Update Notice: Updated in July 2024, this blog shares the latest and most reliable information about the best credit building apps. We’ve gathered all the important details to help you find the top apps and their newest features.

Best Credit-building Apps 2024

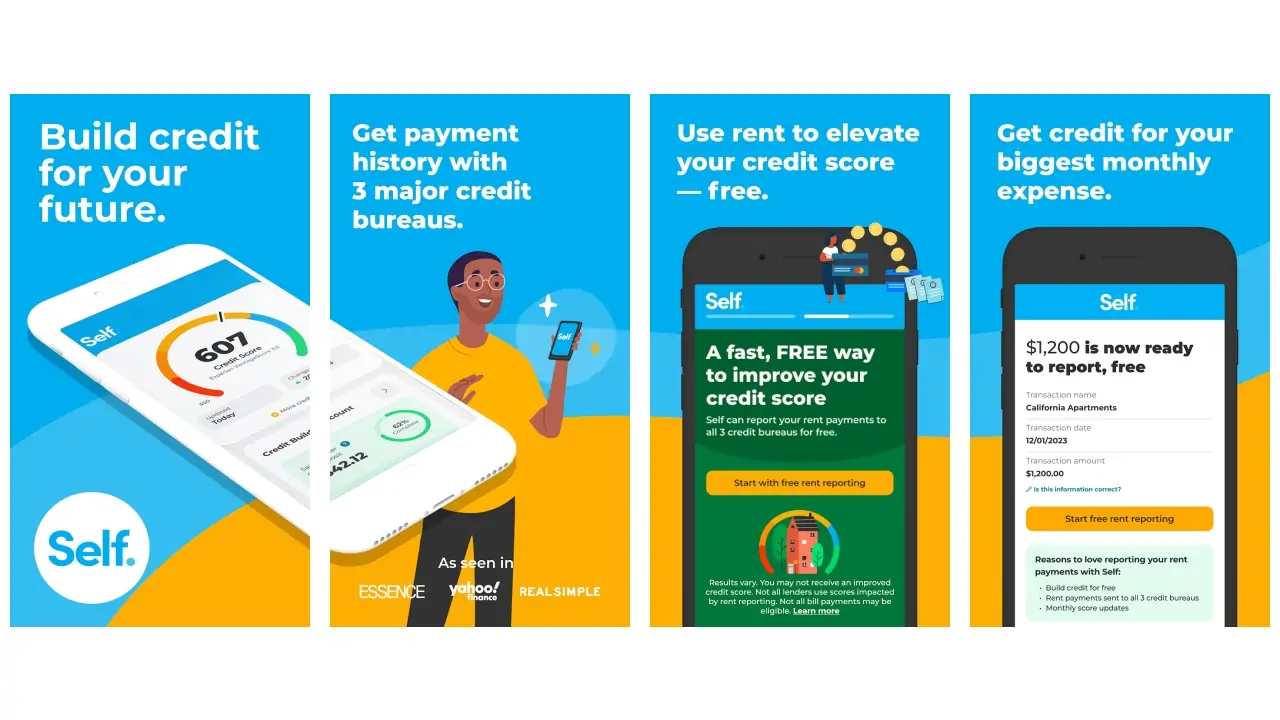

1. Self – Build Credit & Savings

Track & Build Your Credit

Feb 6, 2024

4.6(80.9K Ratings)1M+ Downloads

4.9 (254.6K Ratings)

English

Self helps you build your credit and save money at the same time. You make monthly payments into an account, and these payments are reported to the credit bureaus, helping to improve your credit score. At the end of the term, you get your savings back. It’s a simple way to start building credit without needing a credit card. The app also gives you tips and alerts to help you manage your credit. It’s perfect for beginners who want to build their credit in a safe and secure way.

