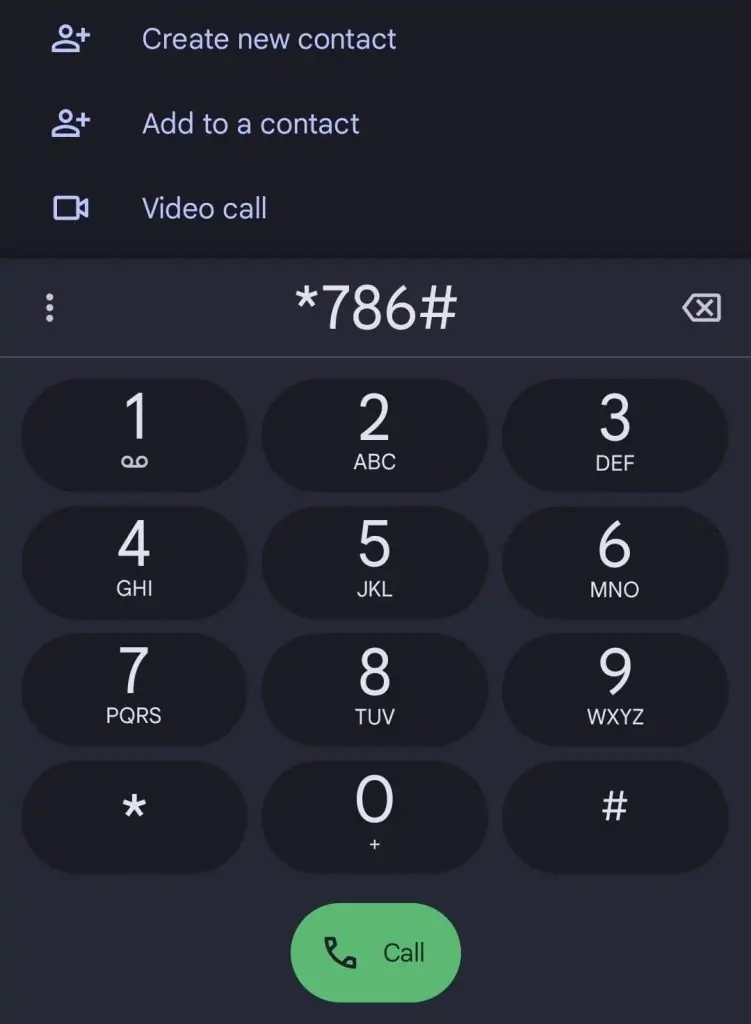

1. Via USSD Code:

- Dial *786#: Use your Telenor SIM to dial this code.

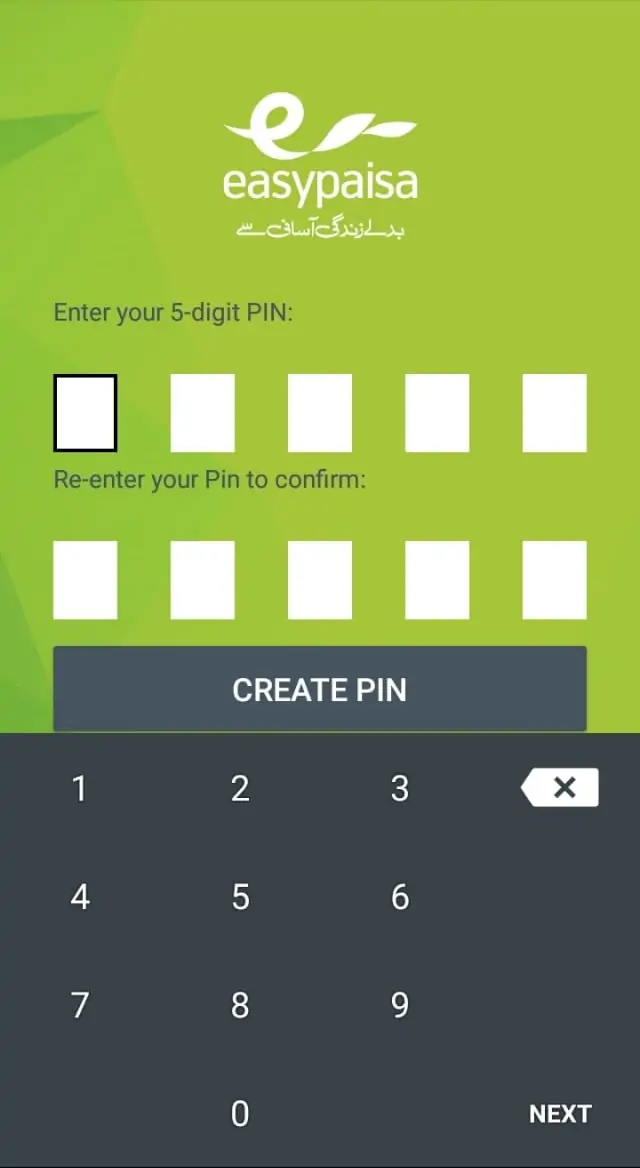

- Create a 5-digit PIN: You’ll be prompted to create a new 5-digit PIN, which serves as a security measure for your account.

