Sending an Easyload through the Easypaisa app is a convenient and straightforward process that allows users to top up their prepaid mobile phone balance instantly. This article provides a step-by-step guide on how to easily recharge your phone or someone else’s phone using the Easypaisa application. Whether you’re a new user or someone familiar with mobile financial services, this guide aims to ensure you can navigate through the process effortlessly.

Steps To Easyload From the Easypaisa App

To easily download from the Easypaisa app, follow these steps.

Step 1: Download the Easypaisa App

First, if you haven’t already, download the Easypaisa app from the Google Play Store or the Apple App Store. Installation is quick, and once done, you’ll need to register for an account using your mobile number.

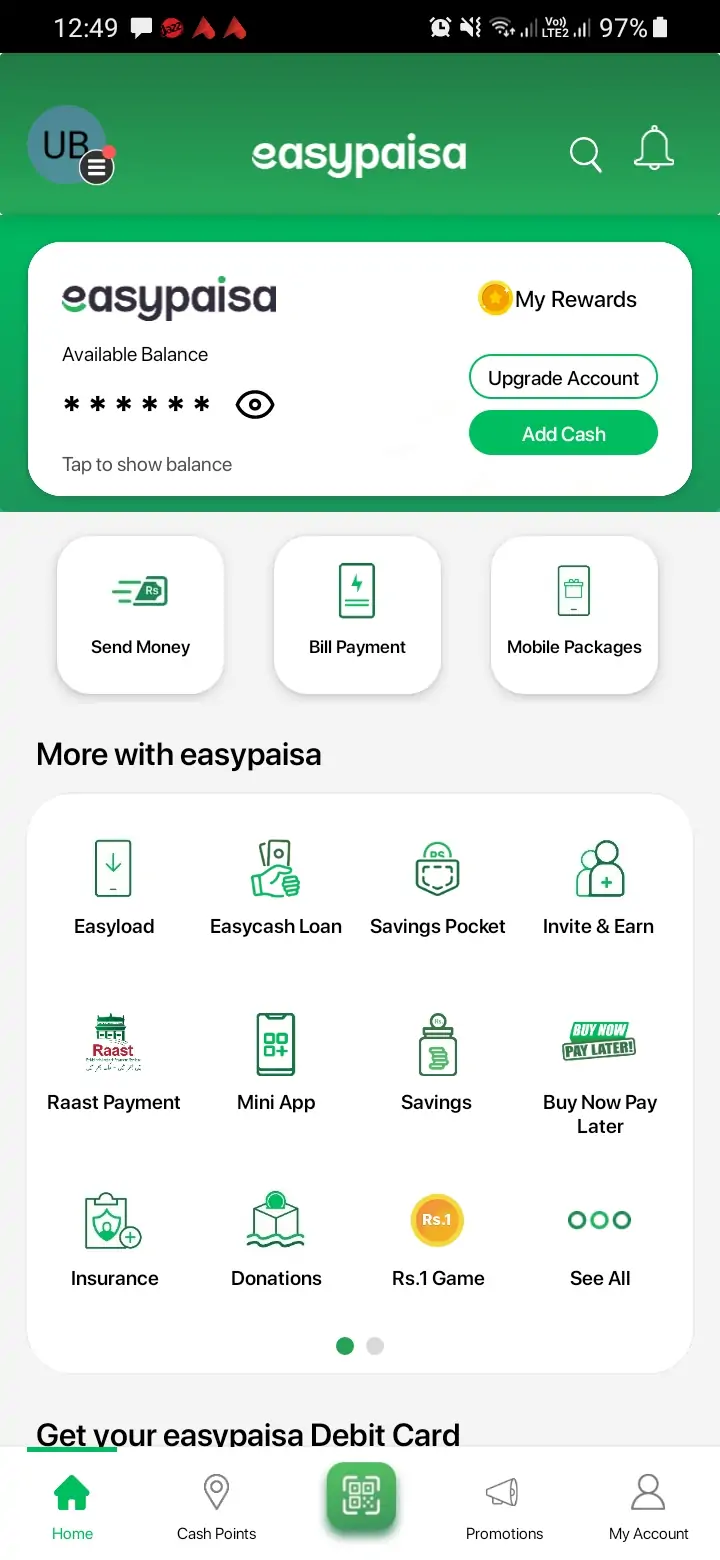

Step 2: Login and Access the Home Screen

Open the app and log in using your four-digit PIN. Once you’re in, you’ll be taken to the home screen, which displays various financial services and features offered by Easypaisa.