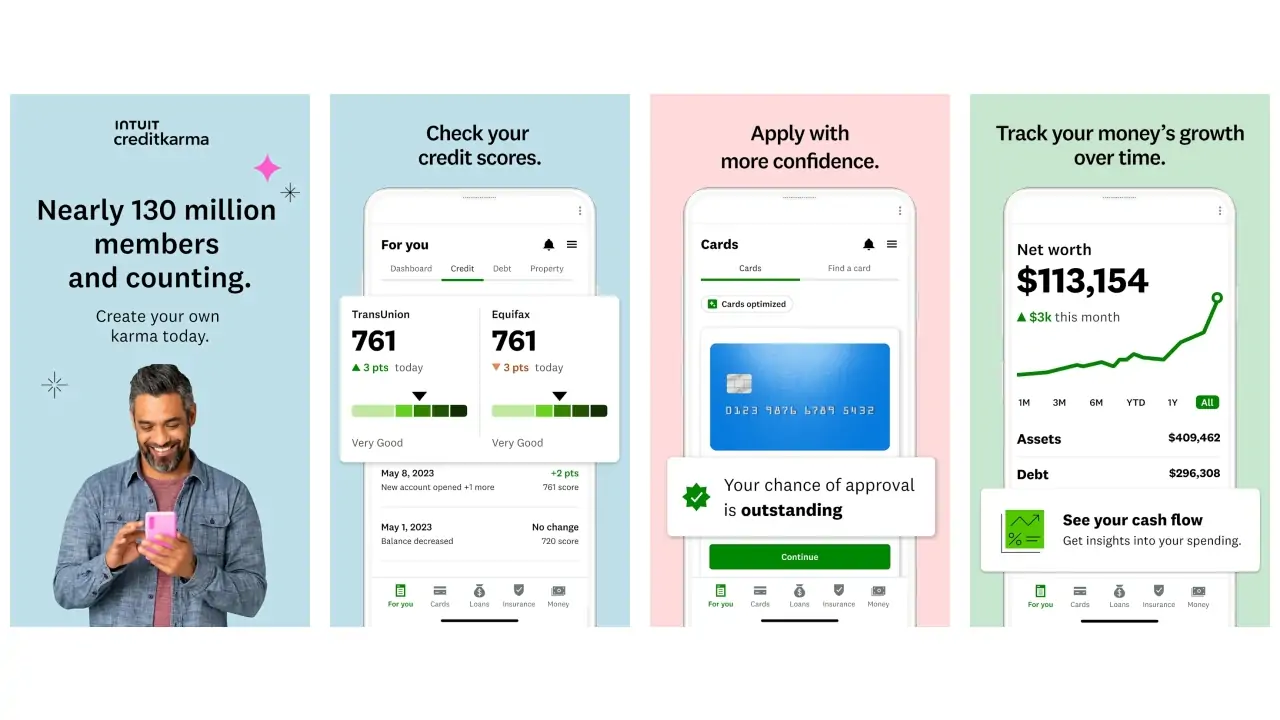

2. Intuit Credit Karma

Credit Karma gives you free access to your credit scores and reports. It helps you understand your credit and find deals on credit cards and loans that suit you. The app offers advice on how to improve your score and alerts you when there are changes to your credit report. You can also keep track of your spending. It’s a simple and helpful way to manage your credit and make informed financial decisions.

