Easypaisa is one of Pakistan’s leading digital financial platforms, enabling users to manage their finances directly from their mobile phones. Whether you’re paying bills, sending money, buying mobile load, or receiving transfers, Easypaisa has become a trusted companion for millions across the country.

With its fast, secure, and widely accessible services, many people rely on Easypaisa not just for sending and receiving money but also for safely storing and withdrawing cash when needed. Whether you’re in a big city or a small town, Easypaisa gives you control over your finances anytime, anywhere.

Ways to Withdraw Money from Easypaisa

Easypaisa offers multiple convenient options for withdrawing money, whether you’re near an ATM, a local shop, or prefer to use your bank account. Here’s a quick overview of the four main methods available:

- ATM Withdrawal: Use your Easypaisa Debit Card at any 1Link-enabled ATM across Pakistan to withdraw cash instantly.

- Agent Shop Withdrawal: Visit any authorized Easypaisa retailer, provide your CNIC and mobile number, and withdraw cash through biometric verification or one-time password (OTP) authentication.

- Bank Transfer Withdrawal: Easily transfer funds from your Easypaisa wallet to your linked bank account using the Easypaisa app or USSD code.

- Easypaisa Debit Card (for spending): While not a direct cash withdrawal, you can use your Easypaisa Debit Card for purchases at physical stores and online platforms, avoiding the need to withdraw cash altogether.

Method 1: Easypaisa ATM Withdrawal

Withdrawing money using an ATM is one of the fastest and most secure options for Easypaisa users, provided you have an Easypaisa Debit Card. This method is ideal for those who prefer quick access to cash without visiting a bank or agent shop.

Requirements:

- Easypaisa Debit Card

- 4-digit ATM PIN (set via Easypaisa App or helpline)

Step-by-Step Guide:

- Visit any 1Link-enabled ATM (available nationwide).

- Insert your Easypaisa Debit Card into the ATM.

- Choose the language (Urdu/English).

- Enter your 4-digit PIN securely.

- From the main menu, select “Withdraw Cash.”

- Enter the amount you wish to withdraw.

- Wait for the transaction to process, then collect your cash and receipt.

Charges:

- A small service fee may apply per ATM withdrawal. These charges vary slightly depending on the bank’s ATM you use (usually around Rs. 17 – Rs. 25 per transaction).

Method 2: Withdraw from Easypaisa Agent Shop

If you don’t have an Easypaisa Debit Card, withdrawing money from a nearby Easypaisa agent shop is your best option. This method is especially useful in rural areas or for users who prefer in-person transactions.

How to Find an Easypaisa Shop:

- Open the Easypaisa App and use the ‘Nearby Agents’ feature

- Or simply visit any authorized Easypaisa retailer—you’ll often find them at mobile shops, general stores, or roadside kiosks with the Easypaisa logo

What You Need:

- Original CNIC (Computerized National Identity Card)

- Your Easypaisa-registered mobile number

Step-by-Step Guide:

- Visit your nearest Easypaisa retailer and inform them that you would like to withdraw money.

- Provide your CNIC and registered mobile number to the agent.

- The agent will initiate the transaction on their end.

- You’ll receive a one-time OTP (verification code) on your mobile phone.

- Share the OTP with the agent to confirm your identity.

- The agent will then hand over the cash and give you a printed transaction receipt.

Method 3: Transfer to Bank Account

Transferring money from your Easypaisa wallet to a bank account is a convenient way to withdraw funds digitally—ideal if you prefer managing money through traditional banking.

Compatible Banks Include:

- HBL (Habib Bank Limited)

- UBL (United Bank Limited)

- Meezan Bank

- MCB

- Bank Alfalah

- Allied Bank

- Standard Chartered

- Faysal Bank

- Askari Bank

- And many more via the 1Link network

How to Link Your Bank Account (if required):

Most banks don’t require pre-linking. However, ensure the account name and CNIC match your Easypaisa profile to avoid errors.