- Re-enter the PIN for confirmation: This step ensures the PIN you’ve chosen is correctly set.

- Account Activation: Following these steps, your Easypaisa account will be activated, granting you access to its wide range of services.

2. Using the Easypaisa App:

- Download the App: Available on both Google Play and the Apple App Store, the Easypaisa app can be easily installed on your smartphone.

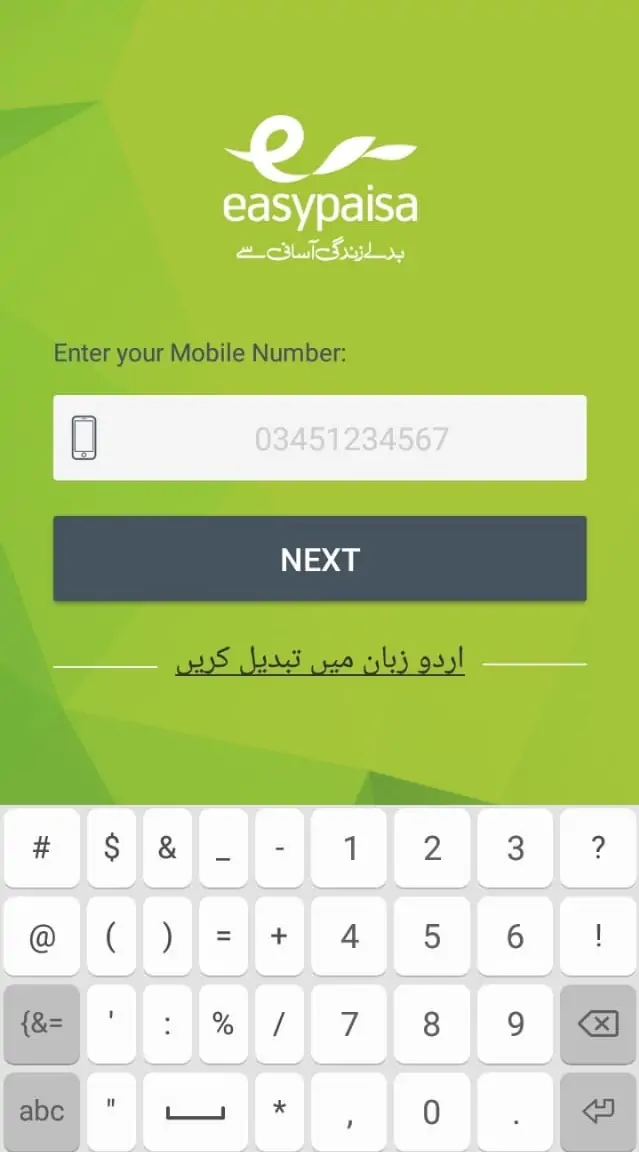

- Enter Mobile Number: Start the registration process by entering your Telenor mobile number in the app.