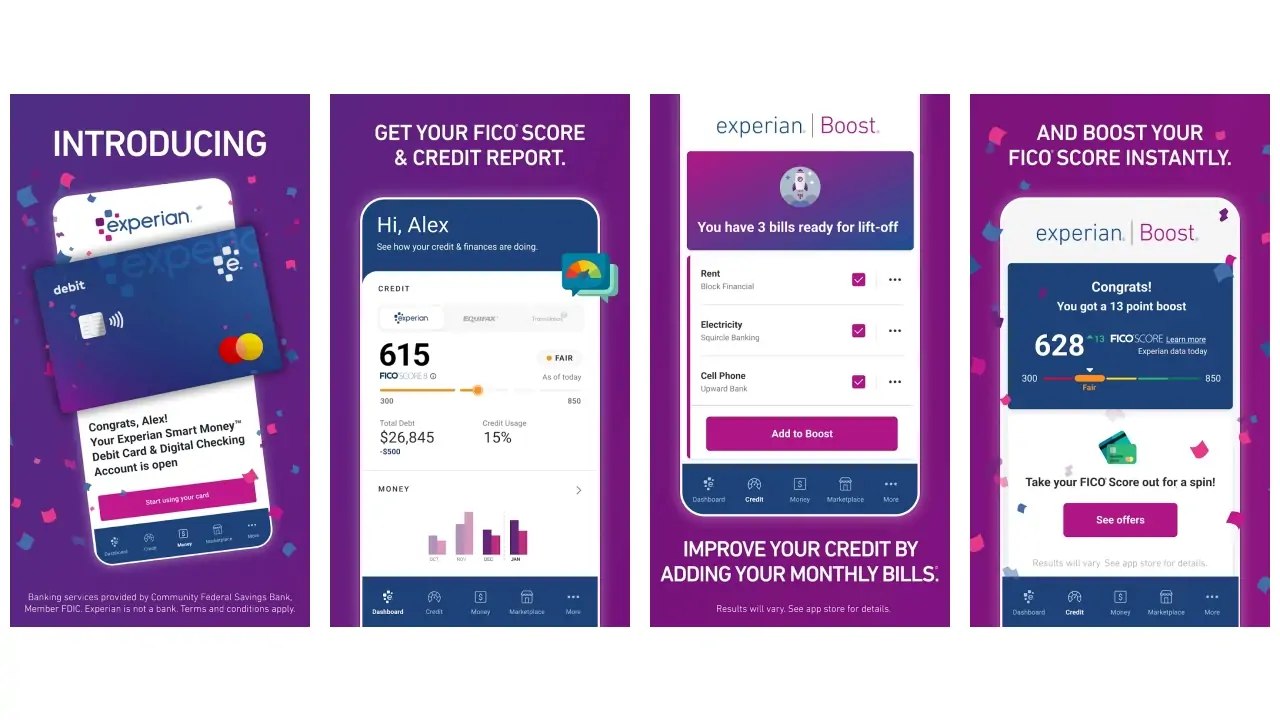

3. Experian

Take Control Of Your Credit

Feb 14, 2024

4.7(566K Ratings)10M+ Downloads

4.8 (2.2M Ratings)

English

Experian provides you with your credit score and a detailed report of your credit history. It offers a special feature called Experian Boost, which can add your utility and phone payments to your credit report to help raise your score. The app also sends you alerts if there are any changes to your credit report, like new accounts or inquiries. It’s a great tool for keeping an eye on your credit and finding ways to improve it.

People likes to read: Money Making Survey Apps

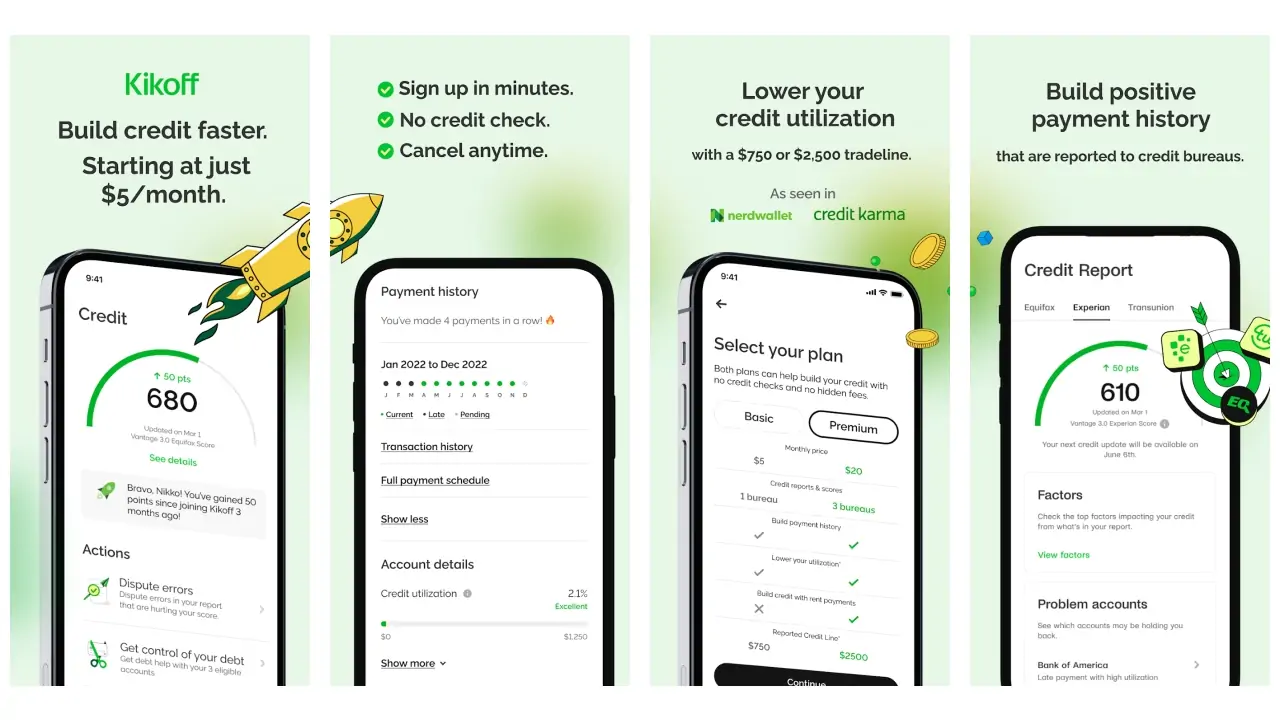

4. Kikoff – Build Credit Quickly

Reports to Equifax + Experian

Jan 31, 2024

4.7(44.8K Ratings)1M+ Downloads

4.9 (86.3K Ratings)

