In Pakistan’s ever-evolving digital landscape, Easypaisa has emerged as a frontrunner in mobile wallet services, revolutionising how millions send, receive, and manage money. Whether paying bills, transferring funds, shopping online, or recharging mobile credit, Easypaisa simplifies everyday financial tasks with just a few taps on your mobile phone. With its widespread availability and user-friendly interface, it’s no surprise that Easypaisa has become a daily essential for urban and rural users.

As digital transactions continue to replace cash dealings, keeping a close eye on your transaction history is more important than ever. Monitoring your Easypaisa activity helps you manage personal expenses and detect unauthorised transactions or suspicious behaviour. Whether you’re a student tracking mobile top-ups or a small business owner checking customer payments, accessing your transaction history ensures transparency, security, and control over your financial records.

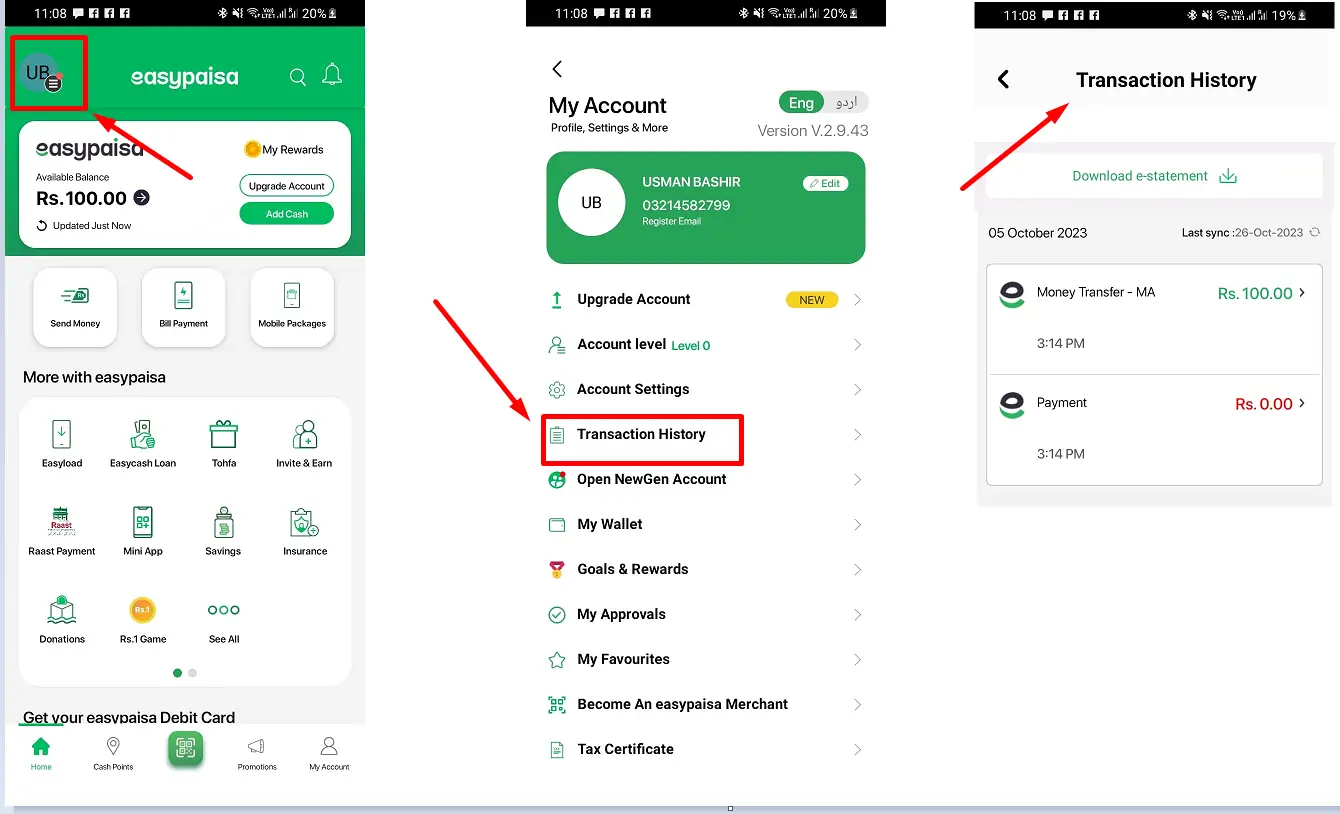

Method 1: Using the Easypaisa Mobile App

The easiest and most reliable way to check your Easypaisa transaction history is through the official Easypaisa mobile app. It offers a clean, user-friendly interface to help you manage your digital wallet in just a few taps. Whether tracking a recent bill payment or reviewing a week’s money transfers, the app makes it all accessible.

Follow these simple steps to view your transaction history:

- Open the Easypaisa App: Start by launching the Easypaisa app on your smartphone. Make sure it’s the latest version for the best experience.

- Log In Securely: Enter your mobile number and PIN. If you’ve enabled biometric security, such as fingerprint or facial recognition, use that for quicker access.