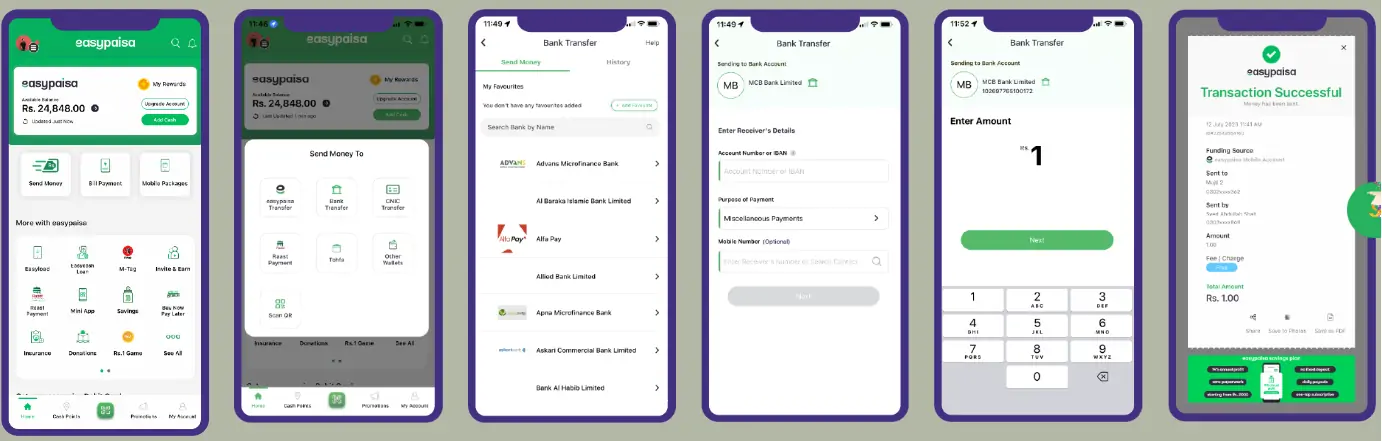

Step-by-Step Guide:

- Open the Easypaisa App on your mobile phone.

- Tap on the “Bank Transfer” option from the main dashboard.

- Select your bank from the list and enter the account number and recipient name.

- Input the amount you want to transfer.

- Review the details and tap “Send Now.”

- Enter your Easypaisa PIN to confirm the transaction.

Transfer Time:

- Instant for most banks via 1Link

- It may take up to 24 hours in rare cases, or if made outside banking hours

Bonus Option: Use Easypaisa Debit Card for Payments

Instead of withdrawing cash, you can use your Easypaisa Debit Card directly for purchases, making your transactions faster, safer, and more convenient.

Where You Can Use the Card:

- POS Machines: Pay at supermarkets, petrol pumps, restaurants, pharmacies, and other retail outlets nationwide that accept card payments.

- Online Stores: Use your debit card for online shopping on platforms that support Mastercard or Visa payments (depending on the card type).

Key Benefit:

Using your Easypaisa Debit Card eliminates the need to carry cash, reducing the risk of loss or theft. It also allows for instant, trackable payments—perfect for budgeting and secure transactions.

Important Tips for Safe Withdrawals

While Easypaisa offers reliable and secure withdrawal options, it’s important to follow a few basic safety measures to protect your money and personal information:

- Always keep your PIN confidential: Never share your Easypaisa PIN with anyone, not even a family member or agent.

- Don’t share OTP with anyone: Easypaisa will send a One-Time Password (OTP) during certain transactions—never disclose it to anyone over the phone or in person.

- Only use verified Easypaisa agents: Make sure the shop or person you’re dealing with has official Easypaisa branding and is listed in the app’s agent locator.

- Double-check transaction receipts: Before leaving an agent or ATM, review the receipt to confirm the correct amount was withdrawn and your balance is accurate.

Frequently Asked Questions

Can I withdraw without the Easypaisa app?

Yes. You can withdraw money through an Easypaisa agent shop using your CNIC and registered mobile number, or by using an Easypaisa Debit Card at an ATM—no app required for these methods.

What is the daily withdrawal limit?

The daily withdrawal limit on Easypaisa depends on the type of account you have. For most users with a Level 1 account, the limit is up to Rs. 25,000 per day. If you have a Level 2 account, this limit increases to Rs. 50,000 daily. When withdrawing from an ATM, the limit may also be affected by the ATM's issuing bank policy, so it’s always good to check with the ATM screen or your Easypaisa app for the latest limits specific to your account.

Are there any charges for bank transfers?

Bank transfers via Easypaisa are usually free for standard transactions to most banks. However, nominal charges may apply for instant or large-volume transfers depending on your transaction history or service type.

What if the ATM doesn’t have cash?

If an ATM shows “Out of Cash” or fails to dispense money, try another 1Link-enabled ATM nearby. You can also withdraw funds through an Easypaisa agent as an alternative. If your account was debited but you didn’t receive cash, call Easypaisa helpline immediately for resolution.

Good earning app

Good earning app