English

Kikoff is designed to help you build your credit score quickly. You can open a credit line with no fees and use it for small purchases. The app reports your payments to the credit bureaus, which helps establish good credit. It’s easy to use and doesn’t require a credit check, making it accessible for everyone. Kikoff is a great choice for anyone looking to quickly build or improve their credit.

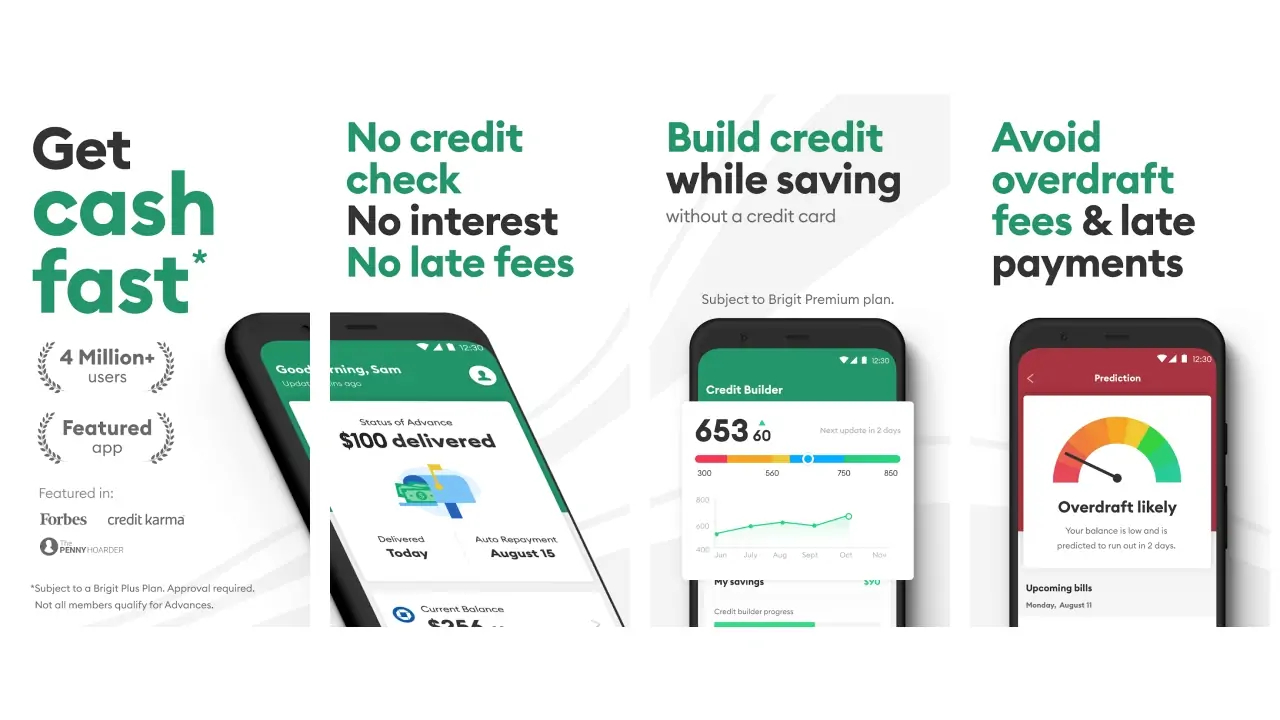

5. Brigit: Borrow & Build Credit

Credit, Budgeting & Saving App

Feb 9, 2024

4.7(171K Ratings)5M+ Downloads

4.8 (274.7K Ratings)

English

Brigit offers small cash advances to help you cover unexpected expenses and avoid overdraft fees. It also helps you build credit by reporting your on-time payments to the credit bureaus. The app includes tools to help you budget and manage your money better. There are no credit checks, so it’s easy to get started. Brigit is a handy app for both borrowing money when you need it and improving your credit score.