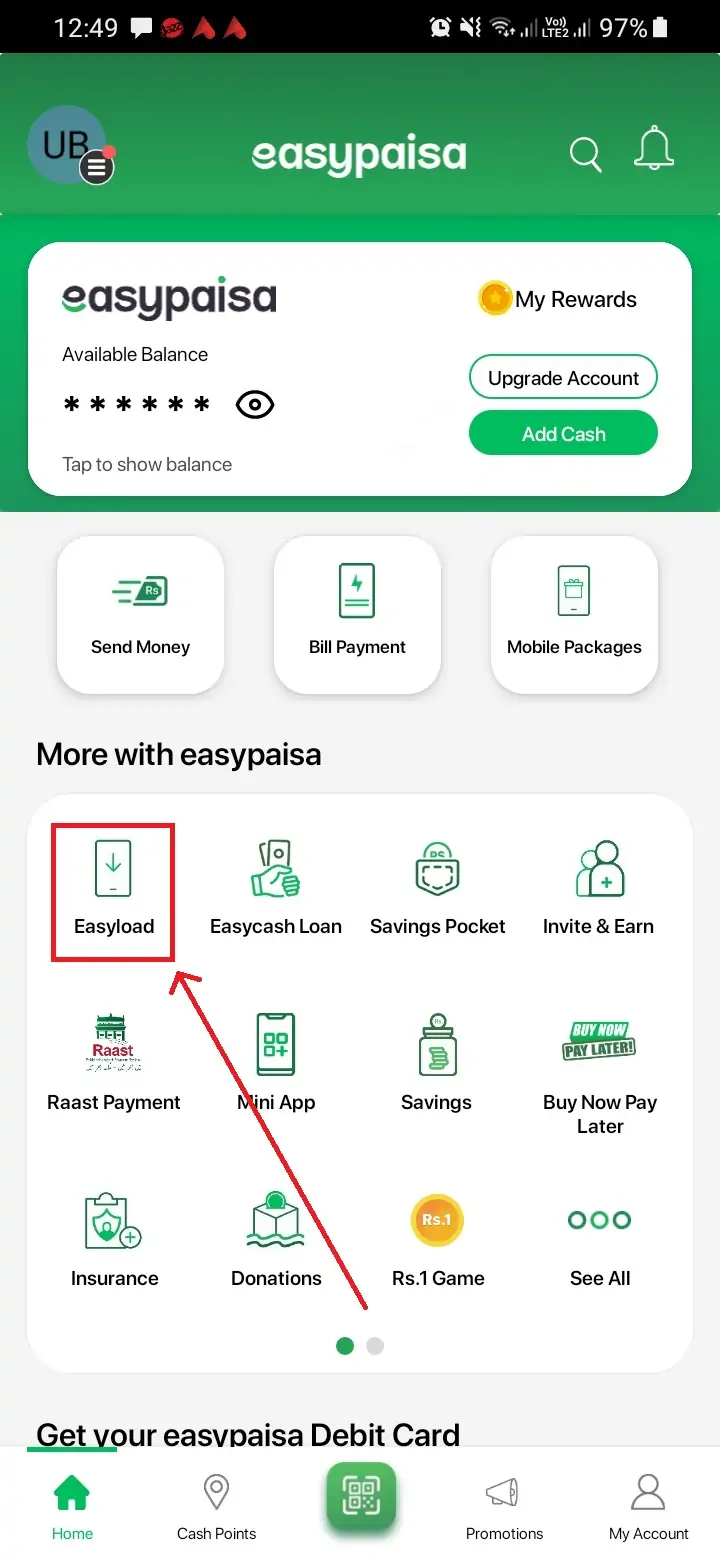

Step 3: Select the ‘Easyload’ Option

On the home screen, look for the Easyload or Top-up option. It might be listed under a menu like Recharge or Pay Bills, depending on the version of the app you’re using.