- Navigate to “My Account” or “Transaction History”: On the home screen, tap the menu or wallet icon. Depending on your app version, look for the “My Account” or “Transaction History” section.

- Filter by Date or Type: You’ll see a chronological list of all your transactions. Use the built-in filter tool to sort your history by transaction type (e.g., sent money, received money, bill payments) or specific dates.

The Easypaisa app supports both Android and iOS devices and is available in English and Urdu, ensuring accessibility for a wide range of users across Pakistan. With just a few taps, you can gain full insight into your financial activity, helping you stay organised and in control.

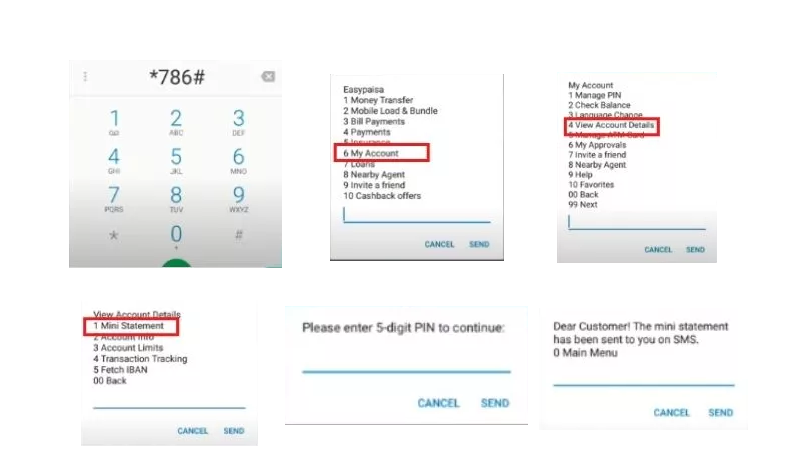

Method 2: Via SMS or USSD Code

For users who don’t have smartphones or prefer a simpler method, Easypaisa also offers access to basic account information through SMS and USSD codes. While this method may not provide a full transaction history like the mobile app, it allows you to conveniently check your latest transactions, balance, and activity status.

Here’s how you can use it:

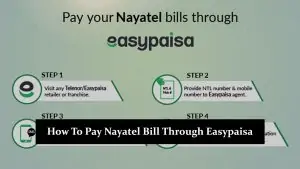

- Using USSD Code *786#:

Dial *786# from your Easypaisa-registered mobile number. A menu will appear with several options. Navigate through the menu to select “My Account” or a similar option, then choose “Mini Statement” or “Last Transactions.” You’ll receive a list of your recent transactions via SMS.

- Via SMS to 3737:

While 3737 is primarily used for sending CNIC numbers to check account registration and for certain balance-related inquiries, some users may be able to request limited transaction info depending on updates to the service. Type specific keywords like HISTORY or BAL and send to 3737, and follow any prompts provided.

This method is especially helpful for those using feature phones or living in areas with limited internet access. It’s also a quick way to confirm recent activity when you’re on the go or need a record in text format. However, it’s worth noting that the mobile app still offers the most detailed and flexible experience for complete access to your transaction history.

Method 3: Online Portal or Web Login (If Available)

While Easypaisa primarily operates through its mobile application and USSD services, many users wonder if they can access their transaction history via a web portal. Easypaisa does not offer a dedicated online dashboard for users to log in and view detailed transaction records through a browser, unlike other banking services.

However, Easypaisa has gradually expanded its digital ecosystem, and limited account services may become available online. If and when web access is introduced, here’s what users can generally expect:

However, Easypaisa has gradually expanded its digital ecosystem, and limited account services may become available online. If and when web access is introduced, here’s what users can generally expect:

- Visit the Official Website: You would go to www.easypaisa.com.pk and look for a ‘Login’ or ‘My Account’ option.

- Log in Using Registered Mobile Number: You would likely be prompted to enter your Easypaisa-registered mobile number and receive a one-time password (OTP) for verification.

- Access Transaction History: Upon successful login, a dashboard would ideally show wallet balance, recent transactions, and downloadable statements, though this is currently unavailable.

- Limitations: If such a portal is introduced, expect limitations like fewer filtering options, limited transaction records, and strict account verification for security purposes.

Until this feature becomes officially available, relying on the Easypaisa mobile app for full access or using USSD/SMS for quick updates is best. For business users or those seeking transaction proof, screenshots from the app are commonly accepted for documentation.

Why Checking Your Easypaisa Transaction History Matters

In today’s fast-paced digital world, where most payments happen within seconds, keeping a close eye on your transaction history is not just a smart habit — it’s essential. Your Easypaisa transaction log isn’t just a list of past activities; it’s a powerful tool that can protect your finances and help you control your money.

- Personal Budgeting: Whether you’re a student managing mobile recharges or a salaried individual tracking utility payments, reviewing your Easypaisa history helps identify spending patterns. It makes budgeting easier and prevents unnecessary expenses from going unnoticed.

- Business Accounting: Easypaisa is often used by freelancers, small shop owners, or online sellers to receive customer payments. Recording incoming and outgoing transactions helps streamline bookkeeping and simplifies tax preparation or earnings reporting.