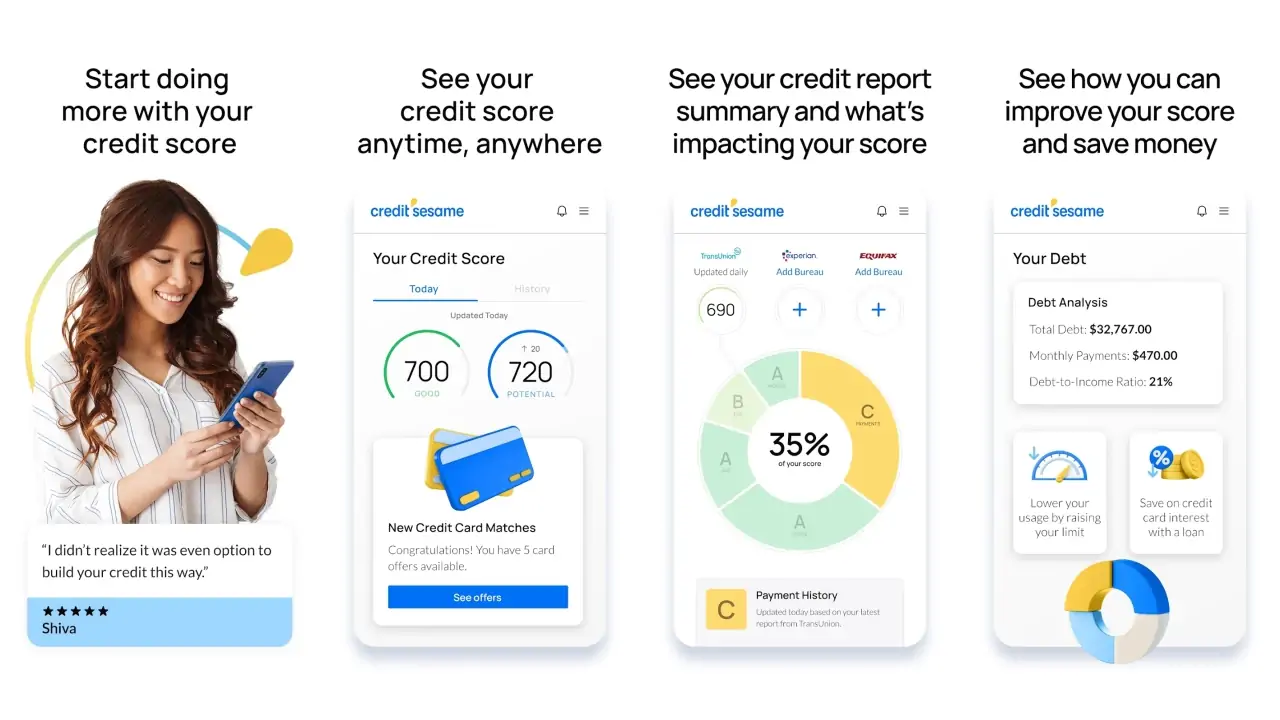

6. Credit Sesame: Build Score

Manage and Track Your Credit

Feb 14, 2024

4.7(164K Ratings)5M+ Downloads

4.8 (389.6K Ratings)

Contains ads Offers In-App Purchases

English

Credit Sesame gives you free access to your credit score and report. The app provides tips and tools to help you improve your credit score. It also monitors your credit and alerts you to any important changes. You can see how actions like paying off debt affect your score. Credit Sesame is a helpful app for understanding your credit and finding ways to improve it.