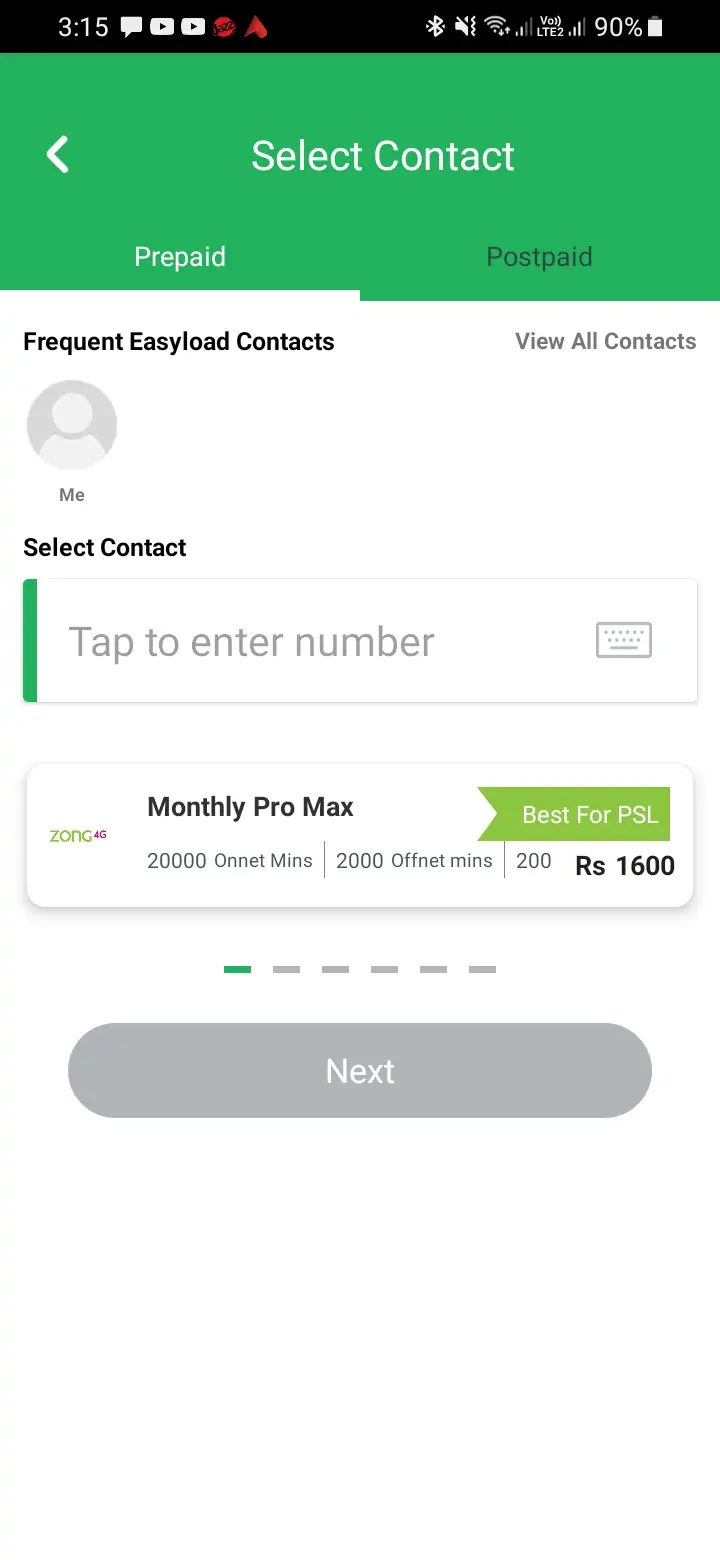

Step 4: Enter Details

- Mobile Number: Enter the mobile number you wish to recharge. Ensure the number is correct to avoid sending the balance to the wrong number.