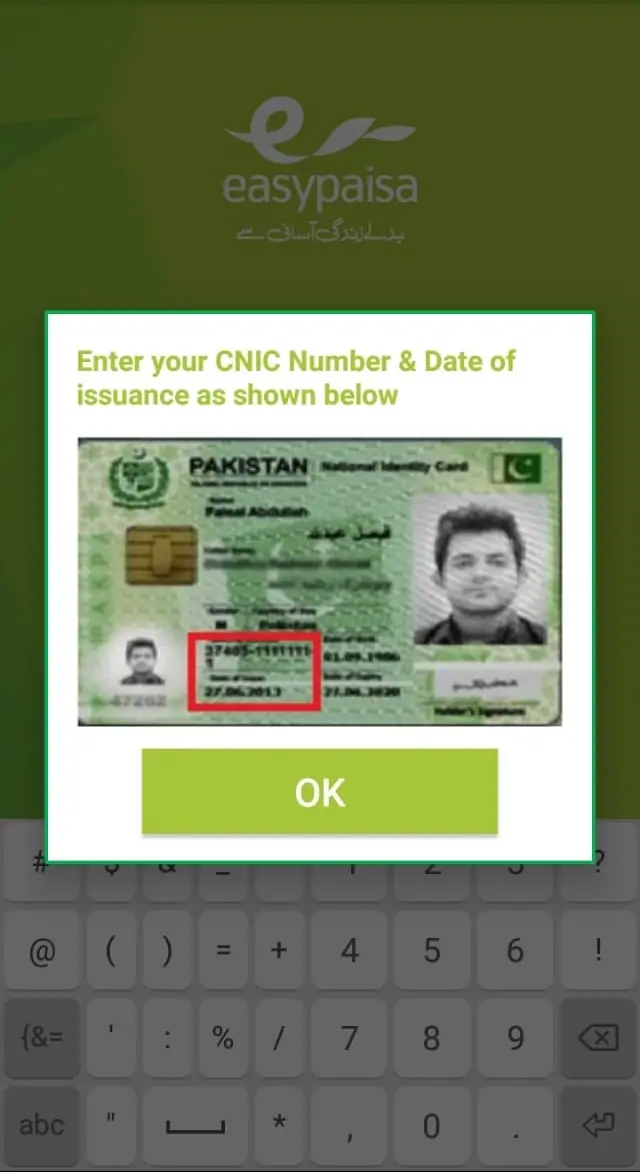

- Provide CNIC Details: You’ll need to enter your CNIC number and its issuance date, which are critical for verifying your identity.

- Create a 5-digit PIN: Similar to the USSD method, you’ll create a 5-digit PIN for securing your account.

- Complete Registration: Follow any additional prompts to finalize the creation of your account.