Read more: Budgeting Apps for College Students

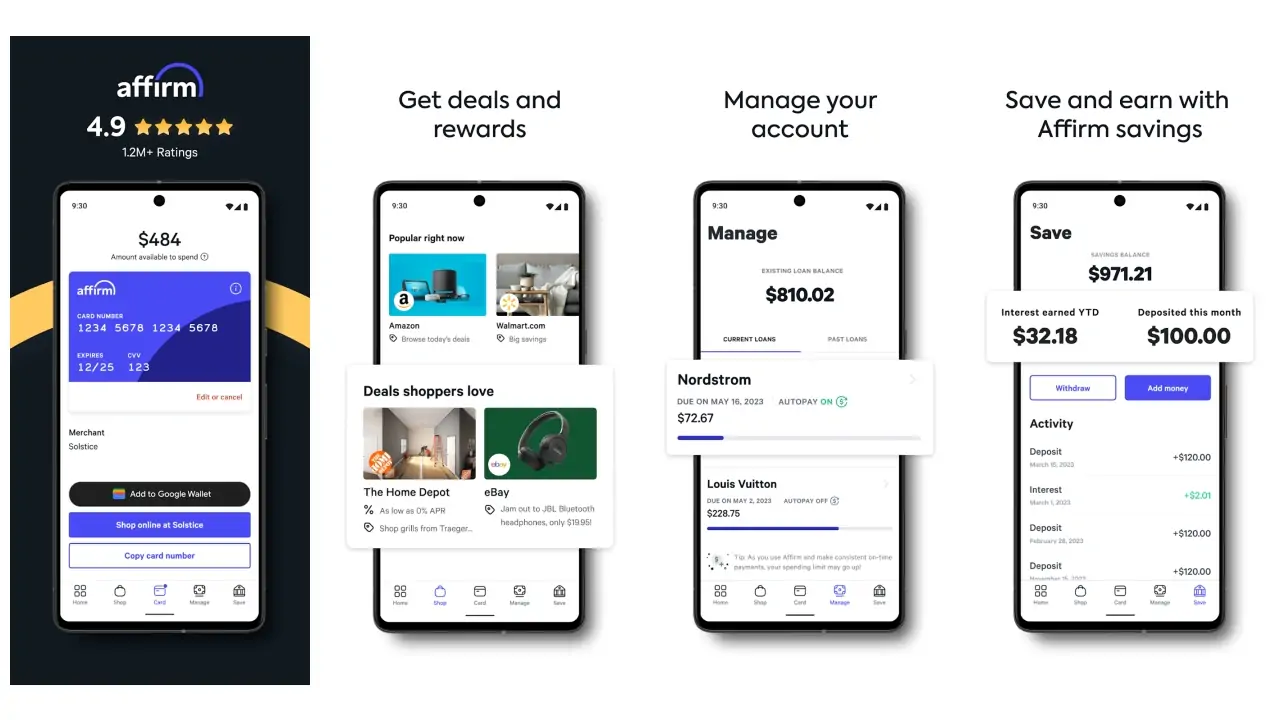

7. Affirm: Buy now, pay over time

Flexible payments, big savings

Feb 13, 2024

4.8(309K Ratings)5M+ Downloads

4.9 (1.4M Ratings)

English, French

Affirm lets you buy things now and pay for them over time with fixed monthly payments. There are no hidden fees or late charges, so you always know what you’re paying. You can choose a payment plan that fits your budget. Affirm is accepted at many stores, making it easy to use. It’s a good way to make purchases more affordable while managing your budget.