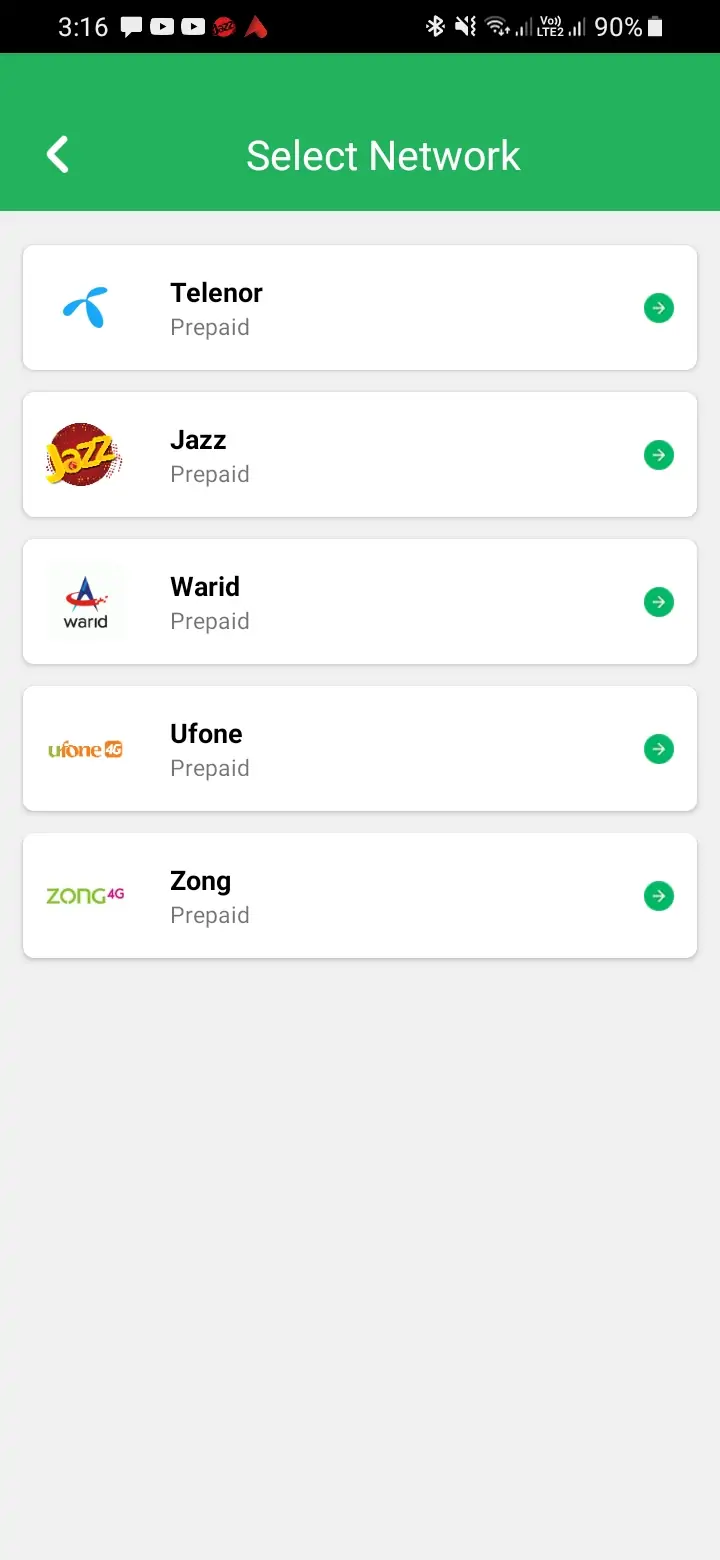

- Operator: Select the mobile network operator (e.g., Jazz, Telenor, Ufone, Zong,warid) associated with the number you’re recharging.

