In the financial world, services like Easypaisa have become a beacon of hope for those looking for easy and quick access to loans. Easypaisa, a prominent mobile banking service, offers a variety of financial services, including the provision of loans. This article aims to provide a comprehensive understanding of how much loan you can get from Easypaisa, guiding you through the process, requirements, and factors influencing the loan amount.

What is Easypaisa?

Easypaisa is a mobile financial service based in Pakistan, providing various services such as money transfer, bill payments, and mobile loans. It’s designed to make banking services accessible to everyone, including those without a traditional bank account.

How Does Easypaisa Loan Work?

Easypaisa designs its loans to be quick and hassle-free. The process is simple: you apply for a loan through the Easypaisa mobile app, and if you meet the criteria, Easypaisa credits the loan amount to your account. The repayment terms are straightforward, with a clear indication of the due date and any interest or fees.

Factors Influencing Loan Amount

Several factors can influence how much loan you can get from Easypaisa:

- Your Income: Your regular income is a critical factor. It helps Easypaisa determine your repayment capacity.

- Easypaisa Transaction History: If you’ve been using Easypaisa for other services, your transaction history can work in your favor. A good history indicates reliability.

- Credit History: Your overall credit history, if available, can affect the loan amount. A positive credit history suggests that you’re a responsible borrower.

- Loan Purpose: Sometimes, the purpose of the loan can influence the amount. Loans for emergencies might have different criteria compared to other types of loans.

- Repayment Capacity: This is closely linked to your income. It’s about how much you can afford to pay back without straining your finances.

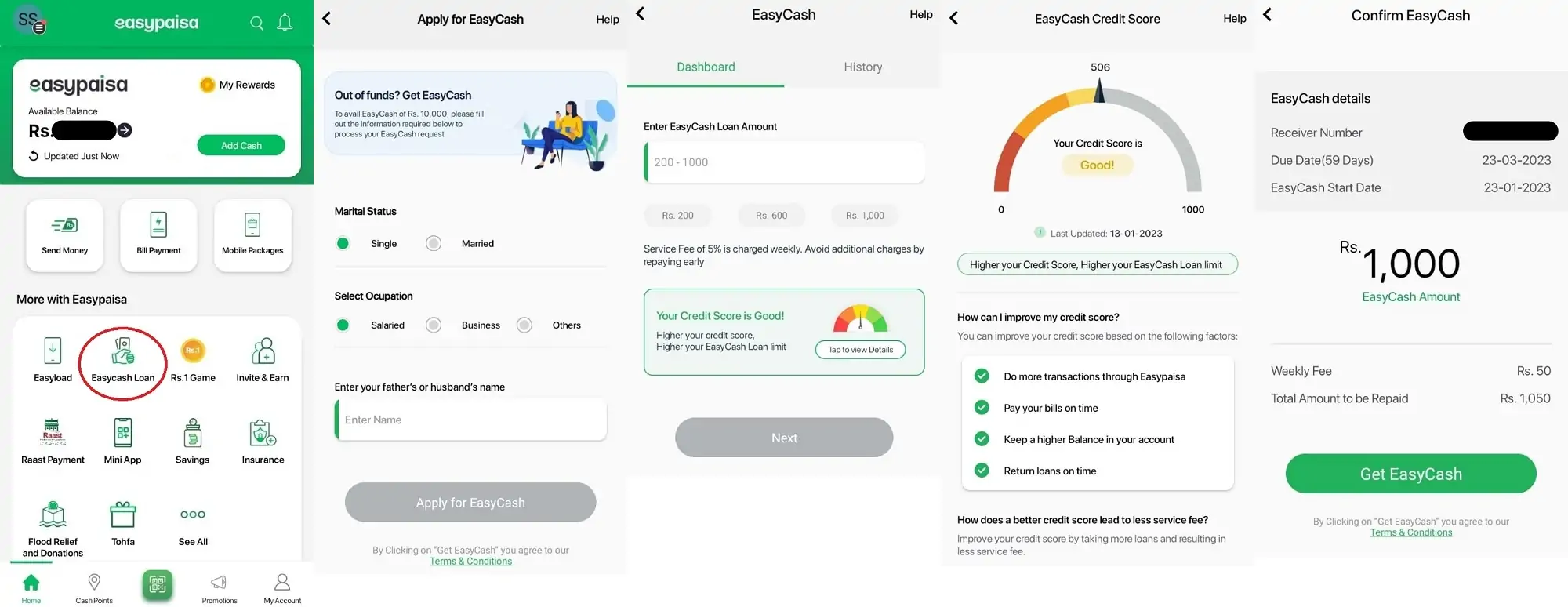

Application Process

The application process for an Easypaisa loan is user-friendly. Here’s a simple step-by-step guide:

- Download the Easypaisa App: The first step is to have the Easypaisa app installed on your Android / iPhone smartphone.

- Registration: If you’re not already an Easypaisa user, you’ll need to register. This involves verifying your identity and setting up an account.

- Loan Application: Within the app, navigate to the loan section. You’ll need to fill out an application form, providing details such as your income and the loan amount you’re seeking.

- Approval: If you meet the eligibility criteria, the loan is approved. The approval time can vary, but Easypaisa strives for quick processing.

- Receiving Funds: Once approved, the loan amount is deposited into your Easypaisa account. You can use the funds immediately for your needs.

Terms and Conditions

Easypaisa offers tailor-made loans for both personal and business needs without the hassle of paperwork, waiting in queues, or needing guarantees. Secure a loan up to Rs.10,000 instantly with these conditions:

- Exclusively for Easypaisa account holders.

- Loan eligibility and amount depend on your Easypaisa account activity.

- Timely repayment enhances your future loan amount and interest rates.

- Early repayment option available through the Easypaisa loan menu.

- Loan plus service fees are automatically deducted from your account on the due date.

- A 5% weekly fee enables early repayment and helps avoid extra charges.

- Failure to repay will lead to blacklisting by the Credit Bureau of Pakistan, with legal consequences as per Pakistani law.

How Much Loan Can You Get?

The amount you can borrow from Easypaisa varies. The range typically spans from a few thousand to a maximum that we can adjust based on the eligibility criteria mentioned above. We determine the exact amount after evaluating your application and considering the factors that influence the loan amount.

Repayment Terms

The repayment terms are crucial. Easypaisa provides clear guidelines on the interest rates, fees, and repayment schedule. It’s important to review these terms carefully to ensure you can meet the repayment obligations.

Tips for a Successful Loan Application

- Ensure Accurate Information: When applying, make sure all the information you provide is accurate. Inaccuracies can lead to delays or rejection.

- Understand the Terms: Fully understand the loan terms, including interest rates and repayment schedule.

- Borrow Wisely: Only borrow what you need and what you can repay comfortably.

- Maintain a Good Easypaisa Transaction History: A positive history with Easypaisa can improve your chances of getting a higher loan amount.

Related articles:

- How to Add Money to Your EasyPaisa App

- How to Change Your Easypaisa PIN Code

- How to Recharge Your Easypaisa Account

- How to Get an EasyPaisa OTP Code

Conclusion

Easypaisa loans offer a convenient way to access funds when you need them. The amount you can borrow depends on several factors, including your income, transaction history with Easypaisa, and your credit history. By understanding these factors and following the application process, you can enhance your chances of getting the loan amount you need. Remember, it’s important to borrow responsibly, ensuring you can meet your repayment obligations without financial strain.

Arjnt lone chaiye gar k leay plz