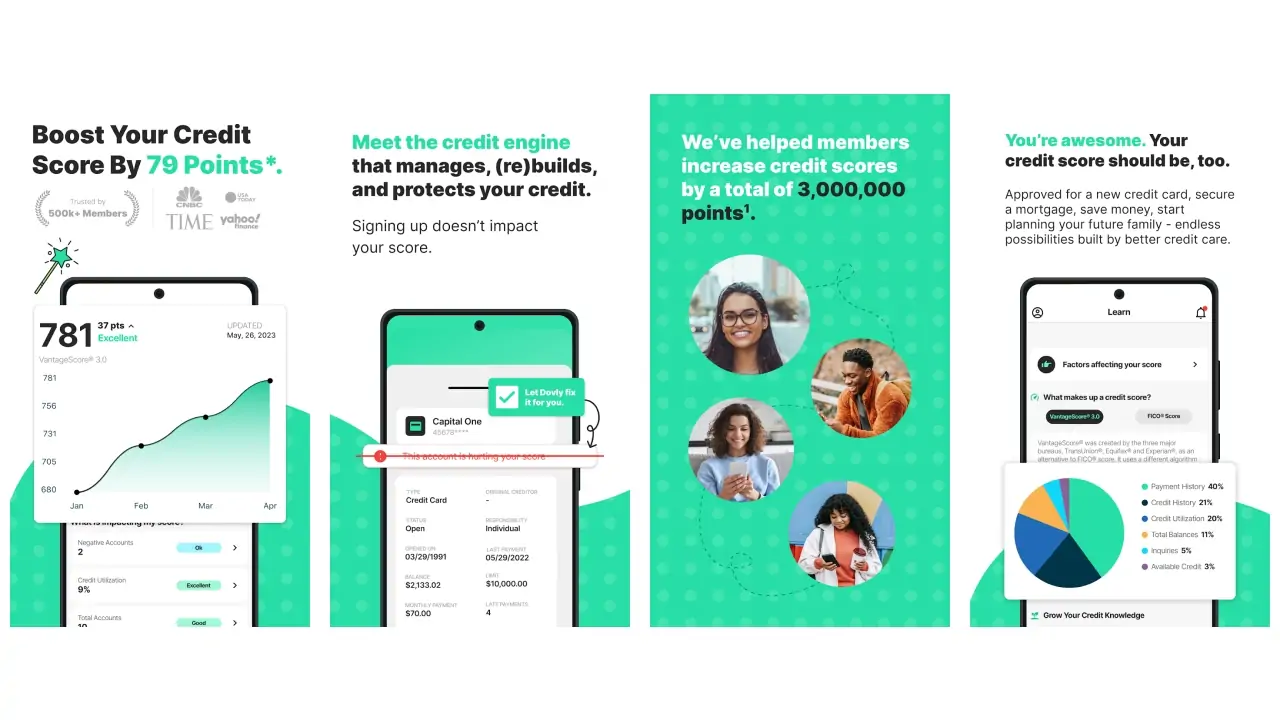

8. Dovly – AI Credit Engine

Boost your credit with AI

Feb 12, 2024

4.7(11.6K Ratings)100K+ Downloads

4.8 (8.3K Ratings)

In-app purchases Offers In-App Purchases

English

Dovly uses AI to help you fix and improve your credit score. The app identifies negative items on your credit report and helps you dispute them. Dovly tracks your progress and gives you advice on how to raise your score. The app also provides free access to your credit score and report. It’s a simple and effective way to manage your credit and improve your financial health.