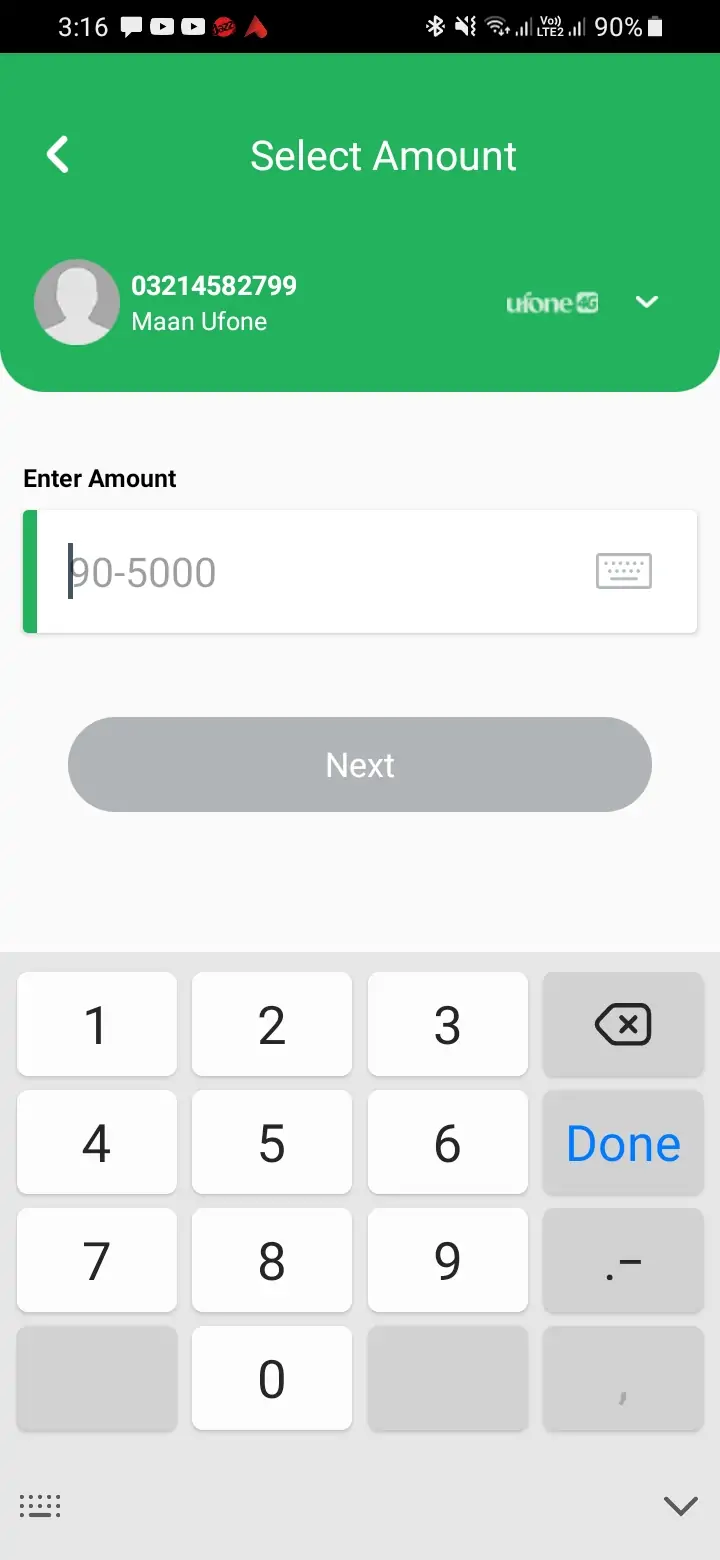

- Amount: Enter the amount of balance you want to load. There might be minimum and maximum limit restrictions, so adjust accordingly.

Step 5: Confirm and Pay

After entering all details, review them to make sure everything is correct. Then, proceed to payment. You’ll have the option to use your Easypaisa account balance or a linked bank card for the transaction. Choose your preferred method and confirm the payment.

Step 6: Transaction Confirmation

Once the transaction is successful, you’ll receive an instant confirmation message from Easypaisa. Additionally, the recipient mobile number will also receive a message confirming the recharge.

Additional Tips

- Promotions: Keep an eye out for any Easyload promotions within the app. Easypaisa often offers cashback or extra balance on certain transactions.

- Transaction History: You can view your Easyload transaction history in the app to keep track of your recharges and expenditures.

- Customer Support: If you encounter any issues or have queries, Easypaisa’s customer support is readily available to assist you.

By following these simple steps, you can efficiently use the Easypaisa app to perform Easyload transactions anytime and anywhere. This digital convenience ensures that you or your loved ones never run out of mobile balance, providing a seamless and hassle-free mobile recharge experience.

Related articles:

- How To Reactivate Easypaisa Account

- How to Increase Your Easypaisa Account Limit

- How to Cancel Easypaisa Transaction

- How To Delete Easypaisa Transaction History

Conclusion

In conclusion, the Easypaisa app revolutionizes mobile recharging with its user-friendly Easyload feature, providing a secure and instant way to top up mobile balances. Its straightforward process ensures that users can effortlessly manage their mobile expenses, saving time and enhancing convenience. With continuous improvements and enticing promotions, Easypaisa exemplifies the efficiency and value digital financial services add to our daily routines, making it an essential tool for modern financial management.