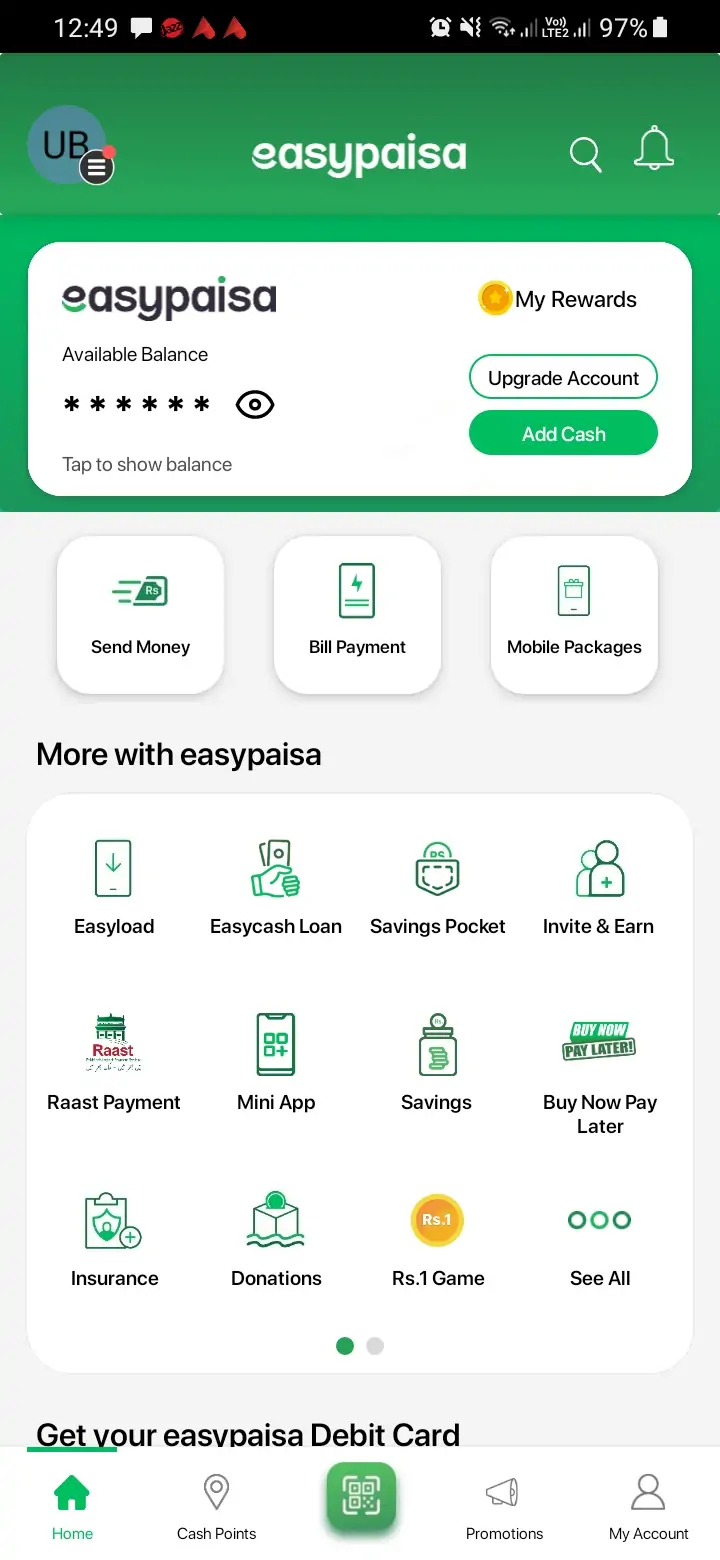

These methods offer a seamless way to access Easypaisa’s financial services, including bill payments, money transfers, mobile top-ups, and more, directly from your phone. Whether you’re learning how to open an Easypaisa account, using USSD codes for quick transactions, or the app for a more comprehensive range of services, Easypaisa provides a flexible solution to meet your financial needs.

How To Create Easypaisa Account For Non-Telenor Users:

For non-Telenor users looking to activate their Easypaisa account, the process is inclusive and straightforward, ensuring that everyone, regardless of their mobile network, can access Easypaisa’s financial services. Here’s a detailed guide on how to activate an Easypaisa account for non-Telenor users:

1. Via SMS:

- Send a Text Message: Compose a message with the format “EP<space>CNIC Number” and send it to 0345-1113737.

- Verification Call: After sending the SMS, an Easypaisa representative will contact you for verification purposes. This step is essential for confirming the details you’ve provided and ensuring the security of your account.

- Set Up a 5-digit PIN Code: Once the system verifies your details, it will ask you to create a 5-digit PIN code. This PIN is crucial for securing your account and you will use it to authenticate transactions.

2. Using the Easypaisa App:

- Download the Easypaisa App: The app is available for both Android and iOS users. You can download it from Google Play Store or Apple App Store, respectively.

- Enter Your Mobile Number and CNIC Information: Upon opening the app, you’ll be prompted to enter your mobile number. Following this, you’ll need to provide your CNIC number and the issuance date of your CNIC, which are important for the verification process.

- Select Your City: Choosing your city helps in customizing the services available to you based on your location.

- Create a PIN: You will create a 5-digit PIN for your account. This PIN will be used to secure your account and authorize transactions.

- Complete the Setup: Follow any remaining instructions to finalize your account setup, after which you can start using Easypaisa’s services.

These methods are designed to be user-friendly, ensuring quick and secure Easypaisa account opening without the need to use the app. Whether you opt for SMS-based registration for simplicity or seek alternative ways for a more comprehensive experience, you’ll gain access to a wide range of financial services that make daily transactions convenient and efficient. This approach ensures that even without the app, setting up your Easypaisa account is straightforward, allowing you to enjoy the benefits of being a part of Easypaisa’s financial network.

Benefits of Having an Easypaisa Account:

- Pay utility bills conveniently.

- Transfer money domestically and internationally.

- Avail short-term loans and insurance.

- Top-up mobile balance and pay mobile bills.

- Access to a broad spectrum of financial services.

Depositing Money into Your Easypaisa Account:

To deposit money into your account after you learn how to register for an Easypaisa account. You can visit any Easypaisa retail shop or Telenor franchise. Alternatively, if your bank account is equipped with a Visa or Mastercard. You can easily transfer funds to your Easypaisa account through your bank’s online portal by adding it as a beneficiary. Easypaisa has revolutionized financial transactions in Pakistan by offering a wide range of services. That cater to both Telenor and non-Telenor users. This makes it a versatile and accessible platform for managing finances digitally. Especially for those who have just completed their Easypaisa account registration.

Related articles:

- How To Make Easypaisa Account On Zong

- How To Deactivate Easypaisa Account

- How to Contact the EasyPaisa Helpline

Conclusion

In conclusion, setting up an Easypaisa account is a practical and convenient solution. For those looking to simplify their financial transactions. With its easy setup process and the ability to handle a variety of financial tasks directly from your phone. Easypaisa provides a valuable service, especially for those without easy access to traditional banking. Whether you need to send money, pay bills, or recharge your mobile, Easypaisa makes these tasks accessible and straightforward. By embracing this innovative service, users can enjoy greater financial freedom and convenience in their daily lives.