Related articles: Financial Management Tools for Students

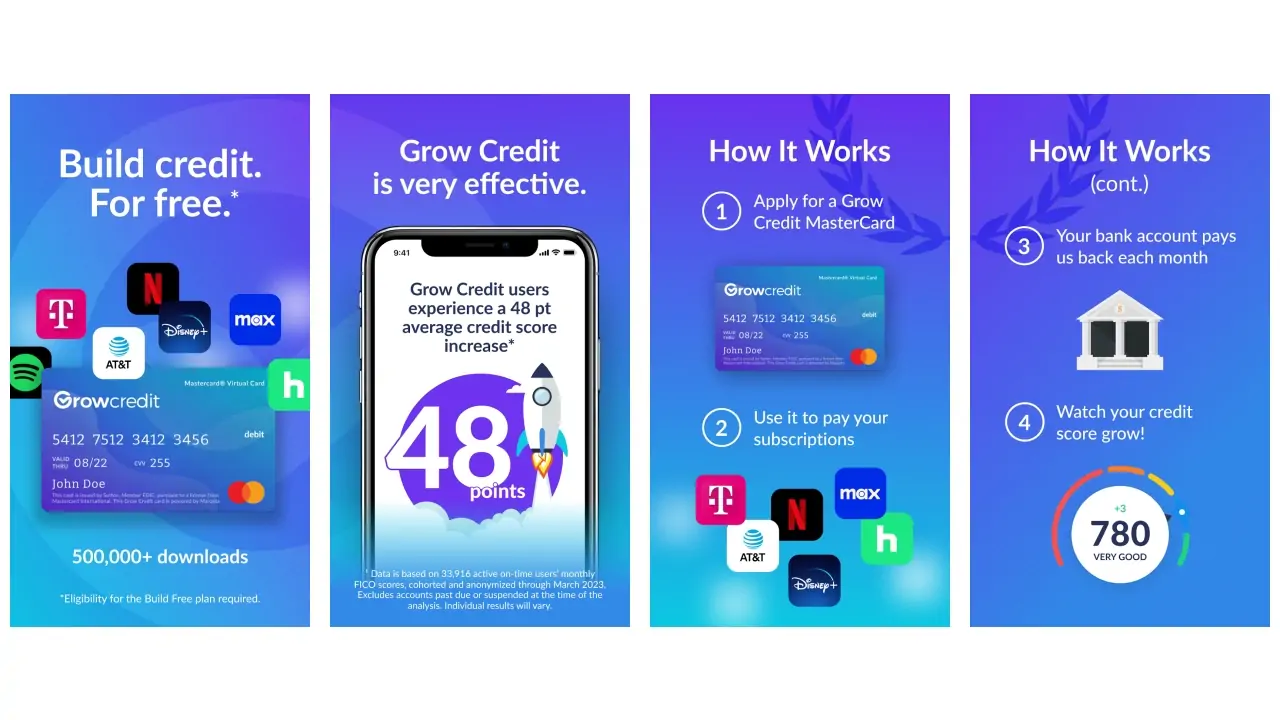

9. Grow Credit

Build Credit for Free

Jan 24, 2024

English

Grow Credit helps you build credit by using your subscriptions, like Netflix and Spotify. You use a credit line to pay for these services, and your payments are reported to the credit bureaus. This helps you build a positive credit history without taking on additional debt. Grow Credit is easy to use and doesn’t require a credit check. It’s a smart way to improve your credit score while paying for services you already use.

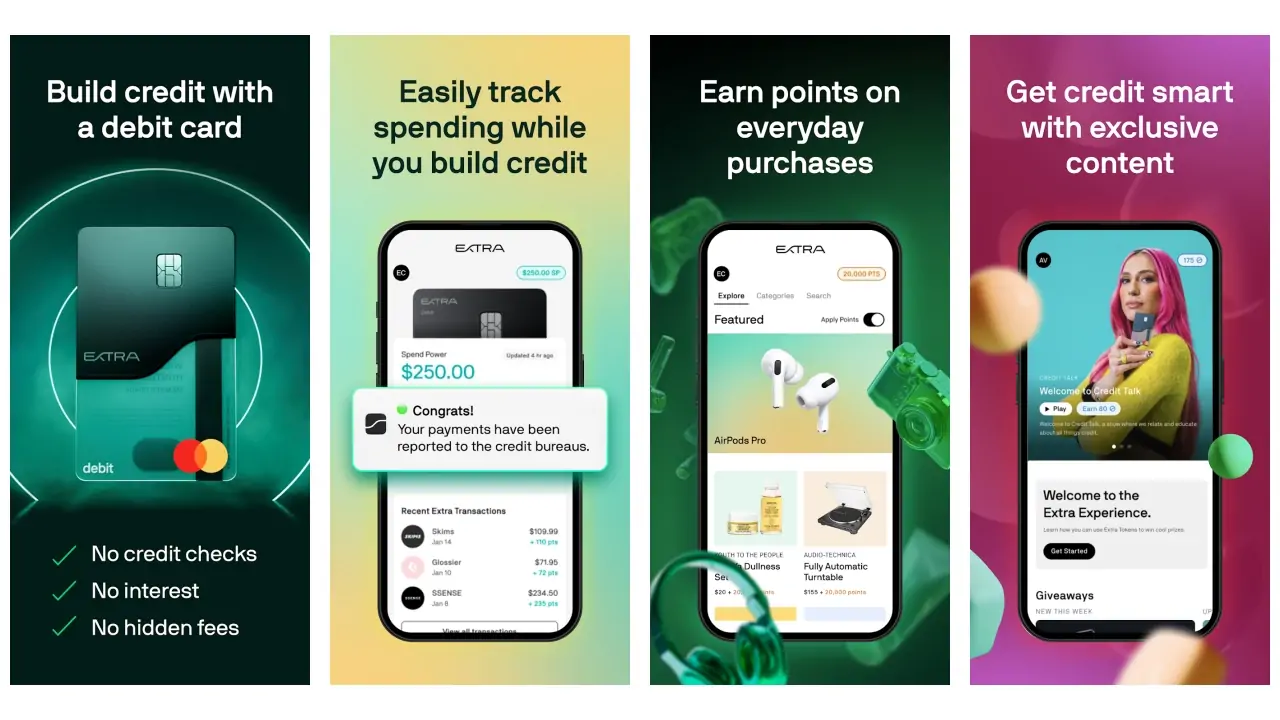

10. Extra: Build Credit with Debit

Credit builder + reward points

Feb 8, 2024

3.6(2K Ratings)100K+ Downloads

4.6 (8.2K Ratings)

English

People also like: Essential Budgeting Apps for Van Lifers

Conclusion:

Credit building apps make it easy to improve your credit score. They offer tools and tips to manage your money and make smart decisions. Whether you’re new to credit or trying to fix it, the right app can help you. Explore the apps we’ve mentioned, pick the one that works best for you, and start building good credit today. With these tools, you can take control of your financial future.