- Detecting Unauthorised Charges: Regularly checking your transaction history can alert you to suspicious or unauthorised activity. If someone tries to misuse your account or conduct a fraudulent transaction, early detection allows you to act quickly and report the issue before further damage.

- Record-Keeping During Disputes or Audits: Your transaction history serves as proof in case of any payment disputes, whether with a service provider, customer, or even Easypaisa itself. Having detailed records can resolve such issues swiftly and effectively.

Simply put, your Easypaisa history offers clarity and peace of mind. It turns abstract numbers into a transparent snapshot of your financial behaviour, helping you build better money habits while protecting your wallet.

Easypaisa Safety & Security Tips

While Easypaisa makes digital transactions incredibly convenient, it is important to stay vigilant and protect your account from misuse. As mobile wallets become more widely used, scammers and fraudsters attempt to exploit unsuspecting users. Fortunately, by following a few essential safety practices, you can always ensure your Easypaisa account remains secure.

- Keep Your App Updated: Always use the latest version of the Easypaisa app. Updates often include important security patches and performance improvements that help safeguard your data from new threats.

- Use a Strong PIN and Enable Biometric Security: For your Easypaisa account, set a unique and hard-to-guess PIN. If your phone supports biometric security, such as fingerprint or facial recognition, enable these features for an extra layer of protection.

- Be Cautious of Phishing or Fake Calls: Never share your Easypaisa PIN or OTP with anyone, even if they claim to be from Easypaisa or a bank. Genuine representatives will never ask for your login credentials. Be alert to fraudulent messages, links, or calls pretending to be customer support.

- Avoid Using Easypaisa on Public/Shared Devices: Only access your Easypaisa account from your smartphone. Do not log in from public computers, cyber cafés, or borrowed phones, as they may be compromised or leave your session exposed.

Common Issues and How to Fix Them

Even though Easypaisa is built for convenience, users may occasionally encounter issues that disrupt their experience. Knowing how to troubleshoot common problems can save time and stress, whether it’s a technical glitch or a missing record. Below are some of the most frequent issues Easypaisa users face—and how to resolve them quickly:

- Missing Transactions Not Appearing in History:

Sometimes, a transaction may not show up immediately due to system delays or temporary sync issues. First, refresh the app or log out and log back in. Check your SMS alerts or email confirmations if the transaction still doesn’t appear after a few hours. You can also contact Easypaisa support with your transaction ID or mobile number for verification.

- App Not Loading or Crashing:

If your Easypaisa app crashes upon opening or fails to load, ensure you use the latest version available in the Play Store or App Store. You can also clear your app cache from phone settings or try reinstalling the app. Also, make sure you have a stable internet connection—both Wi-Fi and mobile data.

- Delay in SMS Confirmation:

Transaction SMS alerts may occasionally be delayed due to network congestion or temporary service issues. Check your app history if you’ve completed a transaction but haven’t received an SMS confirmation. If the transaction shows there, it’s been processed successfully. Consider contacting your mobile network provider or Easypaisa’s helpline for delayed SMS.

- Customer Service and Complaint Process:

If a transaction fails, funds are deducted, or an issue goes unresolved, contact Easypaisa’s customer support by calling 3737 from your registered number. You can also file a complaint through the app by navigating to the Help section. Be sure to keep transaction IDs and screenshots ready to support your case.

Awareness of these common problems—and how to fix them—helps ensure your Easypaisa experience remains smooth and reliable.

Conclusion

With a plethora of methods available, Easypaisa ensures that users from all walks of life can easily access their transaction history. Regular checks not only help in effective financial management but also in ensuring the security and integrity of your account.

FAQs

How often should I check my Easypaisa transaction history?

It's a good practice to check your transaction history at least once a week. However, if you perform numerous transactions daily, you might want to check it more frequently.

Is there a fee for accessing my transaction history?

Typically, viewing your transaction history via the app or website is free. However, some methods, like requesting a printout from an agent, might have a nominal fee.

Can I download or export my transaction history?

Yes, the Easypaisa app and website usually offer options to download or export your transaction history in formats like PDF or CSV.

Immediately contact the Easypaisa helpline and report the suspicious transaction. It's also advisable to change your PIN and monitor subsequent transactions closely.

How long does Easypaisa store my transaction history?

Easypaisa typically stores transaction data for several years, but the accessible history via the app or website might be limited to a few months or a year. For older records, you might need to contact customer service.

Can I hide or delete specific transactions from my history?

No, for transparency and security reasons, individual transactions cannot be deleted or hidden from the history.

Easypaisa maintains strict privacy policies. Your transaction details are not shared with third parties unless required by law or for specific services you've opted into.

Good luck

Dear sir, I paid my annual FBR Tax Return 2023 on 19 October 2023 having Trx ID 24329992461. Please issue me a certificate for my record on my email address

[email protected]

Regards

Dear sir I paid bill but when I check show error bill paid how can I check ammout deducted from my account I have slip when I call call end

To check if the amount was deducted from your account, you can call the EasyPaisa helpline. For Telenor customers, dial 3737, and for other network users, dial 042111003737. Explain your issue, and they will help you confirm the payment status.