In today’s connected world, staying in touch is more important than ever. For Du users in the UAE, transferring the balance to another Du number can be a lifesaver in times of need. Whether it’s helping a friend out of a tight spot or ensuring family members can always call you, this simple process makes it possible. Learn the step-by-step process for Transfer Balance from Du to Du. This guide provides easy instructions to quickly send credit.

What You Need

- Two active Du mobile numbers (Sender and Receiver)

- Sufficient balance in the sender’s account

Step-by-Step Process To How to Transfer Balance from Du to Du

1. Check Your Balance:

- Before initiating the transfer, make sure you have enough credit in your Du Account. You can check your balance by dialing *135# and following the instructions.

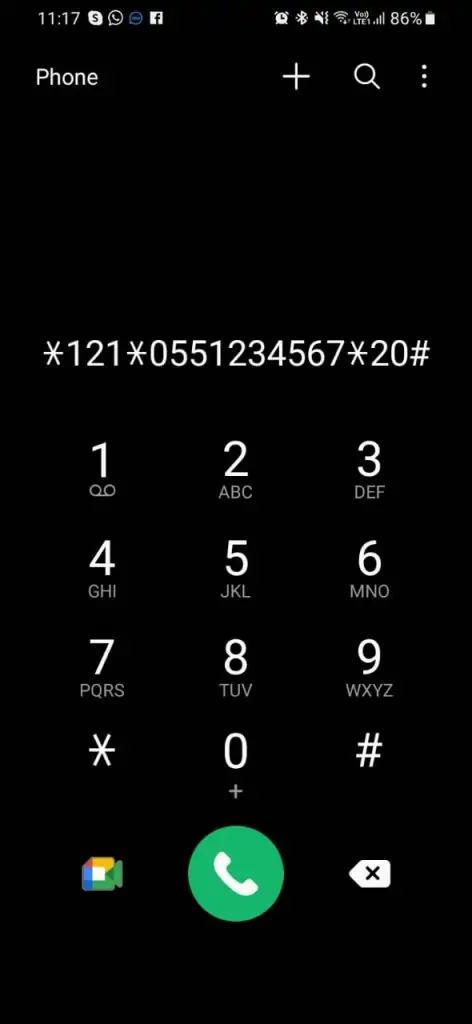

2. Initiate the Transfer:

- Open the dialer on your mobile phone.

- Dial *121* followed by the Du number you want to transfer credit to, then *the amount#.

- For example, to transfer AED 20 to the number 0551234567, dial *121*0551234567*20#.

3. Confirm the Transaction:

- After dialing the above code, you will receive a confirmation message.

- You need to reply with ‘1’ to confirm the transfer.

4. Transaction Completion:

- Once confirmed, the specified amount will be deducted from your balance and added to the recipient’s balance.

- Both parties will receive a confirmation SMS from Du.

Important Points to Remember

- Eligibility: Ensure both the sender and receiver are active Du subscribers. The service is not available for numbers that are inactive or have been suspended.

- Sufficient Balance: The sender must have enough credit to cover both the transfer amount and any applicable service fees.

- Service Fees: Be aware of the service fees charged by Du for each balance transfer. These fees can change, so it’s advisable to check the current rates on Du’s official website or by contacting customer service.

- Transfer Limits: Familiarize yourself with the minimum and maximum transfer amounts allowed per transaction and per day. These limits are set by Du and can be subject to change.

- Non-Refundable Transactions: Once a balance transfer is confirmed, it cannot be reversed. Double-check the recipient’s number and the amount before confirming the transfer.

- Confirmation Process: Pay attention to the confirmation step. Failing to confirm the transaction or responding with the wrong confirmation input will cancel the transfer.

- Network Availability: Balance transfers are dependent on network availability. If there are network issues, the transfer might be delayed or unsuccessful.

- Regular Updates: Du may update its terms and conditions for balance transfers. Regularly check for any updates to stay informed.

Troubleshooting

- Transaction Failure: If the balance transfer fails, check if both numbers are active and if the sender has sufficient balance. Also, ensure that you are following the correct transfer format.

- Error Messages: If you receive an error message, note down the message or code and contact Du customer service for clarification.

- Delayed Transfer: Sometimes, there might be a delay in the transfer. Wait for a few minutes and check if both parties receive the confirmation SMS. If not, contact customer service.

- Incorrect Amount Transferred: If you accidentally transfer the wrong amount, note that the transaction cannot be reversed. You may need to conduct another transfer to correct the mistake, keeping in mind the daily limits.

- Service Unavailability: If the service is temporarily unavailable, try again after some time. Service unavailability can be due to system maintenance or network issues.

- Contacting Customer Support: If you’re unable to resolve the issue, contact Du’s customer support. Have your mobile number, the recipient’s number, and details of the attempted transaction ready for a quicker resolution.

- Checking Account Balance: After the transfer, it’s a good practice to check your account balance to ensure the correct amount has been deducted.

By keeping these points in mind and following the troubleshooting steps, you can effectively manage and resolve most issues related to balance transfers with Du.

FAQs

Can I transfer credit to a non-Du number?

No, this service is only available between Du numbers.

Is there a limit to how many times I can transfer balance in a day?

Yes, Du imposes a limit on the number of transactions per day. Check their website for the latest information.

How do I know if the transfer was successful?

Both the sender and receiver will receive a confirmation SMS from Du.

Conclusion

Transferring balance between Du numbers is a straightforward process that can be completed in just a few steps. It’s a handy feature to know, especially in emergencies or when you want to share your credit with loved ones. By following these simple steps, you can easily transfer balance from one Du number to another, ensuring that you and your loved ones stay connected at all times.